While this figure is quite small it is typical of how a number of smaller secondary airports across Europe have started to challenge larger, primary ones. With an increasing number of business travellers now flying on the LCCs that have driven much of this growth, this has already meant some changes in the corporate scene.

Some of the regional airports have done quite well. Liverpool for example has put quite a hole in Manchester airport's projections over the last 20 years or so and climbed back over the five million ppa barrier in 2018, introducing some routes that are not actually duplicated at Manchester.

Similarly, Girona once threw down a challenge to Barcelona's El Prat airport, exceeding five million passengers although that did not last long and in 2018 it was just two million after Ryanair began using Barcelona airport. Frankfurt Hahn is another airport that prospered from Ryanair services but it passenger numbers have since declined from a high of almost four million to just over two million.

Stockholm Skavsta, to the south of the Swedish capital, is still hosting as many passengers as it did in 2009 with a little over two million, while Warsaw Modlin airport, which saw spectacular growth before it had to close for runway repairs, has now settled around the three million mark.

All these airports have or still do present(ed) a challenge to the nearby primary airports, at least at the short-haul level where a drive out of town can often result in a saving on the air ticket, countered by a downside of a lack of frequency and the arcane departure timings that go hand-in-hand with LCCs such as five o'clock in the morning or eleven o'clock at night.

The Ruhr area of Germany, an industrial/post-industrial land mass of 4,500 square kilometres and 7.3 million people when including nearby Düsseldorf and Wuppertal, is dominated by one airport, Düsseldorf International, Germany's third busiest with 24.3 million passengers in 2018. It could be argued that Cologne-Bonn airport, 40km to the south of Düsseldorf also serves the region but it has its own catchment area, too.

MAP - The Ruhr area of Germany, an industrial/post-industrial land mass of 4,500 square kilometres and 7.3 million people when including nearby Düsseldorf and Wuppertal Source: Google Maps

Source: Google Maps

Düsseldorf is a base for Eurowings, which has 40% of the seat capacity, and roughly half of all seats there are classified as 'low-cost'. Passenger traffic decreased by -1.4% in 2018 but was up by +6% heading into the last month of 2019.

There is only one other airport in the region, Dortmund, which serves directly a similarly-sized city to Düsseldorf, i.e. around 600,000 people. Dortmund is a regional centre though, as evidenced by its football club, which is among the best supported in the whole of Europe, with an average attendance of 79,500.

Dortmund has the same access to the comprehensive autobahn system around the Ruhr. It is to one side of the conurbation (east) but the physical parameters of that conurbation are quite small. Over two million people live in an area 50km long by 15 km wide stretching west-east through Duisburg, Essen, Bochum and Dortmund.

The airport is unashamedly oriented towards low-cost, which accounts for all of the seat capacity (based on schedules for week commencing 13-Jan-2020), with Wizz Air the main carrier (65.5%) followed by Ryanair (20.4%), Eurowings (12.2%) and easyJet the 1.9% balance. The route network is predominantly east- and south-eastbound, reflecting the strength of the immigrant population in this city and its remaining legacy industries, although it has reinvented itself as a technology centre. Routes to western Europe, and especially to industrial centres, are few and far between.

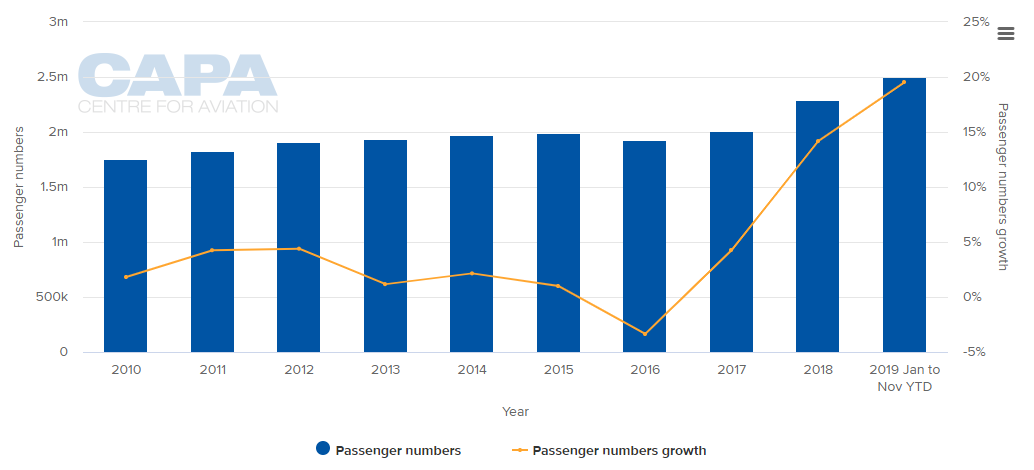

CHART - Dortmund airport has seen passenger numbers rise from 1.7 million to 2.5 million over the 2010s Source: CAPA - Centre for Aviation and Flughafenverband ADV (German Airports Association)

Source: CAPA - Centre for Aviation and Flughafenverband ADV (German Airports Association)

And that is where Dortmund's opportunities lie, especially if easyJet, which only flies to London Luton at present, increases its route network there. And there are similarities between the Ruhr area and northwest England. Both have the same population, around seven million, and a similar socio-economic make up and easyJet has a strong presence in that part of the UK.

In England Liverpool's airport has been able to reach - admittedly at length - a profitable situation in which it can reasonably vie with the much bigger Manchester airport, just 50km away, for certain routes, especially eastern European ones. Dortmund has not quite reached the same point but with growing traffic it can reasonably aspire to breaking its own 'five million' barrier if double-digit growth rates like this continue.