The assumption is supported by data from CAPA's new Airline Capacity Model, which has been developed to provide the aviation and travel industry with a robust and granular guide for future air capacity projection.

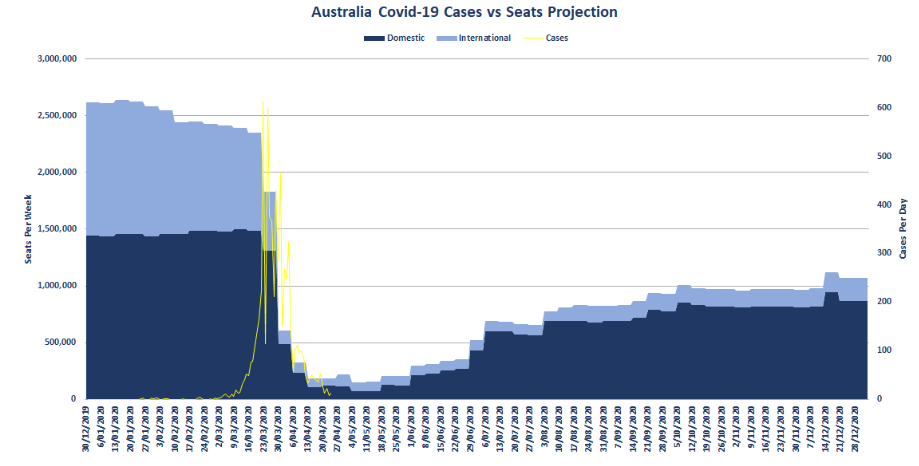

Based on a combination of analysis of government statements, airline projections and underlying demand, the model projects a slow, phased recovery in domestic air capacity in Australia through the remainder of 2020, reaching 37% of last year's volume by early Jul-2020.

Australian Prime Minister Scott Morrison has foreshadowed a return to intra-state travel under the Federal Government's three phase plan to ease coronavirus restrictions. The plan, designed to revive the domestic economy, leaves the timing for the re-establishment of travel to the states. CAPA projects domestic capacity to reach 49% of 2019 levels by the Oct-2020 school holidays and 60% by mid-December 2020.

CHART - The CAPA Airline Capacity Model offers projections for domestic and international air capacity Source: CAPA Airline Capacity Model

Source: CAPA Airline Capacity Model

The model is fed with actual baseline capacity data, drawn from OAG schedules and aircraft configuration data from CAPA's extensive fleet database. In this example of Australia, it considers decisions and announcements by the Prime Minister and State Premiers on travel restrictions and border announcements.

Further unique assessments from CAPA's team of experts are also included based on real time reports from its daily news system, airline route plans and pricing, market conditions (such as the public's willingness and propensity to fly and the introduction of standard criteria on sanitary conditions onboard aircraft and at airports), as well as 'right-sizing' of aircraft to match anticipated future demand.

The airline capacity projections are updated in real time, as major new events occur supported by CAPA's news system, which collates and publishes over 300 global stories every day.

CAPA says it expects "a supply-led return" over the coming three months as airlines "tempt passengers back to the air with low fares whilst emphasising enhanced health and safety precautions". As demand rebuilds, supply (capacity and route network) will then "be adjusted to optimise yields" and the market will steadily recover.

The model's prediction that Australian capacity levels will only reach 60% of 2019 levels by year-end highlights the slow recovery that many are now predicting for the air transport industry… and Australia is seen as being ahead of the curve with a stronger domestic market than many countries.

"International will be hit harder and potentially take multiple years to recover," says Mr Harbison, but this "will be to the benefit of the domestic market - potentially also embracing trans Tasman operations," he adds.

The CAPA Airline Capacity Model sees international air capacity (seat numbers) still down by -92% year-on-year in Jul-2020, -86% in Oct-2020 and -85% in Dec-2020. Effectively, there will be some movement during 3Q, but little change in 4Q.

CAPA says the potential trans-Tasman 'bubble' that is being considered between Australia and New Zealand has been factored into the model from Aug-2020, with some Pacific Islands linkages added in time for the Christmas/New Year holidays. These "bubble" effects may influence "international" capacity growth projections, according to the trusted source of market intelligence for the aviation and travel industry.

The CAPA Airline Capacity Model utilises a phased air capacity resumption scenario moving up from zero operations of grounded airlines; via skeletal networks (5% of operations) for emergency travel and repatriation to acutely restricted operations (25%) with the return of mission-critical business travel and acute VFR.

The next step is to basic commercial operations (50%) with a build up of business travel, motivated VFR/student travel and highly motivated leisure travel; then constrained operations (75%) with expanded business and VFR/student travel and motivated leisure travel; before hitting standard operations (100%) and the return of regular travel.

CAPA is offering an interactive, excel-based model that allows users to then view the assumptions around the resumption of travel in domestic (state-based) and international markets, to build the overall capacity picture with a 12-month subscription. This provides a monthly excel file with Input (assumptions) and Output tabs, the latter offering a total market graphic, as well as airport and route data summary tables. Live demonstrations of the new model are available by request by contacting [email protected]