Air cargo's strong performance in 2017 was sealed by a solid result in Dec-2017 where year over year demand growth increased +5.7%. This was less than half the annual growth rate seen during the middle of 2017 but still well above the five-year average of +4.7%. Again, it was faster than the growth in supply which was up + 3.3% year over year during the month.

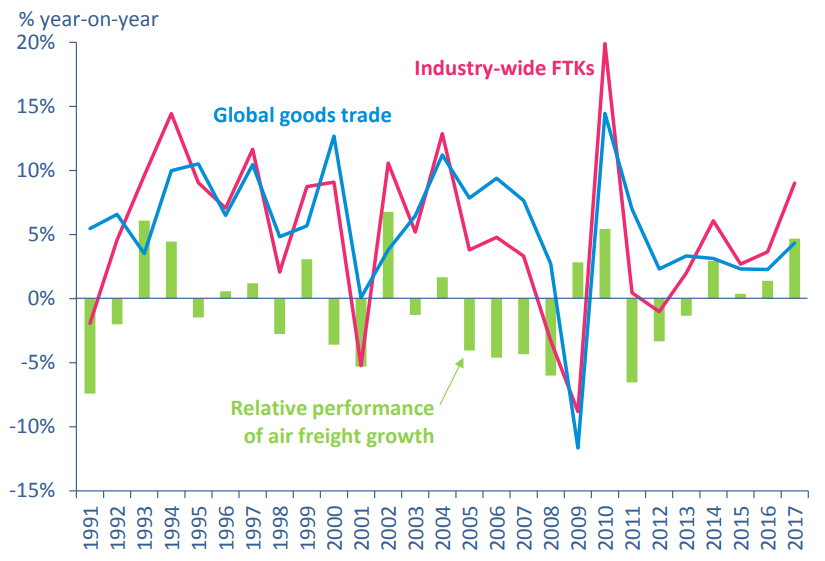

The IATA data shows that full-year 2017 demand for air freight grew at twice the pace of the expansion in world trade (+4.3%), with the airline organisation putting the outperformance firmly at the door of strong global demand for manufacturing exports as companies moved to restock inventories quickly.

CHART - Air freight demand grew more than twice as fast as global trade volumes during 2017, the widest margin of out performance since 2010 and a reflection of an improved business environment for manufacturing businesses Source: IATA Air Freight Market Analysis

Source: IATA Air Freight Market Analysis

"Air cargo had its strongest performance since the rebound from the global financial crisis in 2010. We saw improvements in load factors, yields and revenues," says Alexandre de Juniac, director general and CEO, IATA, but cautions "air cargo is still a very tough and competitive business".

The performance of the industry in 2017 was certainly the most positive that we have seen in a very long time and the outlook for air freight in 2018 remains optimistic with consumer confidence still buoyant and growing strength in international e-commerce and the transport of time- and temperature-sensitive goods such as pharmaceuticals.

Like with the passenger industry in 2018, IATA forecasts that the overall pace of growth for the air freight industry is expected to slow to levels half those seen last year (around +4.5%), but still a healthy increase. Mr de Juniac warns that "challenges remain", including "the need for industry-wide evolution to more efficient processes" which will help improve customer satisfaction and capture market share as the expectations of shippers and consumers grow ever more demanding.

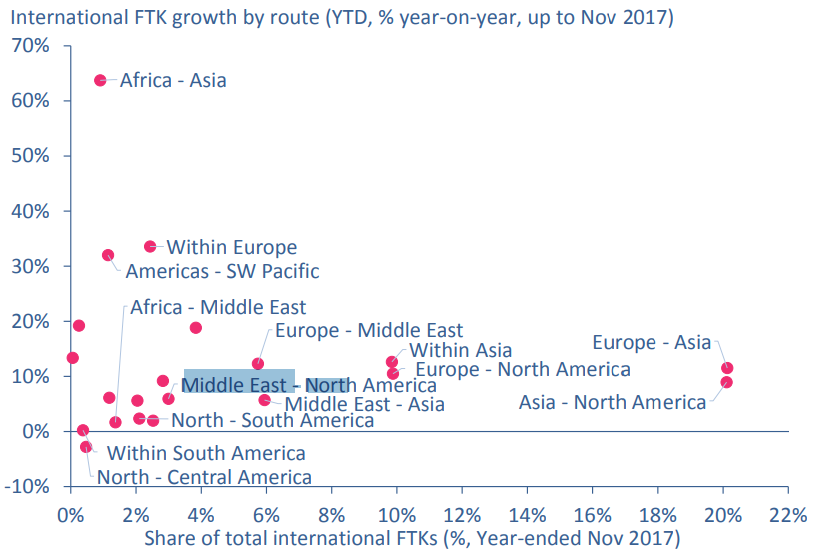

CHART - African airlines' freight volumes has been helped by a strong upward trend in traffic between Africa and Asia following an increase in the number of direct services between the two continents on the back of ongoing foreign investment flows into Africa from Asia Source: IATA Air Freight Market Analysis

Source: IATA Air Freight Market Analysis

Looking across the world by region all reported an increase in demand in 2017:

- Asia Pacific carriers saw demand in freight volumes grow +7.8% in 2017 compared to 2016. Capacity increased +1.3%. The strong performance largely reflects the ongoing demand for exports from the region's major exporters China and Japan which has been driven in part by a pick-up in economic activity in Europe and a continued solid performance from the US.

- North American airlines saw freight demand increase by +7.9% in 2017 against a capacity increase of +1.6% in the calendar year. The strength of the US economy and the US dollar have improved the inbound freight market in recent years and the recently agreed US tax reform bill may help to support freight volumes in the period ahead helping to balance the impact of the recent weakening in the dollar.

- European airlines posted a +11.8% rise in demand in 2017 - the second largest increase of all regions and the largest from within a mature market. This was partly supported by a larger +5.9% rise in capacity in the region. IATA says this development is consistent with Europe's manufacturers' export orders growing at their fastest pace on record.

- Middle Eastern carriers' freight volumes increased +8.1% in 2017 - the third fastest growth rate of all the regions. Capacity increased +2.6%. However, having not seen the strong upward demand of other regions in the first half of 2017, the Middle-Eastern carrier share of global demand dropped for the first time in 18 years.

- Latin American airlines experienced an +5.7% increase in annual freight demand and a +3.1% increase in capacity in 2017. This was the first increase in annual demand in two years and comes alongside signs of economic recovery in the region's largest economy, Brazil. IATA notes seasonally-adjusted international freight volumes are now back to the levels seen at the end of 2014.

- Saving the best performance to last, African carriers' posted the fastest growth in year over year freight volumes, up almost a quarter (+24.8%) in 2017. This is only the second time African airlines have topped the global demand growth chart since 1990, says IATA and was supported by an almost double digit rise in capacity (+9.9%). Demand across the Continent has been boosted by very strong growth in Africa-Asia trade which increased by more than +64% in the first eleven months of 2017, says IATA.

IATA has produced an infographic to highlight the key 2017 performance parameters of the air freight industry ( CLICK LINK to view in detail: INFOGRAPHIC - 2017 in review - air freight volumes)...