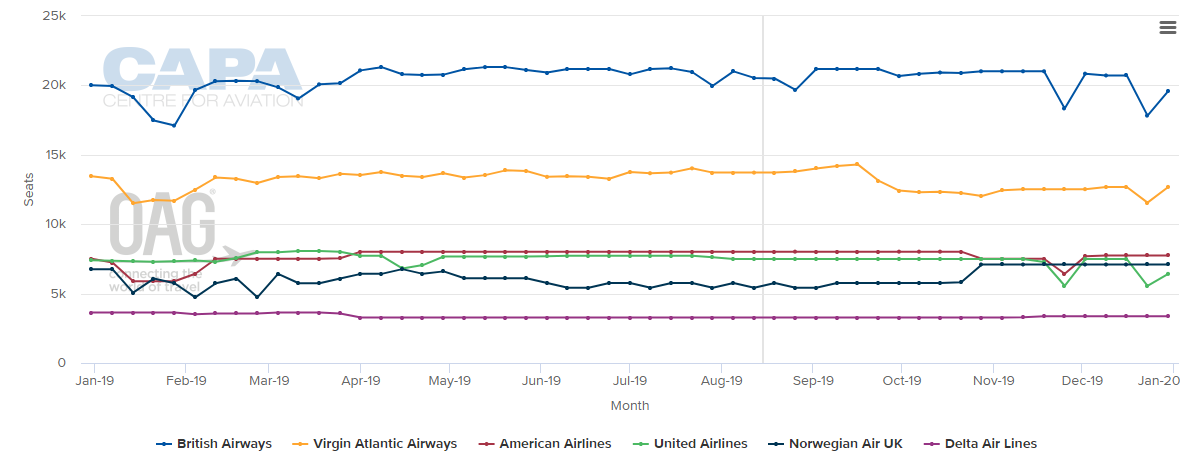

British Airways is the largest operator in the London - New York market which is also served by five other airlines, and its ranked as the world's largest international route by ASKs and the largest intercontinental route by seats (and second largest of all international routes by seats). The LHR-JFK airport pair is the largest international airport pair by ASKs and the largest intercontinental airport pair by seats.

The city pair is dominated by two antitrust-immune joint ventures. British Airways and American Airlines' share is 48.7% and Virgin Atlantic and Delta Air Lines' share is 28.4%, according to data from OAG. The revenues they secure are key to their business strategies, but it is another airline that has been driving capacity and traffic growth over recent years… Norwegian.

While, the Low Cost Long Haul business model is far from proven, Norwegian is certainly attempting to prove that such operators can compete in this marketplace, even securing a share of the corporate demand with its premium product. While not enough to pull the bigger businesses from their deals with the joint business partnerships of UK and US legacy carriers.

The London-New York market will have increased its annual seat numbers by 8.3% in 2019 compared with 2013, which was the last full year before Norwegian's entry. This is a compound average growth rate of only 1.3% per annum.

The emergence of Norwegian is clear to see in the data, growing to a 10.0% market share from a standing start in 2014. The JVs, particularly Virgin and Delta's, have lost share since Norwegian entered, but this is now stabilising and both plan to upgauge on LHR-JFK and to add a JFK service from London Gatwick (LGW), operated by Virgin, in 2020.

But while Norwegian has driven recent growth in this trans-Atlantic market, incumbents "are content to sit on their money machine," acknowledges a new insight analysis from CAPA - Centre for Aviation, one of the world's most trusted sources of market intelligence for the aviation and travel industry.

The recently published report 'London-New York: JV share stabilises 5 years after Norwegian Air entry' presents CAPA's analysis of OAG capacity data on the London-New York market, examining growth and seat share by airport pair, airline, and joint venture. It describes the revenue generating capability of the British Airways LHR-JFK service as "a huge asset" to the UK's leading airline, while suggests Virgin's number two position in this market "helps to underpin its own sometimes fragile financial performance".

CHART - British Airways is the largest operator in the London - New York market which is also served by five other airlines Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

The CAPA report acknowledges that Norwegian's entry into this market in 2014, via the more leisure oriented London Gatwick (LGW), "has changed the landscape and taken some market share away from the leading operators" and cites BA's launch of LGW-JFK in 2016 and Virgin's plans to add this airport pair next year as demonstrating its impact. But, it also suggests there could be more to these decisions: "They may also be sensing Norwegian's increasing struggle for profitability and positioning for its demise if that comes."

What is clear is that BA and American are investing in this highly competitive market (particularly supporting its premium passengers), where Heathrow's constrained capacity has helped to defend the JVs, especially in their bigger and more profitable premium-led segment. "This remains their main focus," says CAPA, but with JetBlue Airways ready to enter this market with a premium-led strategy, more changes can be expected in this area.