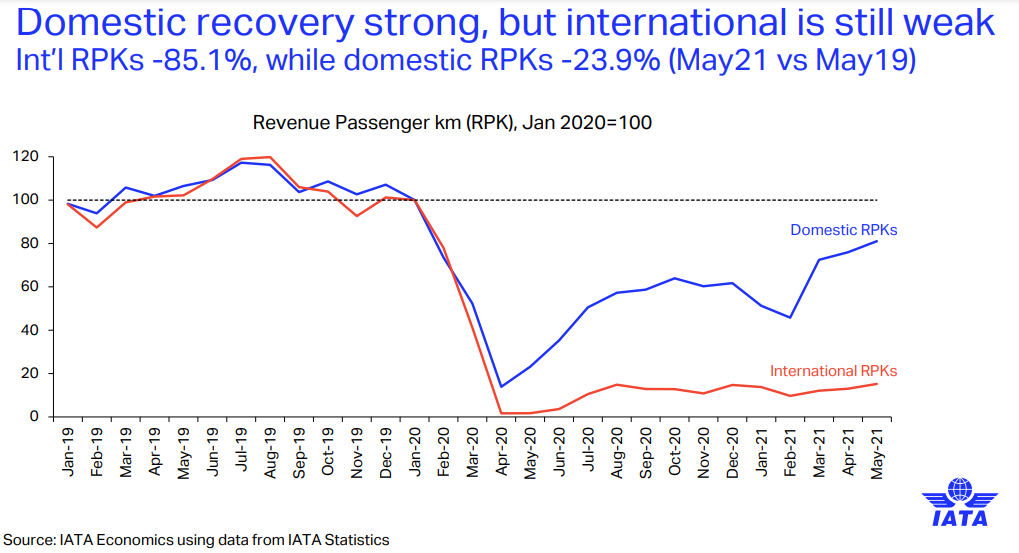

Total demand for air travel in May-2021 (measured in revenue passenger kilometres or RPKs) was down -62.7% compared to the May-2019 pre-pandemic performance. That was a gain over the -65.2% decline recorded in Apr-2021 versus Apr-2019. International passenger demand in May was -85.1% below May-2019, a small step-up from the -87.2% decline recorded in Apr-2021 versus two years ago. All regions with the exception of Asia-Pacific contributed to this modest improvement.

Total domestic demand was down -23.9% versus pre-crisis levels (May-2019), slightly improved over Apr-2021, when domestic traffic was down -25.5% versus the 2019 period. China and Russia traffic continue to be in in positive growth territory compared to pre-COVID-19 levels, while India and Japan saw significant deterioration amid new variants and outbreaks.

Small steps in International recovery

We are starting to see positive developments, with some international markets opening to vaccinated travellers. European carriers' May-2021 international traffic declined -84.7% versus May-2019, improved from the -87.7% decrease in Apr-2021 compared to the same month in 2019. Capacity dropped -75.7% and load factor fell 31.3 percentage points to 52.9%.

Elsewhere, Asia-Pacific airlines saw their May-2021 international traffic fall 94.3% compared to May 2019, fractionally worse than the -94.2% drop registered in Apr-2021 versus Apr-2019. The region experienced the steepest traffic declines for a tenth consecutive month. Capacity was down -86.4% and the load factor sank 45.5 percentage points to 33.2%, the lowest among regions.

In the Middle East, airlines experienced an -81.3% demand drop in May-2021 compared to May-2019, slightly bettering the -82.9% decrease in Apr-2021, versus the same month in 2019. Capacity declined -63.7%, and load factor fell 35.3 percentage points to 37.7%.

North American carriers' May demand fell -74.4% compared to the 2019 period, an improvement over the -77.6% decline in Apr-2021 versus two years ago. Capacity was down -58.5%, and load factor dropped 32.2 percentage points to 51.7%.

Latin American airlines saw a -75.1% demand drop in May-2021, compared to the same month in 2019, notably improved over the -80.9% decline in Apr-2021 compared to Apr-2019. May-2021 capacity was down -69.9% and load factor decreased 14.6 percentage points to 69.5%, which was the highest load factor among the regions for the eighth consecutive month.

Africa is the strongest performing international market with its airlines seeing traffic fall -71.4% in May-2021 versus May two years ago, a gain from the -75.6% decline in Apr-2021 compared to Apr-2019. May-2021 capacity declined -61.8% versus May-2019, and load factor dropped 16.9 percentage points to 50.2%.

Domestic demand starts to surpass pre-crisis levels

Amongst key domestic markets, China and Russia were the two large domestic markets that surpassed pre-crisis levels. There has been a shift from international to domestic destinations in both markets since international travel restrictions remain strict. While Russia domestic traffic rebounded +22% above the pre-crisis levels in May-2021, China remained at +6.3% above the precrisis levels. Russia domestic travel also benefits from government subsidies supporting domestic tourism

US domestic travel strengthened further in May-2021 (-26.2% lower than May-2019) and the pace of recovery is expected to increase in the summer months. The US domestic market is "expected to achieve full recovery by the end of this year or early 2022," says IATA. Domestic traffic in Australia increased as well with the support of leisure travel as international travel restrictions remained in place.

Brazil domestic travel rebounded with the easing of some of the domestic restrictions. Domestic traffic rebounded from a -60.9% decline in Apr-2021 versus the same month in 2019, to a -44% decline in May-2021, as travel restrictions were eased.

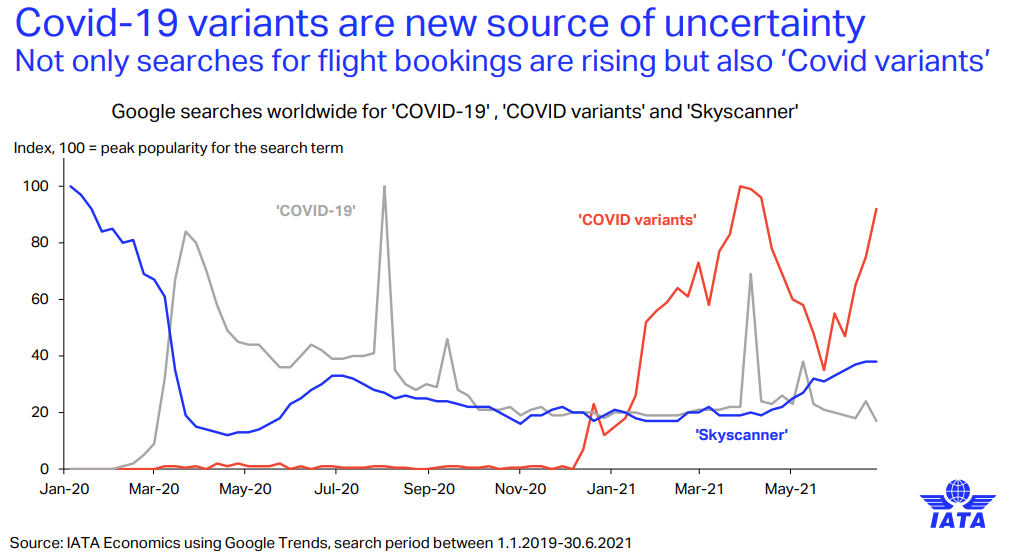

However, recoveries in domestic travel are dependent on the control of new waves. In India, domestic traffic deteriorated further since the country struggles with new variant cases. Domestic traffic fell -71.0% in May-2021 compared to May-2019 amid the emergence of the new and more contagious "Delta" variant. This compared to a -42% decline registered in Apr-2021 versus the same month two years ago. Similarly, domestic traffic in Japan fell with the expansion of restrictions amidst the resurgence of COVID-19 cases.