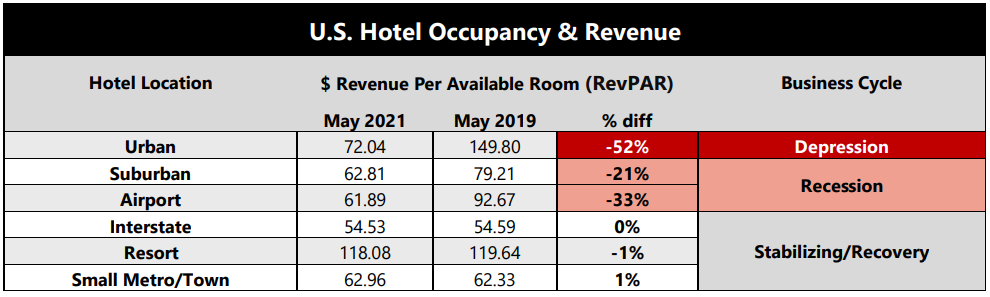

Urban markets, which rely heavily on business from events and group meetings, continue to face a severe financial crisis as they have been disproportionately impacted by the pandemic. Urban hotels were down -52% in room revenue in May-2021 compared to May 2019. For example, New York City, which remains in a depression, has seen one-third of its hotel rooms (42,030 rooms) wiped out by the COVID-19 pandemic, with nearly 200 hotels closing in the city.

Suburban and Airport properties remain in the recession category with RevPAR down -21% and -33%, respectively in May-2021, compared to the performance two years earlier in the pre-pandemic environment. Resort properties are in the stabilising/recovery stage, but were nominally down (-1%) in the year-on-year comparison, Interstate properties saw flat performance (0%: a 6 cent improvement), while Small Metro/Town showed a small rise (+1% and a 63 cent gain).

The recent uptick in leisure travel for summer is encouraging for the hotel industry, but business and group travel, the industry's largest source of revenue, will take significantly longer to recover. Business travel is down and not expected to return to 2019 levels until at least 2023 or 2024, according to most estimates. Many major events, conventions and business meetings across the country have also already been cancelled or postponed until at least 2022.

Looking at the US market from a city basis, AHLA's May comparison between 2021 and 2019 shows seven locations remained in a depression cycle with RevPAR levels down more than -50% year-on-year. These comprise: San Francisco (-70%), Boston (-67%), Washington DC (-65%), New York (-62%), Chicago (-59%), Seattle (-56%), and Minneapolis (-51%).

A further 14 of the top 25 markets are in a recession cycle with Philadelphia (-46%), New Orleans (-41%), Oahu Island (-38%), Denver (-38%), Nashville (-37%) and Orange County (-33%) seeing RevPAR declines of a third or more; Los Angeles (-27%), St Louis (-27%) and Houston (-25%), down a quarter or more; and Dallas (-23%), Atlanta (-23%) and San Diego (-23%) down more than a fifth.

Two markets are deemed to be in the stabilising/recovery cycle: Phoenix where May-2021 RevPAR levels are down just -6% when compared to May-2019; and Norfolk/Virginia Beach, where RevPAR levels are up USD1, a 1% rise.

Only two markets are in the peak cycle, both in Florida where the recovery in leisure demand has been a strong fillip. In the case of Tampa, RevPAR levels are up from USD95 in May-2019 to USD104 in May-2021, a +10% growth. The market leader by a long way though is Miami with RevPAR growth of just under a third between the two year comparison, rising from USD136 in May-2019 to USD178 in May-2021, a +31% rise.

The report highlights that despite an improving situation the economic devastation still facing hotel markets remains real and the data "underscores the need for targeted relief from Congress for the ailing industry," according to AHLA.

While many other hard-hit industries have received targeted federal relief, the hotel industry has not. "We need Congress to pass the bipartisan Save Hotel Jobs Act so hotels in the hardest hit regions, especially urban markets, can retain and rehire employees until travel demand, especially business travel, comes back to pre-pandemic levels," says Chip Rogers, president and CEO of AHLA.

Business travel demand is on the rise, but the question remains just how much will return. Regardless, it is apparent that competition among airlines for business travellers in the US will intensify significantly and LCCs will be among those pushing for a greater share of the market.

The largest of them all, Southwest Airlines, has declared that it is now well equipped to take a bigger portion of the reduced pool of business travellers post-pandemic. The airline believes that its full participation in the global distribution systems (GDS) and adding some more business-friendly airports to its network will position it favourably to capture more corporate travel.

In a recent analysis report, 'Southwest Airlines inflames the battle to win corporate travellers', CAPA - Centre for Aviation, highlights that even before the pandemic, the LCC was preparing to target more business travellers and make it easier for its existing corporate passengers to book travel with the airline.

Citing an interview with chief commercial officer Andrew Patterson at its CAPA Live monthly event, it quoted the executive as saying Southwest aims to "take a bigger slice of the reduced pie of travellers post-COVID".

Before the pandemic, business travellers accounted for nearly 40% of the approximately 130 million passengers that Southwest transported in 2019. Among the numerous new airports Southwest has added to its network during the last year include the big gateways of Chicago O'Hare, Miami International and Houston Intercontinental and they will certainly boost its appeal to business travellers.

A further boost to the US travel and tourism and hospitality industries can be expected from the removal of restrictions on international inbound travel, although the timescale of such a decision still remains uncertain. Right now demand remains stagnant as key borders remain closed. According to the US Travel Association, the US economy loses USD3.4 billion every week from blocking international arrivals - USD1.5 billion of that from restricting visitors from Canada, the European Union and the United Kingdom alone.