Summary:

- The aviation industry is seeing a growing trend to summer seasonality peaks with average daily seat capacity up by double digits (+10.9%) in summer 2018 for a second successive year;

- European markets are more heavily influenced by seasonal shifts in demand with European nations accounting for 18 of the 20 markets with the largest percentage seat growth in summer 2018;

- Palma de Mallorca Airport in Spain's Balearic Islands has the largest percentage growth in seasonal capacity this summer versus winter 2017/2018;

- Looking back over the past five years and Croatia is the world's most seasonal summer market with average seats per day more than doubling between its winter and summer inventories.

Through experience airlines and airports have worked hard to find a seasonality balance to try and match demand with capacity in the most profitable way. Airlines will perhaps add leased capacity during traffic peaks or even lease out their own equipment during the quieter periods.

Similarly, airports across the globe have to ensure they have capacity to meet seasonal peaks, both in terms of infrastructure and staff. There is also no best formula as every airline and airport have a different passenger profile that will affect how hard it is impacted by seasonality - even business travel has its own peaks and troughs across the year.

Looking at OAG schedule data for the winter 2017/2018 and summer 2018 schedules, shows the global level of summer seasonality at +63.7% with total system seats up from almost 2.1 billion to over 3.4 billion. This is an increase of around 1.5 million seats per day between the two schedule periods, an average daily growth of +10.0%.

Europe has by far the most pronounced summer seasonality peak, with Eastern Europe (+25.8%) just outpacing Western Europe (+23.8%) in terms of average growth in seats per day between the summer and winter schedule. North Africa (+13.2%) is the only other region to record a double-digit rise in daily capacity growth between the seasons.

In terms of global airports, it is Palma de Mallorca Airport in Spain's Balearic Islands that has the highest level of seasonality this summer among the world's largest airports with seat levels increasing almost five fold versus last winter. The airport is the main international gateway to the popular holiday island and traditionally sees a significant upturn in summer capacity, albeit this year's growth is more pronounced as a result of the collapse of airberlin and Monarch Airlines, which resulted in a lower level of winter operations.

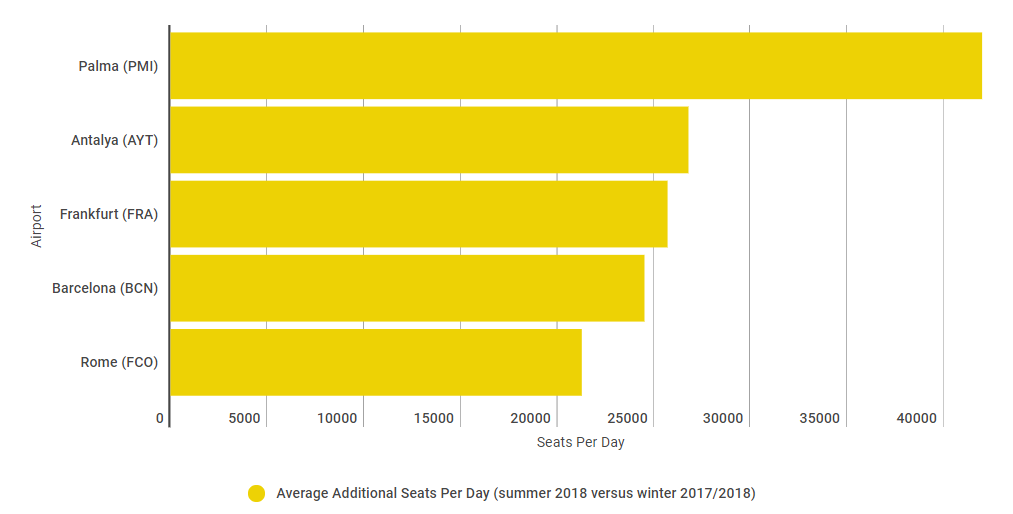

CHART - Palma de Mallorca Airport is one of five airports - all European - that will be offering more than 25,000 additional seats on average per day this summer versus the previous winter schedule Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

As a popular destination for summer tourism you would expect Spain to suffer from significant seasonality and it is one of 21 nations across the globe that will see seat levels more than double during the current summer schedule versus last year's winter operation. This list is dominated by European countries with Tunisia in North Africa and Greenland, geographically considered part of the North American continent, the only exceptions. Most are among Europe's expanded Eastern fringes, but the list includes mature western markets such as Italy and Portugal.

The three stand out markets are Montenegro where seat levels are up 241.9% versus the winter, Greece, with a +313.8% rise in seats, and the world's most seasonal country market, Croatia, where seat levels have more than quadrupled between winter 2017/2018 and summer 2018.

OK, we may not be comparing like for like here with this country analysis as the two schedule periods differ in length (the winter schedule has 147 days and the summer schedule has 217 days). However, even when you take into account this parameter and look at seasonal seat growth on an average daily basis the Croatian rise is still a phenomenal +276.5%.

In fact these three standout markets all still see a doubling in seat capacity per day with Greece's average daily capacity increasing +180.3% and Montenegro's growing +131.6%. On a global scale average daily seats are up by just over +10%, down slightly on summer 2017 (+11.6%), but well ahead of the five-year trend line.

Just looking at one schedule period, may not necessarily give a real insight into the seasonality of a market in the summer as many external parameters could influence the demand. Therefore, in a more detailed analysis, The Blue Swan Daily has looked back over the past five years to get a closer look at summer seasonality trends.

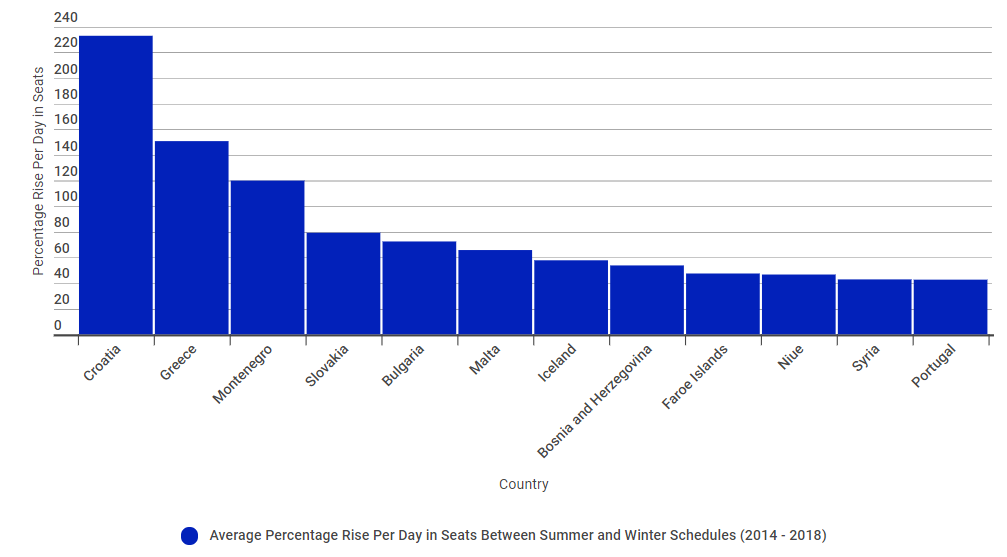

This more detailed analysis, looking at average daily summer seasonal seat growth, once again shows how Europe suffers from a much greater level of seasonality than any other part of the world and highlights how this summer's growth in Croatia, Greece and Montenegro is not just a one year wonder as they also top the global list with consistent seasonal growth over the past five years. With the exception of one year (Montenegro in summer 2015), each has seen at least a doubling of summer capacity versus the previous winter schedule during the 2014-2018 period.

CHART - Croatia, Greece and Montenegro have been the world's most seasonal markets over the past five years with average daily summer capacity inventory more than double that being offered in the previous winter schedule Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Across the world's top 100 airlines by summer 2018 capacity, the average annual seasonal growth in daily seat capacity for summer is +11.7%, or around 1.3 million additional seats. In percentage terms, the UK leisure airlines Jet2.com (+195.8%) and TUI Airways (+115.8%) lead the seasonal growth, which is again dominated by European operators, with a top ten also including LAN Airlines (due to ongoing schedule integration with LATAM Group), Vueling, Eurowings, easyJet, Aer Lingus, Austrian Airlines, Ryanair and Wizz Air.