Airlines particularly have been hit hard. Virgin Australia and Air Mauritius have entered voluntary administration. Virgin Atlantic is apparently up for sale as its founder Sir Richard Branson seeks a lifeline for the UK carrier. There is uncertainty at the route airlines will take out of this current crisis and McKinsey & Company says they "need strategies for navigating the crisis and returning to the skies".

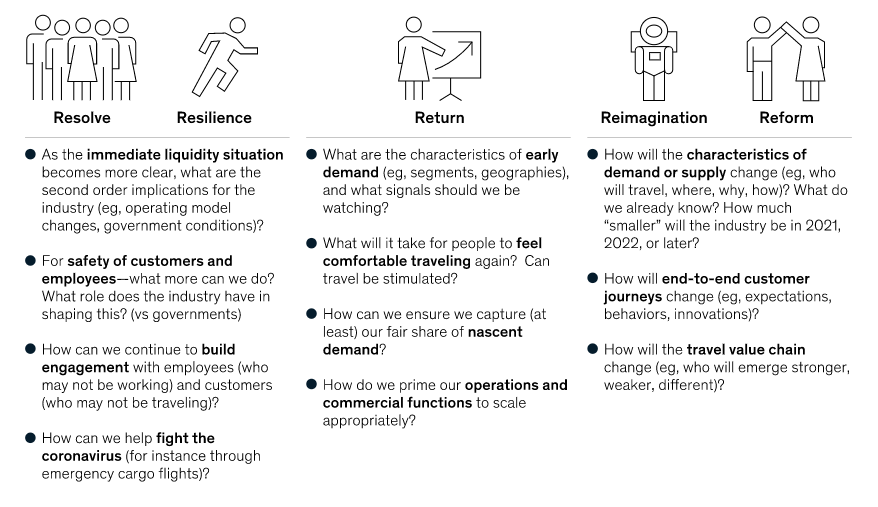

In an article published on its website, entitled 'Coronavirus: Airlines brace for severe turbulence', the consultancy has identified the questions and issues that companies must consider along this journey, with some being identified as relevant during multiple phases. These are 'resolve, resilience, return, reimagine, and reform' and its says the questions airlines must address will evolve as they navigate the process.

The 'resolve' and 'resilience' sides are all about surviving through the crisis, which is easier said than done when air capacity across most countries down to between 10% and 20% of the levels planned. Most airlines are now focused on staying in business and keeping the lights on, according to McKinsey & Company, but it says they will benefit their customers and employees much more if they also think strategically during this difficult time and consider challenging questions.

Taking liquidity issues, for example. It says if airlines fail to address key questions until late in the crisis, "they might not recognise the long-term consequences until it is too late to reverse course". With travel at record lows, it says airlines will also benefit from "developing new strategies to connect with customers, who probably are not flying, and employees, who may not be working".

Looking ahead to the day when travel restrictions lift, the consultant identifies that airlines "might want to begin thinking about adjusting their health and safety operations now" to help hesitant travellers to return.

'Return', says McKinsey & Company, is about ramping up operations. While the route to return is unclear, airlines will certainly experience a gradual and uneven return to operations. The consultancy says that requires an "unprecedented logistical effort". Done poorly, the strategy "may be as costly as the crisis itself".

While demand is currently low, it says airlines "can gain an advantage" by planning their return to large-scale operations now. It may be difficult to predict when that will occur, so they should "carefully monitor early indicators for demand, such as flight-search activity, and examine data to identify customer segment and geographies that may represent new growth pockets," says McKinsey & Company.

One big issue the consultants identify is whether airlines can truly stimulate demand. "Airlines should carefully consider whether any specific incentives or discounts will produce the desired results or simply eat into their financials," according to the consultancy.

Although we do not know what new regulations may emerge to govern travel, it is pretty clear there could be time-consuming additional checks or requirements that could discourage business or short-term leisure travellers from taking trips.

"Regulatory differences between regions may also drive costly complexity in operations and create confusion for customers. Airlines will need to work proactively with one another, regulators, and others in the ecosystem to ensure a smooth and consistent customer experience while ensuring safety," says the company.

The 'reimagine' and 'reform' stages are all about becoming stronger than ever. During these stages, airlines "must acknowledge that once-dependable patterns may disappear and that the traditional methods for determining prices, flight routes, and passenger incentives may no longer be valid because passenger preferences, demographics, and behaviour have shifted," says the consultancy.

It also identifies that in addition to revising their planning processes, airlines may need to "adjust the end-to-end customer journey" since passengers may have "new expectations and behaviours" once they begin to travel again.

We all agree that the airline industry itself will be different once the pandemic subsides. As McKinsey & Company note, some "will be stronger while others will be in a more difficult position than they were previously, or even sidelined altogether". Further consolidation "is likely," it says, but pretty certain in our opinion as new industry building blocks are put into place.

McKinsey & Company warns that with revenues plummeting and continued uncertainty about the pandemic's course, airline leaders "may have difficulty looking beyond the next few months". But, it recognises that those that "think strategically about managing their return to large-scale operations, reimagining their business, and reforming their organisations to suit the next normal will help both their employees and their customers".

"Collaboration could be increasingly important to their success in the new world," it adds. And such collaborations, as well as other strategic moves, "will help airlines resume their primary goal of connecting our world".