France's Vinci Concessions took over the operation of ANA Aeroportos de Portugal in Dec-2012 on a 50-year concession for 10 airports including the since renamed Lisbon Humberto Delgado International Airport: the deal amounting to just over EUR3 billion. It was quite a coup for Vinci, which was in stiff competition with Fraport, Flughafen Zurich and Corporacion America for the assets. While Vinci's bid was the highest the government also noted that it was "the most interesting".

It had to be. Just as with the Berlin airports which were featured last week (see 'Spiele ohne grenzen: the shambles that is the Berlin airport system'), Lisbon was an historically underperforming airport for the capital of a country with a population of 10 million, the third most peaceful in the world and yet also one that established the world's first global empire; one that remains in the form of ex-colonies in Latin America, throughout Africa and into Asia Pacific.

Yet it handled far fewer passengers than, say Madrid's Barajas Airport, and as recently as the first half of the 2000s annual passenger numbers were in the single digit millions.

Amongst Vinci's achievements at Lisbon since the concession began are a new international and transit terminal that increased the size of the terminal area from 230,000 sq m to 406,000 sq m, permitted up to 42 operations an hour, and reduced the immediate need for a new airport, something that had become a thorn in the side of ANA for over a decade.

But Vinci's most notable accomplishment has been in boosting the low cost side of the business in Lisbon, which is growing faster than the full service one. Portugal has no outright LCCs of its own, only subsidiaries of FSCs, and its airlines are open to aggressive competition from foreign budget airlines. Currently, 64.6% of system seat capacity is on foreign airlines, and LCCs account for 44.8% of that capacity while 58% of the capacity is on unaligned carriers.

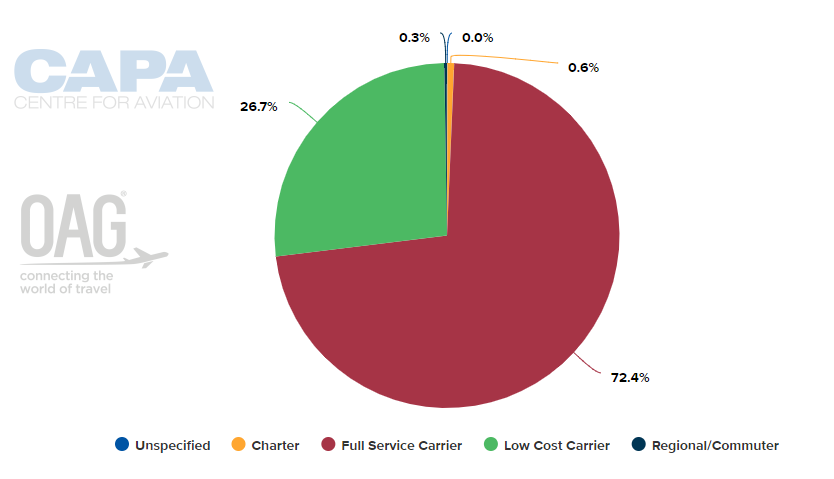

CHART - Full Service Carriers continue to dominate in Lisbon as system seats for the week commencing 04-Sep-2017 show,, but the Low Cost Carriers are now on the rise Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

That position is not quite the same at Lisbon in particular, where, LCCs account for just over a quarter (26.7%) of the total number of seats this week. Even so that puts it ahead of other Mediterranean capital city principal airports such as Madrid Barajas (19.7%), Rome Fiumicino (25.2%) and Athens (18.0%) in that segment.

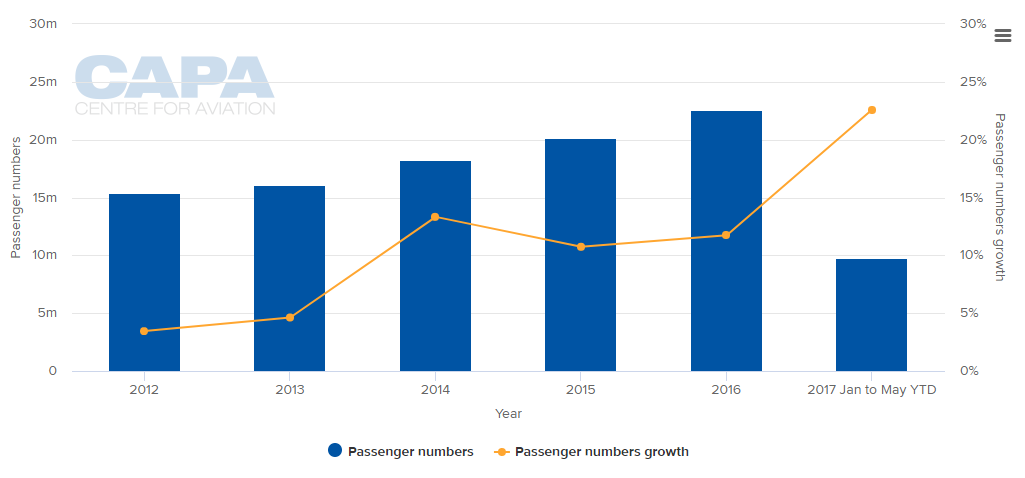

The Vinci effect was evident almost immediately. In 2014 passenger traffic records were broken with 13.3% growth recorded and they have continued to climb ever since. The percentage increase between 2015 and 2016 was 11.7% and in the first five months of 2017 (the most recent figures available) the growth rate has been 22.6%. If that rate is sustained throughout the year the total should exceed 27.5 million in 2017.

CHART - Lisbon has witnessed double-digit rises in traffic for the past two years and in 2017 is enjoying a growth rate of 22+% Source: CAPA - Centre for Aviation and ACI

Source: CAPA - Centre for Aviation and ACI

Remember that Portugal, Spain and Greece all received ECB/IMF bailouts in the wake of the European debt crisis that began in 2009, while Italy is teetering on the brink now. There are many ways of assessing the response to such crises and in the first two quarters of 2017 Portugal has been recovering economically at close to the rate of Spain, which has been the euro zone's star performer this year. That partially explains the traffic growth but not all of it. The remainder appears to be down to management and strategic direction.

It also means the need for a new airport is back on the agenda - despite the new infrastructure Humberto Delgado is bulging at the seams and one location has been earmarked, the military airbase at Montijo. For further information, see this CAPA - Centre for Aviation report from February 2017: Lisbon Humberto Delgado Airport considers 'annexing' another airport to solve capacity shortage.