Summary:

- Moscow's Zhukovsky Airport increased passengers by almost 175% in 2018

- It was designed with LCCs in mind, but currently has none, albeit there may be future opportunities for international LCC connectivity;

- The infrastructure will soon be able to handle 10 mppa, but further anticipated ownership changes will ultimately drive its future strategy.

The airport was used as a testing facility during the Cold War and more recently as a base for Russia's Ministry of Emergency Situations and cargo transportation. It was inaugurated on 19-Mar-2016 at a cost of USD152 million as the fourth full-service commercial Moscow airport complex, and the Russian government signed an order to establish international services at the airport.

Initially conceived when the then three main airports were operating at capacity, Zhukovsky was probably put into operation at the wrong time as Russia's financial crisis unfolded and it initially struggled to attract airlines. The airport welcomed its first commercial service on 12-Sep-2016, with Belavia operating a daily Minsk-Zhukovsky service.

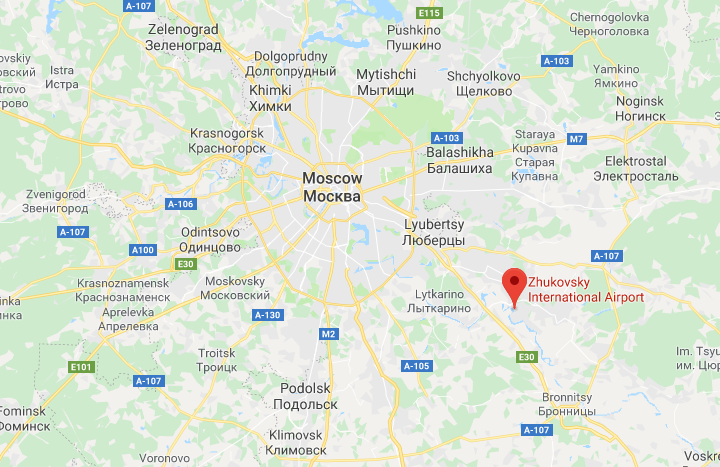

MAP - Zhukovsky Airport, formerly and occasionally known as Ramenskoye Airport, is located 35km southeast of central Moscow close to the site of the old Bykovo Airport Source: Google Maps

Source: Google Maps

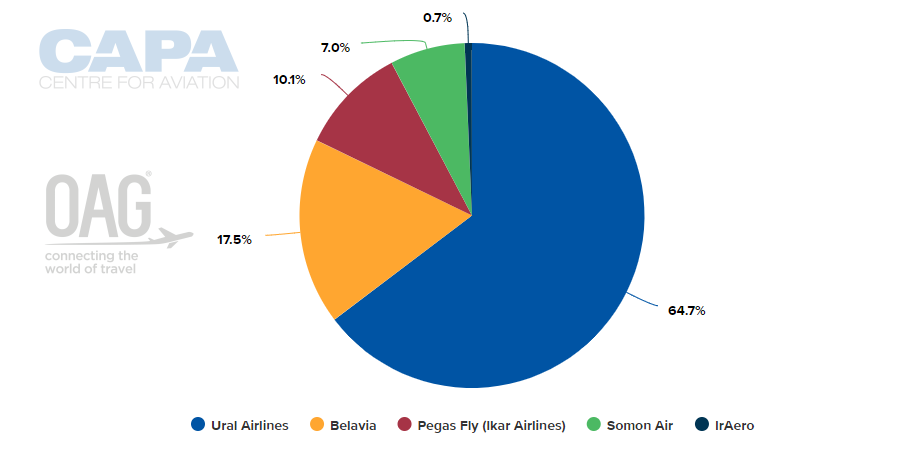

Zhukovsky Airport was expected to meet the requirements of low-cost airlines when it opened but it has not actually achieved that and there is currently zero capacity on LCCs; rather it is spread between full-service, regional/commuter and charter airlines. The Yekaterinburg-based Ural Airlines, which uses Zhukovsky as a secondary hub, accounted for 52.6% of passengers in 2018 and as the chart below shows, currently accounts for almost two thirds (64.7%) of weekly capacity.

CHART - Ural Airlines is the dominant carrier at Moscow Zhukovsky which it uses as a secondary hub Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Feb-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Feb-2019)

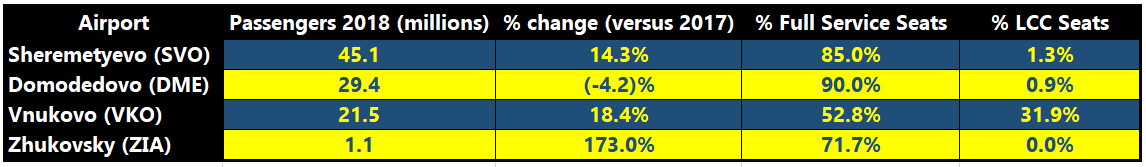

Part of the reason for this is that there are precious few LCCs in the Russian Federation, still. There is only Pobeda to speak of and none of the carriers in the chart fall into that category. On the other hand, when you look at the breakdown of operations across the Moscow airports you see that Vnukovo Airport remains an attraction to LCCs, with, presently, almost 40% of its seat capacity in that segment, and, unsurprisingly, all but 1.5% of it on Pobeda.

International destinations account for 98% of Zhukovsky's seats but right now only 6.4% of seats into and out of the Russian Federation are low-cost. Comparing Vnukovo again, only 41% of its seats are international, while neither Sheremetyevo nor Domodedovo are geared up to low cost operations at all.

TABLE - While expanding, Zhukovsky remains much smaller than Moscow's three established commercial passenger airports Source: CAPA - Centre for Aviation Airport Profiles (seat data: w/c 04-Feb-2019) (NOTE: The table does not take into account regional and commuter flights and charter flights)

Source: CAPA - Centre for Aviation Airport Profiles (seat data: w/c 04-Feb-2019) (NOTE: The table does not take into account regional and commuter flights and charter flights)

All of this points towards a clear opportunity for Zhukovsky to become the main international LCC gateway airport, if the Russian authorities adopt a more welcoming attitude to them. Eastern and Central Europe already account for 30% of its international seats but Western Europe lags well behind at 1.5%. (In contrast, Sheremetyevo's Western Europe seat total is over 38%).

In Nov-2018, Zhukovsky announced plans to expand the terminal from 17,000sqm to 37,000sqm by the end of 2020. Construction work has already begun in 2019. Apron construction work will be conducted simultaneously. The airport will be equipped with aerobridges and new cafes and restaurants and capacity will increase to six million passengers per annum, and later to 10 million ppa.

The construction of a cargo hub with capacity for 120,000 tonnes is nearing completion. It is scheduled to commence domestic operations shortly, followed by international operations.

According to the CAPA Airport Construction Database over USD300 million has been committed to infrastructure projects through to 2022.

Zhukovsky was a 100% joint venture between state-run investor Rostec and Lithuania's Avia Solutions Group, and operated by Ramport Aero. Later it was joined by United Aircraft Management. In 2017 Gediminas Ziemelis, a Lithuanian businessman, entrepreneur, philanthropist and business consultant who is currently the Chairman of the Board at Avia Solutions Group, pledged to invest, along with partners, USD20 million in Zhukovsky for the expansion of the passenger terminal.

But then in Oct-2018, Avia Solutions Group sold its share of the airport management company to the management of Ramport Aero. Later, in Dec-2018, Ramport Aero chairman Boris Aleshin acquired a 22.5% stake in JSC Ramport Aero from United Aircraft Management. The latter now maintains a 52.5% minus one share stake in the company, while Rostec holds a 25% plus one share stake.

In a country where assets change hands frequently further ownership deals can be expected at an airport which has broken through the critical one million passenger barrier. Only once a clear and stable ownership is agreed can the airport truly deliver on its efforts to develop.