These two bases, the airline confirms, will be located at two of its largest current non-Scandinavian outstations: Málaga and London Heathrow. Málaga is SAS' biggest leisure destination and Heathrow is its biggest airport outside Scandinavia.

The airline says the aim is for the new operations to be up and running from winter 2017/2018, providing a smaller number of departures as a complement to SAS's existing production. It is likely this will initially see SAS staff its regular flights between Scandinavia and London and Scandinavia and Spain with crews managed under the Irish air operator certificate. However, long-term it could see the carrier commencing point-to-point routes not touching Scandinavia.

In both markets the LCC competition is strong - in Heathrow's case on a city pair basis. Málaga seems a fairly obvious choice, but Heathrow's high charges and congestion might have pushed SAS to choose a different London airport. It seems that SAS does not wish to alienate its core London customers, but will still benefit from the lower labour costs that are available almost anywhere in Europe outside Scandinavia.

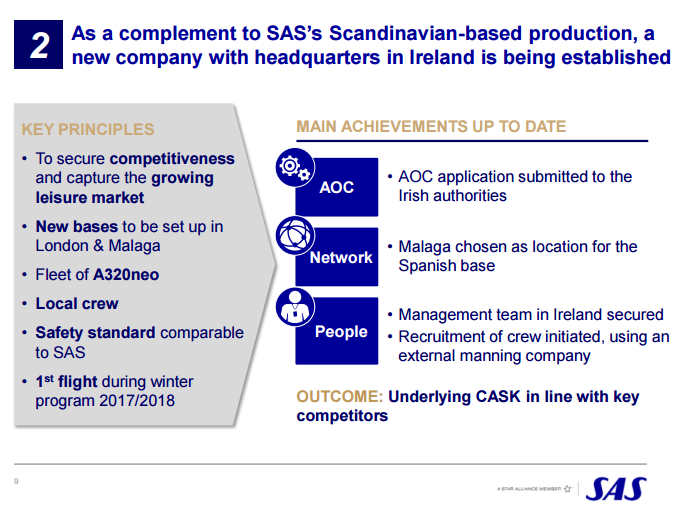

SLIDE -Key Principles and Achievements of new SAS Ireland Operation Source: SAS Scandinavian Airlines

Source: SAS Scandinavian Airlines

"In line with SAS's strategy of focusing on those customers who travel frequently to, from and within Scandinavia, the majority of SAS's airline operations will continue to be based in Scandinavia moving forward," says Rickard Gustafson, president and chief executive officer, SAS. "The establishment of new bases means we can complement our Scandinavian production and, in time, build an even broader network with a superior schedule to the benefit of our customers."

The aircraft based in London and Málaga will have the same customer offering and appearance as other airline operations at SAS and with corresponding requirements in terms of safety and standards. SAS acknowledged the financial effects from operations at these bases will be small, but will gradually increase as operations grow.

SAS clarifies that its main focus will remain on its strategy supporting customers who travel frequently to, from and within Scandinavia. This is where it remains the leading airline when measured by passengers and share of capacity, despite intense price pressure and rising demand for lower-yield leisure travel.

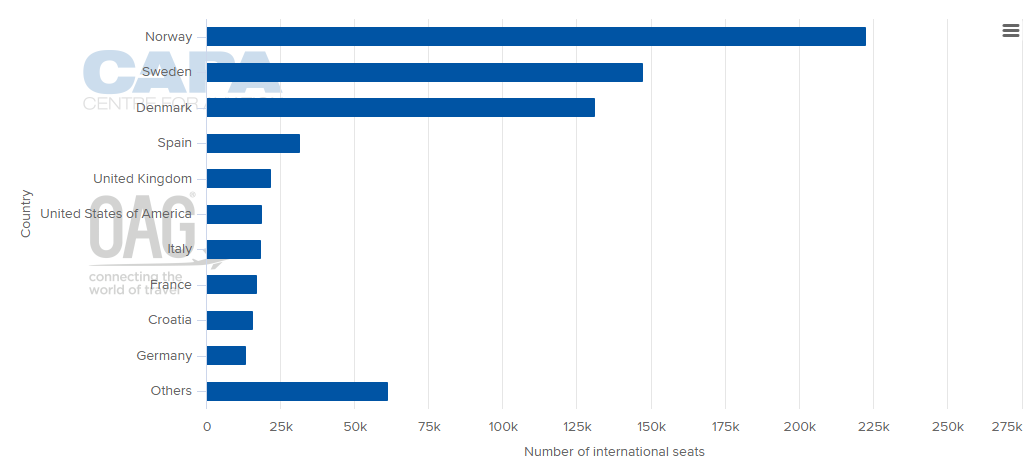

The airline's focus on Scandinavia is reflected by the fact that some 70 per cent of its passenger revenue comes from Scandinavia, dominated by the Norway and Sweden markets. Its network model means it offers the most departures from the primary airports in Scandinavia, supplemented by the offering from Star Alliance and partners - around 80 per cent of passengers who travel on its intercontinental routes begin or end their journeys in Scandinavia. However, Spain and the UK are its largest markets outside of its home environment.

CHART -Source: SAS Largest International Country Markets (weekly seats) Source: CAPA - Centre for Aviation and OAG Schedules Analyser

Source: CAPA - Centre for Aviation and OAG Schedules Analyser

But SAS acknowledges that if it is "to secure the long-term profitability of key traffic flows" it needs to actively participate in the growing leisure market. Over the past couple of years it has been attempting to achieve this by introducing short-season peak summer flights on popular tourist routes, however it has found it hard to compete with rivals which have much lower cost structures.

"SAS must have the same preconditions as other market participants," if it is to actively participate in the growing leisure market, says the carrier. "We need to be more flexible and increase the productivity of flight operations to leverage the market potential."

SAS's move is unusual for a legacy airline, demonstrating new creative thinking spurred by competitor disruption. It expects its new Irish-registered airline subsidiary to have a level of unit cost (cost per ASK, CASK) that is in line with key competitors, which when you consider the average hourly labour cost in Scandinavia is more than EUR43, compared with EUR25 across the European Union and EUR26 in the UK, that's a significant cost saving. It will also be able to offer earlier inbound flights into Scandinavia from London and Spain using locally based crew and aircraft, thereby saving overnight accommodation and parking costs.

READ MORE… SAS: first lower cost non-Scandinavian bases will be Málaga and (expensive, congested) Heathrow