The report, 'Anticipating the Travel Recovery', found several other changes in traveller behaviour since the first edition was originally conducted in late Apr-2020 and early May-2020. This latest edition was from a global survey of travellers in Sep-2020 and Oct-2020, including representation from nine countries (Australia, Canada, China, France, Germany, Italy, Spain, United Kingdom and the United States).

"Personal judgment is now the leading factor for deciding to travel, ahead of government restrictions, advice from the World Health Organization or even having a vaccine," explains Bruce Spear, a partner with Oliver Wyman. "This means the travel industry must focus on measures that increase individual customer safety such as mandatory masks, cleaning and rapid testing and not wait for governments to issue directives."

But news this week on successful vaccine trails may influence the findings significantly even if there is still a long way to go before this translates into the delivery of the vaccine to the wider population. You then have the concerns over a new strain of the virus that may have recently jumped from minks to humans and may be resilient to the current wave of vaccines that could ultimately push us back again.

Even if it could be many months until we can talk properly of recovery the market reaction to the news from Pfizer and BioNTech that its vaccine can prevent more than 90% of people from getting COVID-19 highlights that it could represent a landmark moment in this crisis.

International Airlines Group (IAG), owner of British Airways, Iberia and other European airlines, rose +40%, engine maker Rolls Royce was up a third (+33%), the US majors of American Airlines, Delta Air Lines and United Airlines rose around +15% on opening, but those that had gained the most from our alternate way of life have seen their stock lose some of their gains - home food delivery expert Just Eat were both down around -10%, while Zoom, one of the biggest climbers through the pandemic, was down -14% as the US stock market opened.

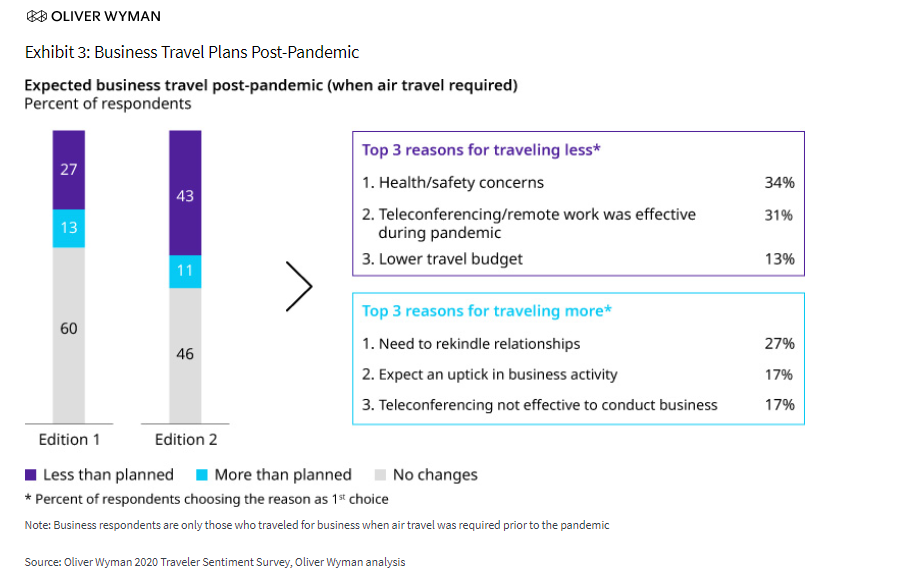

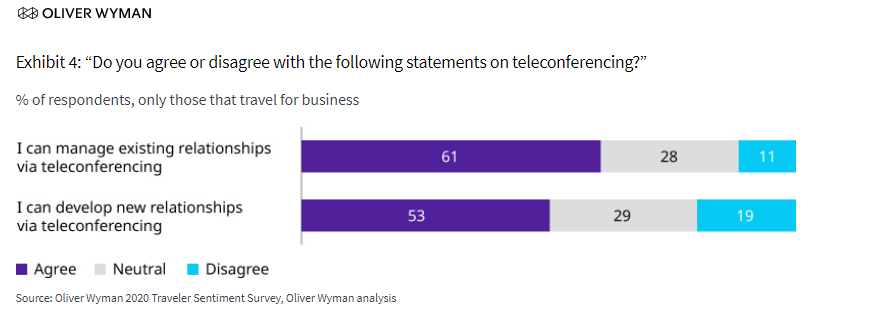

While Zoom's wings may be clipped by the effective delivery of a vaccine it has already become a key part of business life and that will not necessarily change even when travel again takes-off. The Oliver Wyman survey indicates that more than half travellers (53%) believe they can develop new relationships via teleconferencing. This drops a little to for business travellers under 30, but 47% remains a significant level.

The big worry from the survey is that two in five respondents (43%) who travel for business plan to travel less in the future. That shows a significant shift in sentiment and a 16 percentage point rise on the 27% that said the same back in the earlier edition. Similarly, this edition highlights that three in ten business travellers expect to shorten their future trips when possible, which will impact hotel stays.

It is a different story for leisure travel, which has already shown greater strength. Interest in leisure travel remains strong and has grown since the first edition, with almost two-thirds (63%) of respondents expecting to travel the same amount or more post-pandemic.

The research shows that most travellers in the US, Spain, Italy, China, and Australia are planning domestic trips, while travellers in Canada, UK, France, and Germany are planning international locations mostly in their home region for their next leisure trip post-COVID. The number one driver for these leisure trips globally is to visit friends and family.

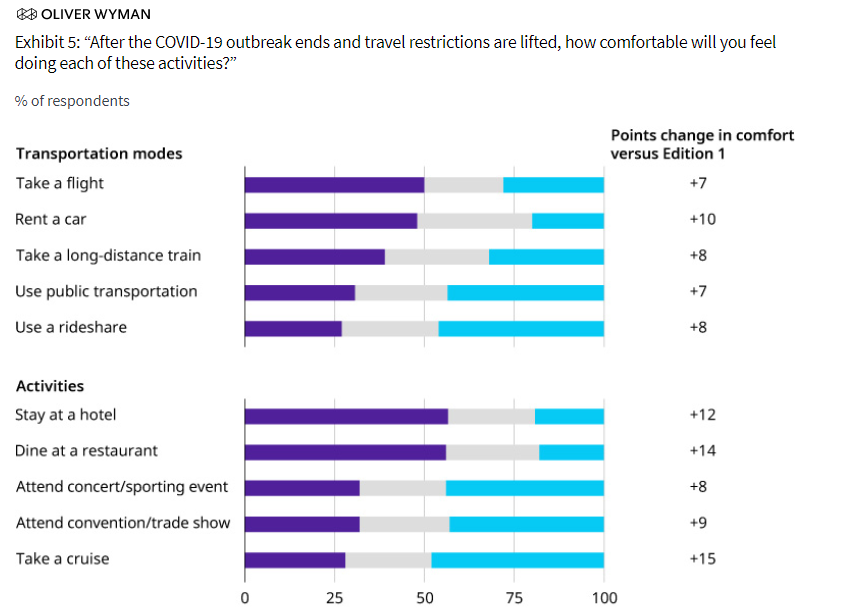

The findings also illustrate that travellers are more comfortable with various transportation options than they were when data for the previous edition was collected. Half are now comfortable taking a flight and almost 60% are comfortable staying at a hotel. However, less than a third are comfortable using public transportation or ride sharing. In the US, over 40% of respondents are still uncomfortable using public transportation or rideshare.

There is even more confidence in cruises, a sector that was hit hard earlier in the pandemic by news stories of passengers being quarantined at sea as COVID-19 spread through the ship. Oliver Wyman's research shows that since then, the gap between cruises and other experiences involving significant interaction with others has closed. Respondents now feel as comfortable taking a cruise as attending a convention or going to a concert or sporting event. Past cruisers are more comfortable than first timers, it says.

Interestingly, the research suggests that price still remains the number one factor for consumer choice, followed by cleaning policies and treatment of travellers. The exception is in China, where aircraft cleaning policies and treatment by the airline outrank price. Travelers view cleaning and mask mandates as the most important health and safety measures, but two in five would still like to see an empty seat next to them on planes and trains.

As we continue to adjust to our new COVID reality, travel providers will see a shift in their core customer base due to reduced business demand," according to Jessica Stansbury, a partner with Oliver Wyman. "Leisure travel will continue to drive the recovery and addressing new customer expectations will be critical. There is no wiggle room for travel companies when it comes to defining, communicating and enforcing policies for cleanliness and ensuring safety," she says.