Avalon Airport started operations in 2004 with support from Jetstar Australia, so that the airline did not directly cannibalise sales by its parent, Qantas, at Melbourne. It is owned by a private company, Linfox, and is situated close to the city of Geelong, 55km south-west of Melbourne. The airport is still only served by Jetstar Australia to destinations including Sydney, Hobart, Gold Coast and Adelaide. Therefore, Avalon remains a single airline, domestic-only airport, supported by a major MRO facility which Qantas has.

Melbourne Avalon Airport network map for the week commencing 27-Nov-2017

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

While growth has been consistent since 2014, Jetstar it seems has no plans for adding new services to the airport any time soon. The question then remains, could international services be the next step for the secondary airport?

International low-cost airlines like AirAsia X initially talked of the value in lower-cost airports, however have never launched services rather favouring larger airports like Melbourne Tullamarine, even if at a higher cost due to the opportunity for more connections. Despite this, earlier in the week AirAsia X Malaysia announced it was slashing capacity to the Gold Coast, Perth and Sydney in 2018 in an attempt to improve the profitability of its Australia operation. The long haul low cost airline is cutting flights to Perth by 50%, to Gold Coast by 36% and to Sydney by 21% from the beginning of Feb-2018.

AirAsia's total Malaysia-Australia capacity will drop by 26% year-on-year, however Melbourne, which has historically been AirAsia X's strongest and largest market in Australia, could see new flights added. The Melbourne schedule now for 2018 includes 14 weekly flights to Melbourne Tullamarine, with additional services slated for 2018, as well as the option of additional services Avalon Airport.

The introduction of the airports first international services would boost passenger numbers and assist AirAsia X tap into a market which has already proven to be extremely profitable for the airline. Any capacity increases to Victoria would partially offset the reductions in New South Wales, Queensland and Western Australia. Melbourne is the most popular destination in Australia for Malaysians and has the largest Malaysian Australian community, driving strong ethnic, or visiting friends and relatives, traffic. Melbourne also has a large Malaysian student population.

Demand in the local Kuala Lumpur-Melbourne market continues to grow. In AirAsia X's other three Australia markets there is less local demand, and the airline has been impacted by intensifying competition in the broader Australia-Asia market.

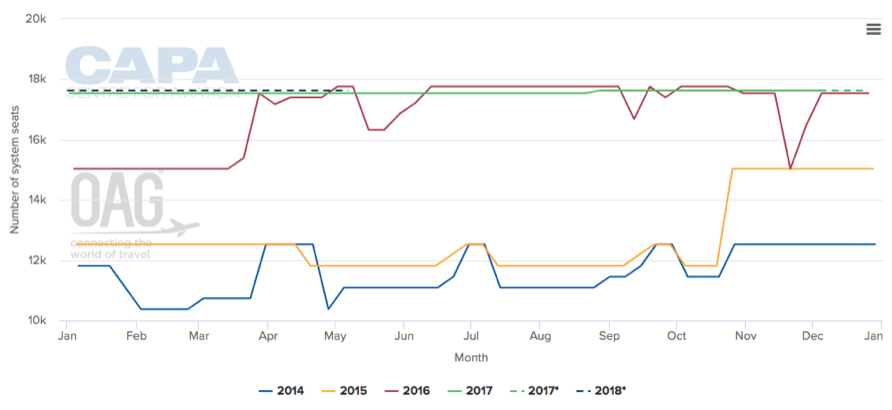

Future international services from AirAsia X would seriously boost capacity which seems to have plateaued. The green line below represents total available seats to/from the airport in 2017, which has clearly been stagnant throughout the year. The broken black line represents predictive future values for 2018 based on loaded schedules which once again show minimal changes to capacity.

Melbourne Avalon Airport weekly total system seat capacity

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

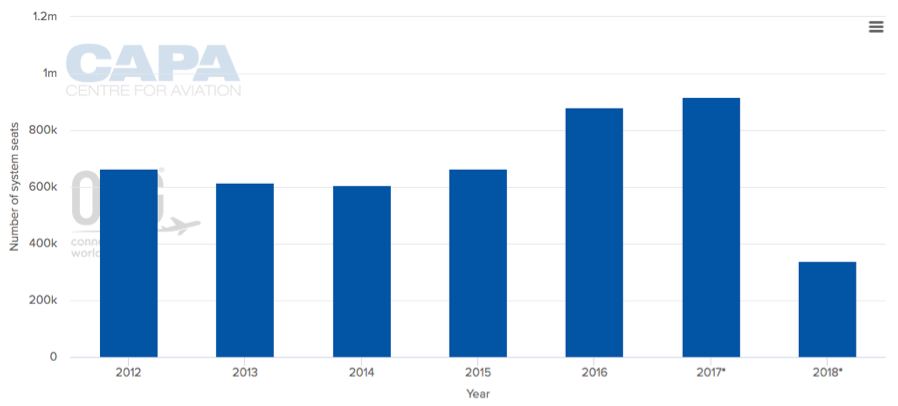

Melbourne Avalon Airport annual system seat capacity