In the recent Feb-2021 edition of CAPA Live - a monthly virtual summit, offering insights, information, data and live interviews with airline CEOs and industry executives across a next-gen virtual event platform - Peter Harbison, founder and chairman emeritus of CAPA - Centre for Aviation highlighted how hotels and airlines have been forced to adapt, most notably full-service airlines whose model is most at risk from the current demand crisis.

In the airlines case, most long haul and many short haul air routes "rely on business travel," he said, noting that the assumption that all business travellers fly in business class "is a myth" and although that's very important, it's about a lot more than just business class.

"Business travel tends always to be higher yielding even when it's in economy or premium economy. Business travellers tend to book later, to have firm dates and (paradoxically) to need the flexibility to change bookings at the last minute. These are all premium priced products, regardless of class of travel," he explained.

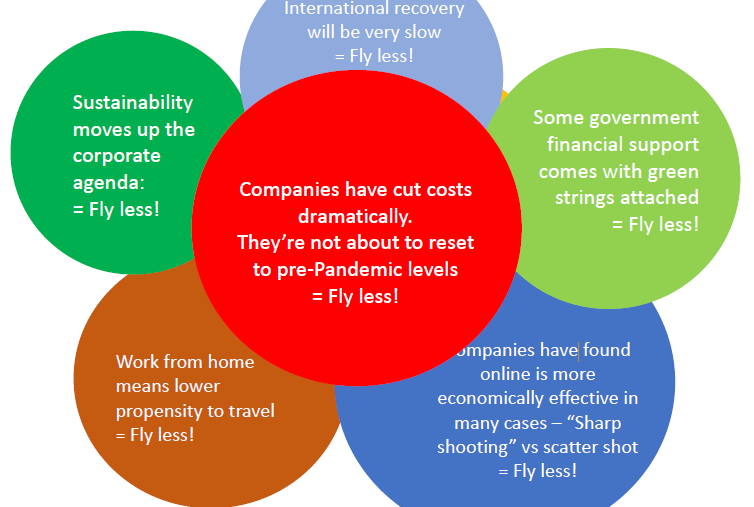

His warning was that "business travel will be depressed for many months" as a range of factors combine to mean people will fly less. Even before COVID, the rate of business travel growth was already declining in many parts of the world, while according to McKinsey international business travel from the US took five years to rebound fully after the GFC, a minor blemish compared to the impact of the pandemic on the sector.

A Jan-2021 Deloitte survey of 90 finance directors of the UK's largest companies revealed that almost half (44%) will reduce "discretionary spending" such as travel even further over the next 12 months. The CFOs are also anticipating a fivefold increase in home-working relative to pre-pandemic levels by 2025.

The future environment is far from clear, but Mr Harbison acknowledged that hotels have shown more progress in adjusting for the change. Accor has said it will "go very, very deep on buffering what could be a loss in business travel" and the company is also in the early stages of making unused floors of its hotels available to companies to set up remote working hubs. Other brands have similarly started marketing empty hotel rooms as space for workers who don't have the luxury of a home office.

Meanwhile, noted Mr Harbison, many Full Service Airlines are talking tough. "Do they have ability - or the good sense - to adapt their models to meet the new reality?" he questioned.

The COVID-19 crisis has ignited a change in our industry - we will recover, but in the next few years, we will certainly see a reinvention of the business travel space. The next twelve months will be a vital component in the process of rebuilding the corporate travel industry. The industry must come together to build a more efficient and sustainable sector with key forums playing an important role.

The monthly CTC - Corporate Travel Community supported content within CAPA Live is one port of call, as are partner events such as the HRS Corporate Lodging Forum, the first of which on the Asia Pacific region takes place on 02-Mar-2021.

The latter, the eighth annual edition of the flagship event from the business travel hotel solutions provider - entitled 'Emerge. Stronger. Together.' - will this year explore what the future of corporate travel might look like, as well as discussing sustainability, elevating traveller satisfaction, and cost savings. Last year, 1400 business travel decision-makers joined to hear the latest trends. CTC readers can register directly here - Emerge. Stronger. Together. - or via the banner below.

The forum will explore what COVID-19 has taught us and what innovations will transform the industry in the next 3 years; how brands, investors and operators are navigating through a zero cashflow environment; how a green hotel programme can support travel professionals to achieve their company's sustainability goals; study the latest innovations driving the touchless payments revolution; and consider if this is the end of traditional RFP to a data-led decision making procurement process.

There will also be special deep dive sessions looking at the current situation of the hotel landscape, recovery outlook and market-specific trends in specific country markets, as well as sessions on how hotels can efficiently fill rooms even before vaccines become widespread and the rising demand for extended stays, and how they can be incorporated into travel programmes.

The business travel market has ground to a near halt over the past year as people have learned to communicate via videoconferencing channels without the need to jumping on a plane or staying in a hotel. But they will be back just as soon as the environment allows, maybe not in the same numbers, but with a renewed appetite for travel

Until then the loss of demand will continue to deliver commercial implications for many sectors of business. A study from Oxford Economics back in 2009 found that USD12.50 of additional revenue is generated for every USD1 spent in the US on business travel, a figure that certainly rose over the subsequent decade and the loss seen in thousands of balance sheets through 2020.

As we all examine and offer visions into how business travel will look in the future it is essential that we collaborate and learn for one another how we can ensure a sustainable future for an industry whose economic value has been highlighted strongly during the COVID-19 pandemic.