Summary:

- The hostels sector is showing higher online penetration than hotel or vacation rental categories, new research from Phocuswright highlights;

- The Second Edition of Phoscuswright's Global Hostel Marketplace 2016-2020 shows digital natives ranging from ages 18 to 34 have fuelled rapid adoption of online and mobile hostel booking.

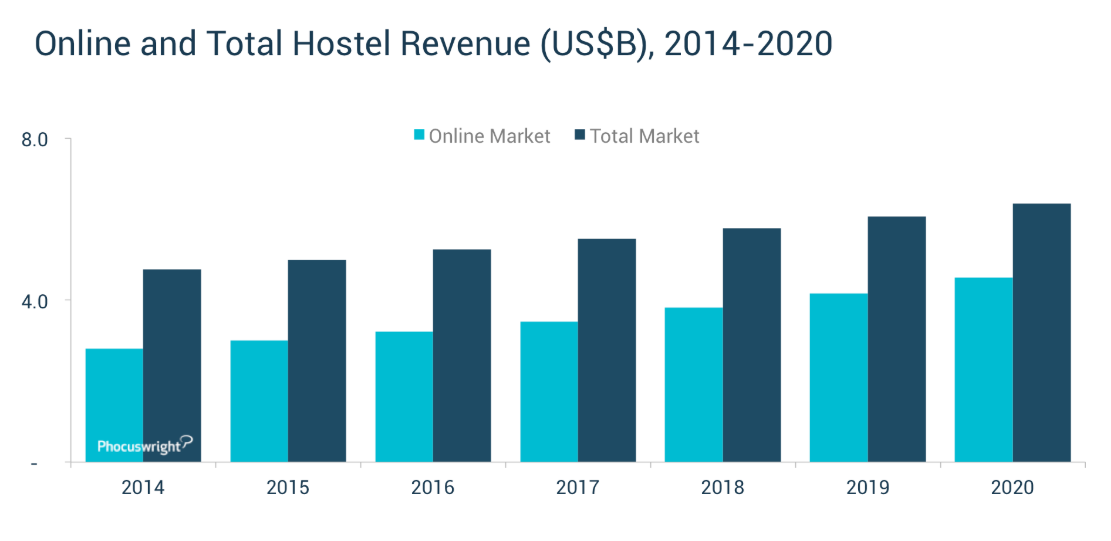

- The research shows the USD5.5 billion global hostel market in 2017 will grow to an estimated USD6.4 billion in 2020;

- The online hostel market is predicted to grow its share from 7% to 11%, rising from USD3.5 billion to USD4.6 billion as OTAs become leading booking channel.

Although hostels largely remain in the category of "alternative accommodations", the sector is showing higher online penetration than hotel or vacation rental categories, according to updated research from Phocuswright.

Highlights from the company's Global Hostel Marketplace 2016-2020 Second Edition show digital natives ranging from ages 18 to 34 have fuelled rapid adoption of online and mobile hostel booking.

The original publication had identified sweeping changes taking place in the hostel landscape. From the rise of hostel chains and design-focused experiences to digital-centric booking and a planned increase in private rooms, it highlighted how hostel operators were adapting to the expectations of their guests.

The updated research, which tracks continuing developments in the sector, shows the USD5.5 billion global hostel market during 2017 will grow to an estimated USD6.4 billion in 2020, and over the same time period, the online hostel market should growth from 7% to 11%, rising from USD3.5 billion to USD4.6 billion.

Unsurprisingly, online travel agencies (OTAs) are the most popular purchase channel for hostel travellers. "Amid a highly fragmented market of independently operated properties serving mostly younger, more price sensitive travllers, OTAs have become the leading booking channel," said Phocuswright. "OTA share of total hostel bookings will rise from 44% in 2014 to 54% by 2020."

And even as hostels conjure up images of young backpackers, industry publication Hotel Management has reported that investors are increasingly being drawn to the hostel industry. The publication highlighted in early 2017 TPG Real Estate's purchase of Germany's A&O Hotels and Hostels.

The publication noted the appeal of hostels to Millennial travellers has made investment in the hostel business more appealing.

CHART - Phocuswright predicts a growing demand for hostel accommodation with the online market taking a far greater share of bookings Source: Phocuswright's The Global Hostel Marketplace 2016-2020 Second Edition

Source: Phocuswright's The Global Hostel Marketplace 2016-2020 Second Edition