The 1Q 2021 report highlights that global real GDP contracted by -3.6% in 2021, 1.1 percentage points better than expected in its previous quarterly report). This, it says, mainly reflects "a faster than expected recovery in advanced economies" in 3Q 2020 from the initial COVID-19 wave lockdowns, followed by "a more moderate than expected economic impact" of restrictions in 4Q 2020.

Many economies - especially in Europe - are still subject to significant social distancing and economic activity restrictions in 1Q 2021, however the global economic outlook has nevertheless "substantially improved since the end of 2020,"according to the quarterly macro changes for the world's key economies.

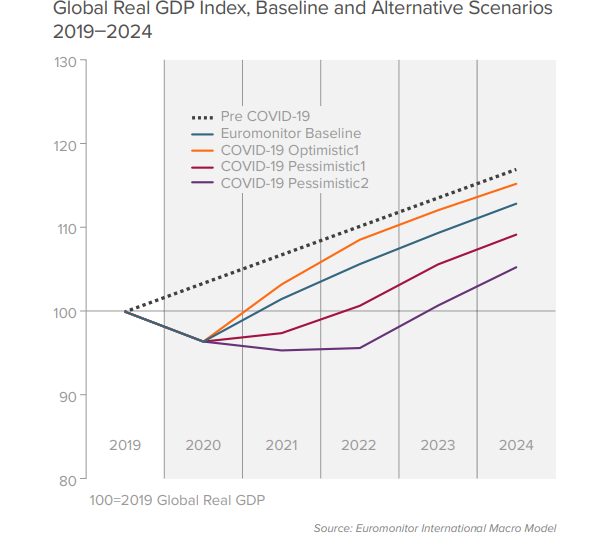

As such, it projects that global real GDP growth in 2021 will be around +5.3% with a variance from +4.3% to +6.3%. The global recovery is expected to continue in 2022 with real GDP growth of around +4%. These are positive sentiments , but even under these baseline projection will still leave global real GDP around -3.7% down on the pre-pandemic forecast level.

Despite concerns over new COVID-19 variants spreading across the world, the overall outlook is "more optimistic in 1Q 2021, with significantly lower downside risks," explains Euromonitor International. In fact, it expresses that its baseline forecast and even a more optimistic scenario with 2021 real GDP growth of between +6.3 and +7.8% "are now assigned around 60% probability compared to around 51% probability in the 4Q 2020 scenarios outlook".

Major vaccination campaigns are in progress, and vaccination rates sufficient for herd immunity are likely to be attained in advanced economies in 3Q and 4Q 2021. However, the spread of recent, significantly more infectious virus mutations that require stricter and longer social distancing measures to control is seen as "the main downside risk factor" including to the research.

The concerns are obvious. The greater spread of new virus mutations would also require higher vaccination rates to attain herd immunity and may also require additional research to develop new vaccine variants or modify existing offerings, delaying vaccination campaigns. The impact could be significant and are clearly visible in the COVID-19 Pessimistic1 and cOVID-19 Pessimistic2 recovery scenarios in Euromonitor International's projection, highlighted below.

Among the world's advanced economies, GDP growth forecasts for 2021 have been revised down across almost all countries, the exceptions being USA, which has risen +1.5 percentage points (pp) since the 4Q 2020 report, and Canada, which remains unchanged. South Korea has been revised down -0.3pp, Japan -0.5pp, the UK -1.0pp, and the Eurozone -0.9pp with revisions there varying from -0.7pp in Germany and France to -1.2pp in Spain and -1.3pp in Italy.

Looking into 2022 and things look more positive. Japan (-0.1pp), South Korea (-0.3pp) and Italy (-0.3pp) see small downward revisions, but all other advanced economies see upward revisions in GDP growth, from +0.2pp rises across the Eurozone, +0.4pp in the US and +0.6pp in Canada, to +1.5pp rises in both Spain and the UK.

Looking at some of the emerging and developing economies there are also some notable shifts in GDP forecasts over the past quarter. Since its 4Q 2020 report, Euromonitor International has revised upwards its China (+0.5pp) and India (+1.6pp) numbers for 2021, but offset this by reducing growth levels in 2022, albeit at a lesser rate.

In fact, it is a more pessimistic viewpoint on these markets for 2021 and 2022 with nations such as Indonesia, Mexico, Russia and Turkey being revised down: only Brazil sees a positive movement in 2022, but the 0.1pp rise in the GDP forecast for the year is more than offset by a -0.2pp fall in the 2021 projection.