With a significant change in the proportion of which Corporate travel makes up the total activity of travel, the impact on airlines, hotel companies and other supplier principals has a significant flow down effect throughout the entire industry ecosystem.

Fundamentally, any change in the level and proportion of travel activity relating to corporate travel will impact business models on which profitability and, in turn, pricing are built. Whilst pricing is not simply a function of cost, price points for corporate travel, and ultimately pricing for other segments of the market will undoubtedly be re-examined and changed as the proportions of sub-segments of activity change, notwithstanding the competitive market pressures and the risk of price increases further impacting demand.

"I do not see the industry ever going back to the way it was, because there is so much repair that's going to have to be done. You are not going to get back to the same level of growth for some considerable time. [But] most airlines are restructuring in a very positive way: they're going to be more efficient and the cost base will be more variable, they'll be able to respond to crises going forward"

Willie Walsh former CEO of International Airlines Group (IAG), owner of Aer Lingus, British Airways and Spain's Iberia and Vueling, 22-Sep-2020

Indeed, taking air travel as an example, some city pairs only exist because of their premium corporate travel revenues, in turn dependent on the internal meeting cadence of corporate travel.

Taking aviation at the top of the corporate travel pyramid, logic then requires us to examine the implications of change in terms of aircraft types and the mix within airline fleets, the configuration and the balance in RASK (Revenue per available seat kilometre) that is finely tuned to the price / seat mix. We already assume with the retirement of most of the world's remaining 747 fleets, the storage and part retirement of relatively new Airbus 380 and other mid / long haul aircraft that airlines are ridding themselves of, not only inefficient and expensive to operate aircraft types, but also those with large premium cabin dependence that are no longer fit for purpose in their current form or configuration.

This raises the question is corporate travel having its own "Kodak Moment"? What is the prognosis for Corporate Travel and its ecosystem? What scale will the inevitable post-pandemic activity bring not only to the travel industry, but more widely to economies around the world?

Interestingly, the term "Kodak Moment" has its own Wiktionary definition, in fact it has not one, but two definitions: a sentimental or charming moment worthy of capturing in a photo; and the situation in which a business fails to foresee change within its industry and drops from dominance to minor player or bankruptcy.

A generation ago a "Kodak Moment" was associated solely with the first definition when at the start of the 1990s Kodak was still one of the world's top five most valuable brands, and in 1976 Kodak enjoyed a 90%+ share of analogue film market share in the USA, and over 75% of cameras. So synonymous was the brand with analogue photography that the "Kodak Moment" was that moment when you wanted a photograph to create a memory or an image of an event that would live on forever.

However, by the mid nineties Kodak was a company already in decline, and fast forward to 2012 the company filed for Chapter 11 bankruptcy having been unable to deal with the challenge laid down by the advent of digital cameras and having realised too late that it was a victim of the industrialised world's oft feared term "disruption". Having missed recognising what was happening around it, Kodak subsequently failed to evolve and pivot fast enough to save the company. In 2012, the second definition of "Kodak Moment" was born.

Many other companies have suffered their own "Kodak Moment" - the world is littered with high profile examples of companies who recognised far too late the signs of disruption already taking place around them, failing to plan, missing the opportunity to take pre-emptive measures to diversify and to avoid becoming the latest victims of disruption. Blackberry, Nokia, Yahoo!, Bata Shoes, Toys"R"Us are just a few high profile examples of companies that refused or failed to recognise their core products had an inevitable expiry / shelf life when faced with the challenge of disruptors.

Yet there are also leading examples of companies that recognised the risk of disruption and were able to plan and evolve to avoid their own "Kodak Moment" - take IBM and, in a different industry, Best Buy as successfully not only avoiding their "Kodak Moment", but evolving to a successful and sustainable future.

The original Darwinian theory (at least in a business sense) of "survival of the fittest" has become "survival of the disrupted".

So, in today's advanced digital age, and under the acute microscope brought about by the pandemic is corporate travel experiencing its own "Kodak Moment"? Perhaps not to extinction, but is disruption and are the digital disruptors the beneficiaries of the lockdown and inability to travel, now the shapers of the future size of certain segments of the corporate travel market from which there will never be a recovery to the heady levels and delightfully profitable mix of 2019?

(Note: The writer is not intending this piece to be interpreted as the death knell of corporate travel, but to serve as an inflection point to help the travel industry ecosystem consider how to evolve to a profitable and sustainable future in a world changed both in economic terms, but also in expectations relating to health, safety and well-being of citizens and planet earth itself.)

The need to disrupt Travel's inertia

The travel industry and its ecosystem is notoriously slow to change, a combination of the scale of the assets and the reluctance of the players to anticipate and drive change, the industry is by and large shaped by the customers it serves. When the customer is forced to pivot, the travel industry is often found wanting. On this occasion, the impact of change is enforced and the "shock" to the system is not likely to be a temporary one such as in the aftermath of SARS, 9-11 and the 2008/9 Global Financial Crisis (GFC).

Of all companies, Zoom has prospered whilst values of travel industry stocks have plummeted. Founded in 2011, launched in 2013, Zoom made its IPO debut valued at USD9.5 billion, with 10 million daily meeting participants pre-pandemic that soared to 300 million by the end of Apr-2020. Its market value is a staggering USD121 billion, as at mid-Sep-2020. Not bad for a company of 2,500 employees.

A combination of "right place, right time" with a global audience demanding access to such disruptive alternatives to travel, the length and globality of the pandemic prompt a deeper dive into the impact of Zoom and others such as Microsoft's Teams will change corporate demand for travel forever, or whether a full recovery is possible, even over an extended 4-5 year time horizon.

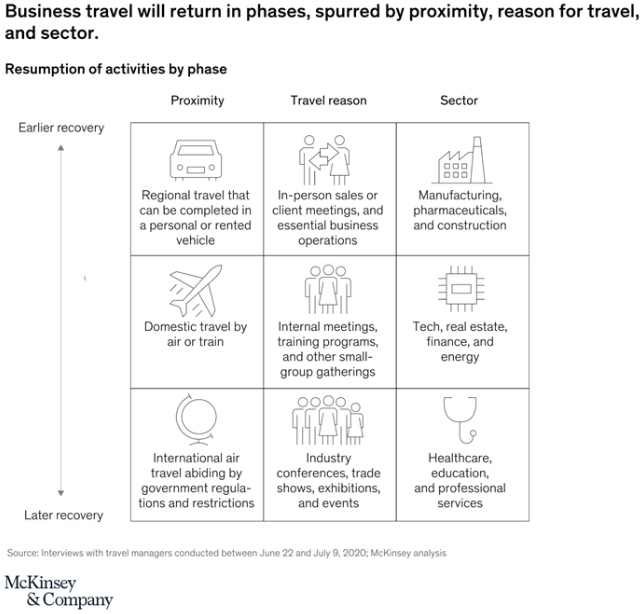

Much has been written on the future shape and speed of recovery for Corporate Travel, much has no basis of fact, whilst some is based on educated estimates, indeed McKinsey aligns on a return of Corporate Travel in phases, as shown in their graphic below.

It is important to reflect on the scale of decline and some history of recoveries from other declines caused by "shocks" such as 9-11, SARS and most recently the 2008/9 GFC. Covid-19 has caused a decline which is four times greater than 9-11 and six times greater than that of the GFC. What is largely agreed is the shape and speed of recovery this time will be different compared to anything we've experienced before.

Factors weighing on the recovery

- Health and Safety and the well-being of employees and the duty of care responsibilities of their employers and of respective governments. Whilst these concerns will have genuine action driven by the HR departments and medical advice of companies and governments, CEOs and CFOs will incorporate this into their focus on cost savings, profitability and return to shareholders and stakeholders as reasons to only cautiously support a return to travel.

- The length of the pandemic has enabled disrupters and alternatives to travel, such as technology based products and services not just to be trialled, but improved and in many cases offer a "new normal".

- These technology-based alternatives have been embraced and in many cases welcomed as alternatives to travel not only intercity, interstate or between countries, but even as alternatives to going to the office. Some categories of travel are highly likely to be forever changed in terms of frequency at least, and not just temporarily.

- Restructuring of the employment base is likely to reduce the average age of employees. The "new age" travellers born with technology and likely to embrace technology based alternatives to travel.

The death of flying for the internal company meeting?

The writer invites travel companies and corporate customers to consider McKinsey's assessment of the prospects and timing of recovery of the "Internal Meeting", noting the data and opinion is solely based on research with Travel Managers and not from a wider audience of CEOs and CFOs. It would be insightful to overlay the opinions of the these functions to assess the risk and impact if these indicate a different likelihood of recovery of the internal meeting and other travel categories.

For nine months and more, we've all managed without in person forms of face to face internal meetings. Many participants claim they have not missed, nor has productivity suffered and that alternatives have proved as efficient, if not more efficient on a net-net basis when factoring travel time, inefficiency of other interruptions when attending onsite events. Studies illustrate vastly lower costs and indicate a better ROI without the historical cadence and frequency of internal meetings.

I'm not suggesting in-person meetings do not have a future of any sort, but I do believe the travel industry should scenario plan for the implications of a significant reduction in the frequency of many forms of internal meetings and potentially other categories of travel, such as some levels of job interviews etc.

A new way of networking and learning online?

In a second example, events and conferences can be held virtually with some success, such as CAPA's own recent Australia Pacific Aviation Summit powered by virtual event technology. CAPA's upcoming 'CAPA Live' events will also be virtual, using the Swapcard platform, and will no doubt find a way of improving the networking capability.

Thousands of events are shifting online, as major trade-show and conference companies remove in-person events from their schedules, outside China, right through to the end of 1Q2021 and beyond.

Is Corporate Travel prepared?

Faced with the likelihood of such changes having a permanent impact on the travel industry ecosystem, are the principals - airlines, hotels, car rental, TMCs etc., preparing sufficiently for their equivalent risk of a "Kodak Moment"? Is there a lethargy or a vain hope of King Canute being able to hold back the tide? Are we individually and more importantly collaboratively utilising data and undertaking scenario planning to help each other towards a sustainable and profitable future, and have a genuine attempt to find a win-win scenario not just for the industry ecosystem but for the customers themselves?

As an industry, we don't necessarily have a positive track record of success, but consider the challenges of each group within the ecosystem and to consider these (in addition to the all essential health and safety) when designing strategies to enable the ecosystem to emerge successfully, albeit changed from the current pandemic induced crisis.

Airlines

The challenge facing airlines is not simply one caused by demand, the economics are affected by the type and source of the demand. End customers sharing thoughts and intent on post-pandemic activity will help airlines enormously in areas of:

- Aircraft type, fleet size and configurations

- City pair capacity, aircraft size and frequency

- Pricing, (yes unavoidable) and dialogue will help arrival at price points that sustain regrowth and not stifle demand by rising to levels unsustainable for some segments of travellers, not only in Corporate Travel, but importantly with the new balance of proportion in other segments such as VFR, Leisure etc.

Airports

- Slot allocations

- Capacity management

- Retail footfall, car parking and other non-aeronautical revenue streams

- Pricing

- Future investment

Hotels

- Capacity, mothballing whole properties or part therof

- Investment

- Staffing

- Service offering

- Meeting space and the role of disruptors

- Pricing

Car Rental

- Fleet size, and by category and location

- Location size, footprint and staffing

- Cadence and avg. length and mileage of rental

- Fleet renewal strategy

- Investment

- Pricing

TMCs

- Capacity

- Revenue balance and size as mix changes from suppliers / customers

- Work done without revenue, for example in light of change fee removals by airlines

- Further automation will build efficiency and remove avoidable cost without harming service - i.e. corporate customers using more technical interactions with a TMC

- New pricing models as the transaction fee model is dead in its current form

Technology providers

- Investment decisions

- Building on acceleration of existing products

- New product innovation - what is the new "next best thing" - "Wars drive innovation eventually used commercially, Covid-19 is Corporate Travel's opportunity"

- New revenue models

Associations

- Providing industry leadership

- Stimulating discussion between the ecosystem (within competition and legal constraints)

- Engagement and Communication

Governments

- Understanding the challenge of the ecosystem

- Sifting fact from "crying wolf"

- Stimulus and support

- Communication and education

Customers

- Communication

- Sharing of intent

- Openness to consider new models and the genuine risk and implication of supplier failure

A broader degree of data and information sharing would enable a more inclusive approach to finding a sustainable future for all constituents of the ecosystem. We should embrace disrupters and the opportunity to embrace change and to incorporate the very best of disrupters and technologies that are available to us all, as highlighted in this CAPA feature: Corporate travel. A glass quarter-full is still plenty.

Out of darkness comes light and enlightened dialogue and collaboration can lead us all to a future that is more sustainable and comfortable for our industry and all those working within it.

Towards a "noble purpose"

My former CWT CEO Hubert Joly, more recently chairman & CEO of Best Buy and now a senior lecturer at Harvard Business School currently writes on the theme of the need for a "Refoundation of Business and Capitalism". Typical of Hubert's sense of relevance and "now", he expands to suggest all companies should develop their own "Noble Purpose" and encourage investors, boards of directors, industry and community leaders, associations, analysts, regulators, business education institutions, to align and work together to advance the necessary refoundation of business and capitalism. With his record of successful leadership in the travel industry, never have Hubert's ideas been more relevant to the challenge the our industry faces today.

Let's work together to ensure this is not the second definition of the "Kodak Moment" for the travel industry, and that through collaboration we can work together and deliver via our own "Noble Purpose" a case study of how the risk was averted and that we refounded our industry for a sustainable and profitable future.

Martin Warner has over 35 years expertise & leadership in Travel Distribution. He is Principal at MW Travel Consultancy Limited providing advisory services to the travel and associated industries, a global business that develops ideas and provides to solutions to opportunities across travel and related industries. His recent engagements have included GDS, Airlines, Alliances, TMC's, and in Payments (relative to travel). He is especially focused on advising on strategies and solutions in the evolving Distribution Strategy & Payments initiatives for aviation currently being driven by IATA and its airline members. IATA's NDC implications and New Payments initiatives in travel (IATA TiP and NGISS) programs have implications and imperatives for Principals; Intermediaries; Suppliers and end Customers (Corporate & Consumer) across the Travel & Payments supply chain.

Martin Warner will appear on the "Corporate Travel Critical Thinkers Panel - Is corporate travel having its 'Kodak Moment'?" Panel at October's CAPA Live Summit.

CAPA Live will become the central hub that keeps our global CTC network informed and connected, exploring topical content with industry leaders, housing a centralised information zone full of must-have resources, expert opinion pieces and analysis, as well as on-demand videos and community discussion forums. CAPA Live will be provide a professional source of virtual interaction where you will be able to chat/video call with your network, speakers, industry thought leaders, peers, buyers/suppliers, CAPA analysts and even your own team members who are part of the community.

Click here to learn more and register. Tickets from just USD49!