As part of a series tracking the effects of the coronavirus pandemic across different industry sectors, Global Web Index, has offered an interesting insight into how consumers' media consumption habits have changed during the outbreak. The research is based upon a late Mar-2020 custom survey dataset of almost 4,000 internet users aged 16-64 from United Kingdom and the United States of America (USA).

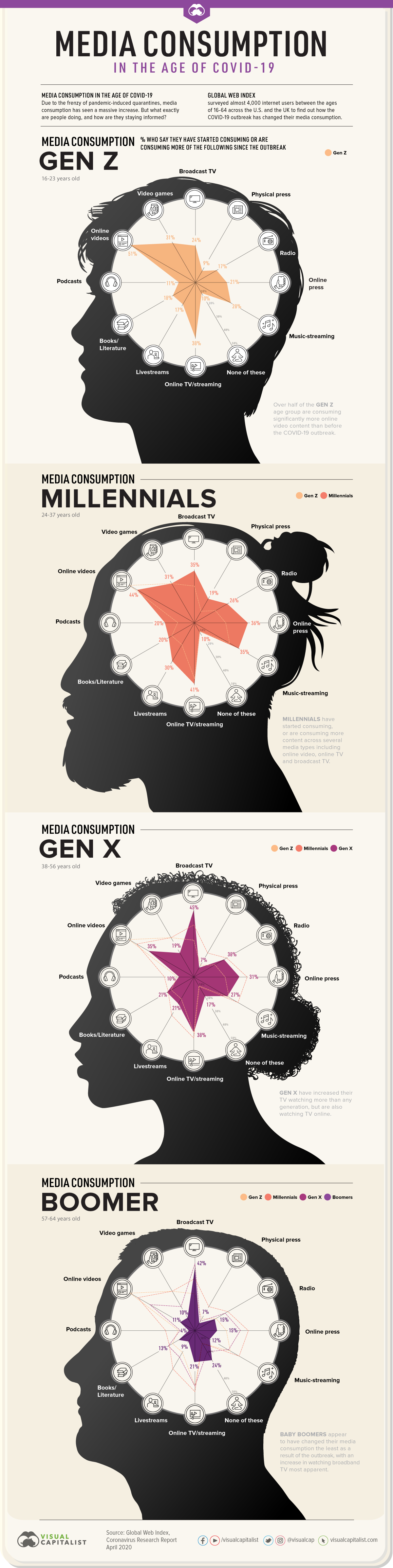

With most of the world spending the majority of their time at home in social isolation due to government mobility restrictions, it's no real surprise that people are consuming vast amounts of media. But the findings from Global Web Index, which have been impressively brought to life but the visual illustrations from Visual Capitalist that appear in this story, provide valuable insight for travel marketers as they prepare for life after COVID-19. They especially highlight how different generations are currently consuming media and the key channels for engagement.

The research shows that media consumption is up since the outbreak, and it's primarily video-based. Almost nine in ten (87%) US consumers and eight in ten (80%) UK consumers say they're consuming more content - broadcast TV, online videos, and online TV streaming take the top spots overall for increased media consumption.

Predictably, younger generations are generally consuming more media than older generations, and there are some notable differences by age. Just over half of Gen Z say they're consuming more online videos like YouTube and TikTok more than other generations, making it their top media to consume right now. More than two in five (42%) boomers are consuming more broadcast TV compared to around one in four (24%) of Gen Z.

Just over one in five boomers are also spending more time on online TV, this peaks at 41% for millennials. Livestreams (30%) and podcasts (20%) are more popular among millennials than other generations, while men and those in the higher income bracket are more likely to say they're consuming a variety of content more compared to women and those in the lower income bracket.

The research also notes that online media is spiking and it's newer forms of media that might have more staying power - especially in the US. Online videos could have the greatest staying power after the outbreak ends in the US and among Gen Z and millennials especially - Three quarters (76%) of US online video watchers say they plan to consume just as much of this content when the outbreak is over compared to 58% in the UK.

Interestingly, over 70% of book readers say they intend to keep reading just as much when the crisis ends - this is higher than all other forms of media. Gaming could have more staying power for millennials, with 77% of this group saying they expect to continue gaming compared to 57% of Gen Z.

The findings suggest that women are considerably more likely than men to continue reading and listening to podcasts after the crisis ends, while men are more likely to continue livestreaming and playing video games. Around two thirds (68%) of millennial podcast listeners say they intend to keep consuming just as much after the outbreak, indicating potential areas of revenue for digital content providers in the aftermath of the crisis.

The report also highlights how the pandemic is also bringing back the "social" aspects of social media. Half (49%) of US and 39% of UK consumers are reading more news stories on social media as a result of the outbreak - this is described as the primary motivator to use social media across markets, gender, and income right now.

There are some differences by age; baby boomers are using social media more to keep in touch with friends (30%) than to read more news (27%). Conversely, 54% of millennials are turning to social media to read more news. Around a third (30%) of consumers in the US say they're sharing their opinion more on social media as a result of the outbreak compared to just 16% of consumers in the UK with millennials and Gen X more inclined to sharing their opinion more than other generations.

Apps are also proving key in connecting people at this time - but there's key differences between markets In the US, the findings show that Facebook holds to top place to connect with friends and family at this time, while in the UK, WhatsApp is used more than other apps to connect with friends and family.

The WhatsApp platform take the top spot in the UK across all generations, gender, and income - rising to 77% among millennials and those in the highest income bracket. As age increases, the gap between using WhatsApp and Facebook Messenger narrows in the UK. For example, 63% of Gen X say they're using WhatsApp to communicate with friends/family and 62% say they're using Facebook messenger.

Around two in three (68%) of consumers say they're searching for coronavirus updates on the internet - making it the biggest online activity across markets, income groups, gender and generations - with the only exception being for Gen Z who are more likely to be listening to music (71%) than searching for coronavirus updates (67%).

Aside from coronavirus content, people are consuming a wide variety of content online during the outbreak, such as listening to music (58%), watching movies/shows (49%), watching funny videos (42%), playing games on mobile (40%), and looking at memes (32%). Notably, some of these activities relate to finding humorous content or simply looking for positive non-coronavirus content.

Regardless of what type of content we are consuming, all generations are increasingly relying on devices to remain informed, creating a huge opportunity for media companies to engage a captive audience. For travel marketers, while searching for travel is not currently a top online activity for most consumers, preparing for the future and educating consumers of the potential once mobility restrictions are lifted is surely an opportunity not to be missed.