Air travel: vaccinations and confidence the key to recovery

Confidence is everything, especially in the recovery phase of a pandemic. Where confidence is returning, so are traveller bookings - and such confidence seems highly correlated to areas that have a combination of (a) an effective vaccine rollout and (b) (predictably) low restrictions or barriers to travel.

The US domestic market is one such location. Air passenger volumes in the US are now down just 20% on 2019 levels, having crossed the important 2-million-per-day threshold in last month continuing the strong momentum since May-2021.

But yields in most cases remain substantially lower than 2019 levels, although they are trending upwards. A key indicator will be once the traditional business travel season returns in the US in Sep-2021.

TO READ ON, VISIT: Air travel: vaccinations and confidence the key to recovery

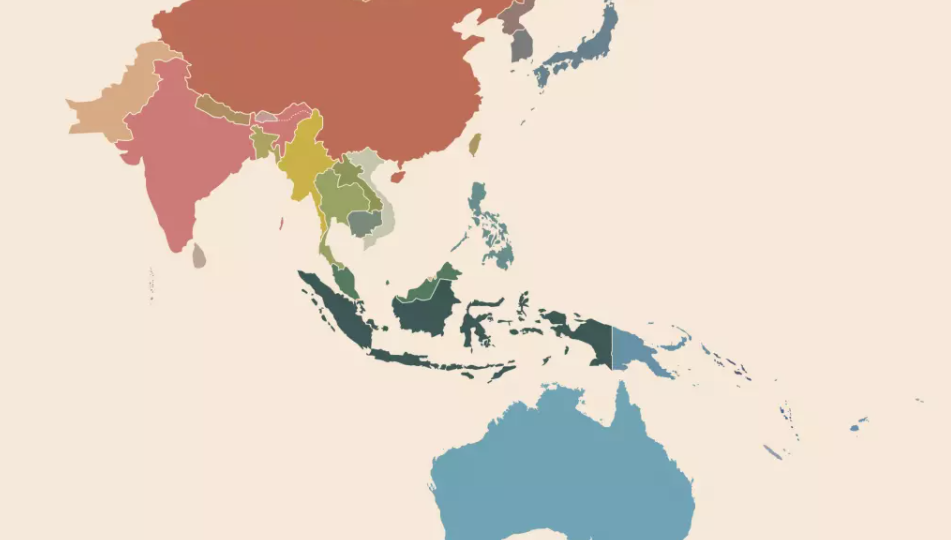

Asia-Pacific aviation: countries outline roadmaps for travel return

Although international travel recovery remains a distant prospect, some Asia-Pacific countries are looking ahead and developing scenarios for reopening borders. Such roadmaps will help give the airline industry clarity on how the international market might re-emerge when the COVID-19 pandemic finally subsides.

Australia, Singapore and Thailand have all revealed their approach to removing restrictions once vaccination rates reach certain levels - and in the case of Thailand, first steps have already been taken. All three countries have been hit by new COVID-19 outbreaks that have set back their recovery efforts, but they also recognise the importance of laying the groundwork to move to a new normal.

Key details are yet to be set for the Australia and Singapore plans, such as timelines and vaccination rates required.

However, these two and Thailand are some of the key Asia-Pacific aviation markets, and their planning moves may prompt others in the region to follow their example.

TO READ ON, VISIT: Asia-Pacific aviation: countries outline roadmaps for travel return

European aviation. UK lags EU in opening up and in capacity recovery

In the past five weeks Europe has risen from worst-performing region ranked by seats as a percentage of 2019 levels to third out of six. The key driver has been an easing of international travel restrictions.

Europe's total seat numbers are 36.5% below 2019 levels in the week commencing 26-Jul-2021.

Although this is not very different from last week's -37.0%, Europe has moved from fourth to third in the regional ranking this week. The Middle East, where seat capacity is down by 46.8% versus 2019, remains at the bottom. This week (week commencing 26-Jul-2021), Africa is down by 39.8%, Asia Pacific by 38.7%, Latin America by 28.7%, and North America by 23.5%.

Yet Europe's progress on both capacity and easing travel restrictions has been stronger in the EU than in the UK.

In addition to providing more certainty and consistency over its green/amber/red lists, the UK needs to address the issue of testing - in particular the cost of testing and its necessity for fully vaccinated travellers.

TO READ ON, VISIT: European aviation. UK lags EU in opening up and in capacity recovery

India's airline capacity rebounds after latest COVID wave

As India's devastating second wave of COVID-19 subsides, domestic airline capacity is once again rebounding strongly. Airlines have been adding back service in response to easing travel and capacity restrictions, and load factors are also increasing.

The second wave spike began around Mar-2021, and quickly propelled India into a state of crisis. Daily cases were higher than in the first wave that struck in mid-2020, and the official death toll rose above 420,000 - although it is believed that the actual total may be higher.

The second wave stalled what had previously been an impressive traffic recovery in Indian domestic markets. Now the airlines are looking to return quickly to those levels, and eventually move beyond them.

TO READ ON, VISIT: India's airline capacity rebounds after latest COVID wave

Eurowings Discover: Lufthansa's newest alternative for airline growth

Eurowings Discover, Lufthansa Group's newest airline, operated its inaugural flight on 24-Jul-2021. An Airbus A330-200 flew from Frankfurt via a short stopover in Mombasa on Kenya's Indian Ocean coast to Zanzibar in Tanzania.

The airline's name and livery are consistent with being a sub-brand of Lufthansa Group's Eurowings subsidiary.

However, Eurowings Discover has its own AOC, its own code (4Y) and its own CEO (Wolfgang Raebiger, who also served as captain on the inaugural flight). Moreover, it is a direct subsidiary of Lufthansa, rather than of Eurowings, and will operate on both long haul and short/medium haul.

It is positioned as a leisure airline, but with full service features. Frankfurt-based, it will add services from Munich from summer 2022. By the end of 2021 it plans to be operating seven medium haul and 10 long haul routes (competing with Condor on seven of these long haul routes). Its fleet plan targets 11 A330s and 10 A320s by mid 2022.

Eurowings Discover addresses the problem of Eurowings' withdrawn long haul network. It may also help to focus Eurowings on efficiency on short haul.

TO READ ON, VISIT: Eurowings Discover: Lufthansa's newest alternative for airline growth

Istanbul's Sabiha Gökçen airport still an alternative to New Istanbul

Sometimes, the completion of even the first stage of a brand new international airport can mean problems for existing, competing airports, where infrastructure might not be considered adequate, or where they are in the 'wrong part' of a city.

There are few new airport projects anywhere that compete in size and scope with the new Istanbul Airport, which was built not only to improve on the capacity limitations of its predecessor, but also openly to challenge the Gulf airports for wider regional pre-eminence, also supporting a broader future for Turkish Airlines.

That might have meant curtains for Istanbul's 'other' airport, Sabiha Gökçen, but it has established such a powerful position during the past decade that it can influence and decide its own fate, rather than being at the mercy of Istanbul Airport.

TO READ ON, VISIT: Istanbul's Sabiha Gökçen airport still an alternative to New Istanbul

SPECIAL REPORTS: Aviation Sustainability and the Environment

This regular weekly CAPA report features a summary of recent aviation sustainability and environment news, selected from the 300+ news alerts published daily by CAPA. This week's issue includes: Boeing releases first Sustainability Report, outlines ESG achievements for the year; Alaska Airlines lists sustainability highlights for 2Q2021; Qatar Airways engages with IATA's Environmental Sustainability training programme; Scottish Affairs Committee launches inquiry into impact of COVID-19 on airports; Launceston Airport bans single use plastics from terminal building.

TO READ ON, VISIT: SPECIAL REPORTS: Aviation Sustainability and the Environment