Summary:

- Austria is forecast to be the fastest growing of the world's top 50 aviation country markets over the current Northern Hemisphere winter schedule;

- The Austrian market has become a market of focus for many of Europe's leading LCCs following the collapse of airberlin and NIKI;

- Colombia, Morocco and Qatar will all join Austria in growing by more than a fifth this winter, new The Blue Swan Daily research indicates;

Analysis by The Blue Swan Daily of OAG schedule data shows that Austria has moved ahead of Belgium, Egypt and the Republic of Ireland to be positioned just outside the 40 largest aviation markets by departure capacity. This winter departure capacity is up +25.5% versus the winter 2017/2018 inventory, based on current published schedules. This is an additional 1.8 million seats, up from just over seven million to almost nine million.

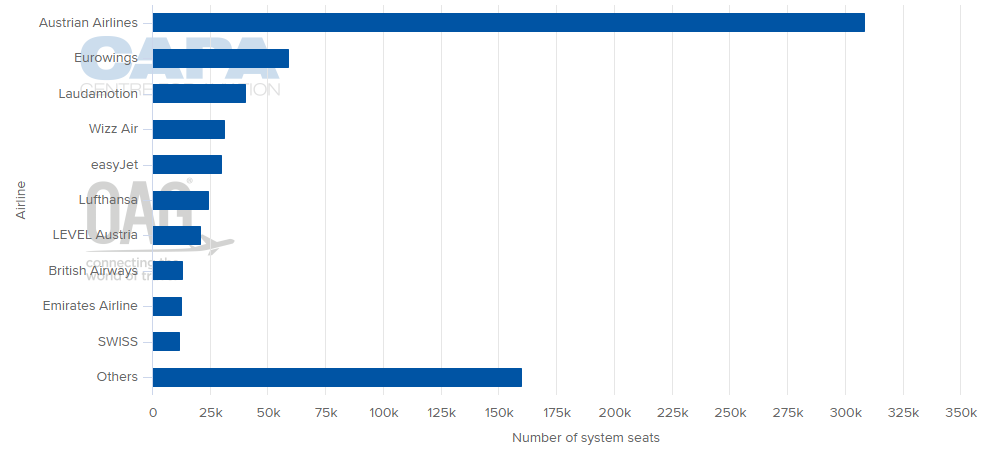

The Austrian market has become a market of focus for many of Europe's leading LCCs following the collapse of airberlin and NIKI. The gaps in the market - particularly flying out of Vienna International Airport - have been quickly filled with Austria now home to the easyJet's brexit-proofing easyJet Europe operation, Ryanair competing via its Laudamotion investment, LEVEL beginning short-haul flying, and not forgetting Wizz Air.

But, incumbent carrier Austrian Airlines has warned that the Austrian market will "not tolerate" such expansion with its chief commercial officer, Andrea Otto, warning of a potential "bloodbath". He warned: "If someone goes on our routes, we will respond… Whether all this is good for the Vienna location is another question".

Looking more closely at the Austrian market we can see that the recent LCC growth has more than filled any void from the loss of airberlin and NIKI, which had influenced last winter's offering, and then more. In fact Austria's growth rate compared with winter 2016/2017 is less than 1% lower at +24.8%.

CHART - The growth in LCC capacity at Vienna International Airport in 2018 has been extraordinary, but Austrian Airlines still dominates Source: CAPA- Centre for Aviation and OAG (data: w/c 26-Nov-2018)

Source: CAPA- Centre for Aviation and OAG (data: w/c 26-Nov-2018)

Vienna International Airport accounts for 84.2% of this season's departure seats, up from +82.0% last winter and a decade low of 80.9% in winter 2016/2017. Highlighting its increasing competitiveness, It has grown capacity +28.7% versus last year following years of modest season-on-season in growth. It is clear that only time will tell how sustainable all this additional capacity will be.

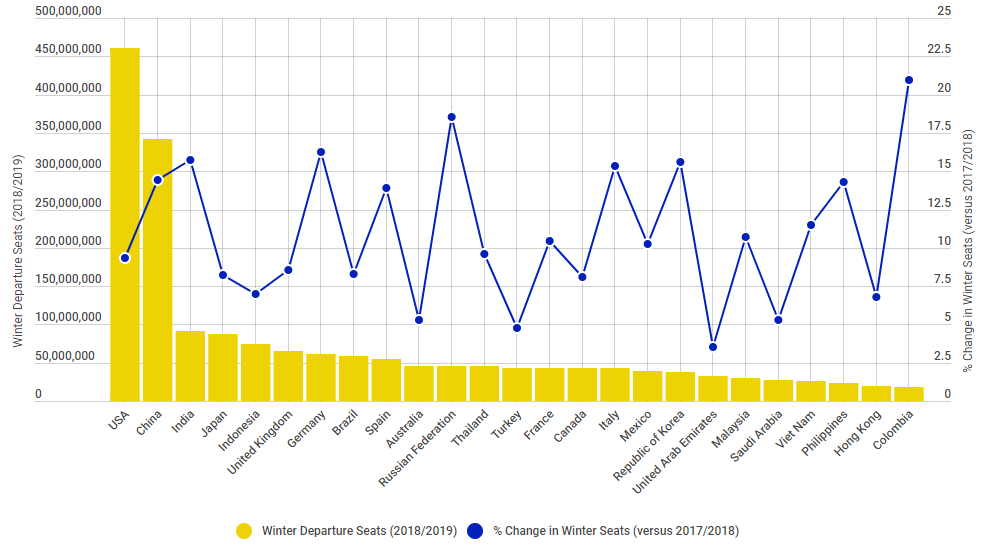

Back on the global data and on the whole things look positive for the winter across the top 50 country markets - only Iran and Pakistan are expected to see falls in departure capacity versus winter 2017/2018. Among these, more than half could grow at double-digit rates, based on published schedules, with Colombia, Morocco and Qatar joining Austria in growing by more than a fifth.

CHART - All of the world's top 25 aviation markets this winter are expected to see growth versus winter 2017/2018, based on current published schedules Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Outside of the Top 50 markets, published schedules highlight significant rates of growth among a number of nations; a list dominated by countries from Africa....

- Expected to grow more than a fifth: Afghanistan, British Virgin Islands, Central African Republic, Eritrea, Jordan, Kenya, Madagascar, Malta, Paraguay, Slovakia, Togo, Tuvalu and Ukraine;

- Expected to grow more than a quarter: Bhutan, Cameroon, Gabon, Gambia, Guatemala, Guinea, Malawi, Mozambique, Nauru, Puerto Rico and Uganda;

- Expected to grow more than a third: Comoros, Dominica, Georgia, Gibraltar, Guinea-Bissau, Liberia, Saint Barthelemy, St Kitts and Nevis and Uzbekistan;

- Expected to grow more than half: Chad, St Helena and the US Virgin Islands;

- Expected to see capacity more than double: St Maarten (a legacy of last year's storms) and Yemen (due to previous political tensions).