Many highlight a contradictory and confused position where travellers continue to balance risk against the need to return to some form of normality. However, a new insight from travel data specialist OAG provides a more upbeat outlook with overall fear levels of catching Covid-19 while flying seen as tepid with most consumers open to air travel.

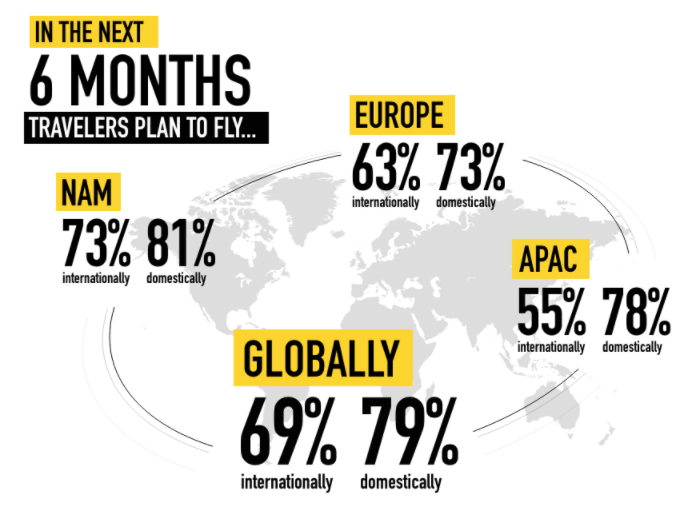

The 'Covid-19 Recovery: Getting Passengers Back on Board' study on traveller confidence is based on a global survey of over 4,000 users of its flightview travel app. It reveals that more than two thirds of users (69%) intend to fly internationally within the next six months, while more than three quarters (79%) have plans for domestic air travel.

The eagerness to travel is more apparent among millennials and Gen-Z. Both generations are less apt to make travel adjustments and more eager to travel domestically compared to their worldwide counterparts, according to the findings.

The results illustrates that the sentiment to travel is strong, but there still remain numerous factors that mean turning this into action remains a struggle, not least the ongoing government border restrictions and quarantine rules that are increasingly being introduced to stop the spread of Covid-19.

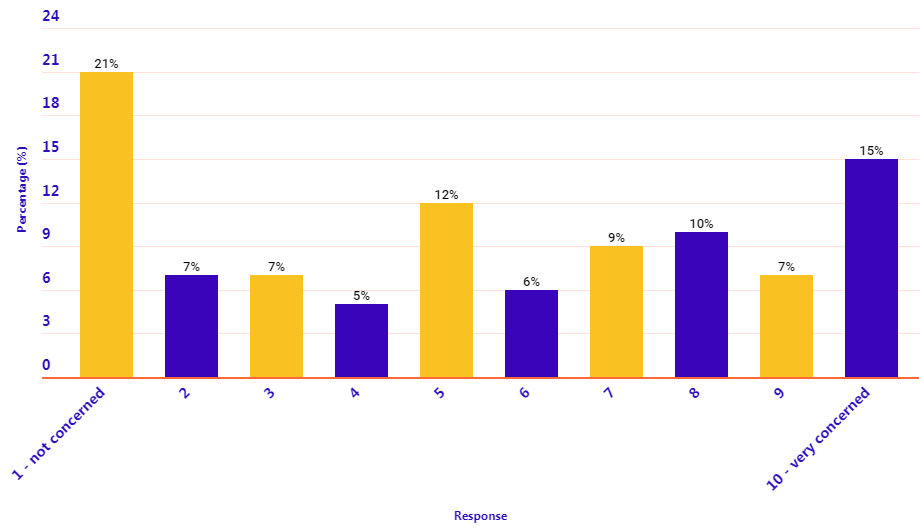

The OAG survey shows that while many consumers remain wary of catching Covid-19 while travelling, the overall fear factor (as it relates to catching the virus while at the airport or flying) is not as prominent as most think. On a scale of 1-10, with one being not concerned with catching the virus while travelling and ten being very concerned, more than half of respondents (52%) rated their fear level at five or below, with just under a third (32%) ranking it as an eight or higher.

Interestingly, the survey also finds that nearly a third of travellers have not adjusted their travel habits (and don't plan to) as a result of the virus. When it comes to those that are adjusting their habits, there's a segment of the population that's still willing to fly, acknowledges OAG, but taking a more conservative approach. The survey data shows that 37% will fly if it's critical, 25% will fly directly and avoid using connecting flights and airports, while 10% will fly during off-peak times.

It is clear that travellers will look very differently on the travel concept for a long time and trends are already emerging, such as move to later booking windows. Similarly, airlines have already implemented various safety measures and processes to reassure travellers. The wearing of masks is one that is becoming accepted as an effective safety measure whether visiting shops, dropping the children at school or even visiting any public areas.

More than three quarters of respondents in the OAG survey (76%) agreed mask mandates are the most effective safety measure airlines and airports can implement, followed by improved cleaning procedures. Leaving any middle seat free on all flights was ranked third, appearing much higher in North America - where it has been a practice adopted by airlines - than other geographical regions.

But, consumers are still most afraid of catching coronavirus while on the plane (40%), followed by airport terminals (17%), according to the survey data and suggests that the industry is still not adequately getting messages across about the risks of infection in modern generation airliner cabins or of the plethora of steps being introduced through the entire customer journey to reduce potential infection.

As OAG quite rightly identifies, the major path to rebuilding confidence "lies with the industry more aggressively communicating to travellers what it is doing to ensure flying is safe". Positive efforts have been made by the industry to educate consumers over attempts to make travel as safe as possible, but these need to be reinforced to ensure any potential hurdles in transitioning sentiment into action are removed.

It is not a simple process though and will take a concerted effort from passengers, via airlines and airports, to regulators and to regional and national government, even beyond to international agencies such as IATA, IACO, WHO and more. Most importantly though, there now appears to genuinely be a demand for travel and that is the lifeblood for any recovery.