The Covid-19 pandemic has sadly forced a lot of people out of work, and that number will likely continue to grow as the recovery chugs along at varying pace. It has also changed the way we work - and notably where we work - opening the door to hotels to reposition their offer.

Although working remotely seemed to be a temporary solution during the pandemic, jobs website Adzuna suggests it could be here to stay and confirms that new corporate positions being opened to support this new trend with firms advertising positions for 'head of remote' and 'director of home working'.

When it comes to corporate travel things are, and will continue to look, very different, but thankfully the industry covers a wide variety of journeys ranging from office meetings, sales missions, conferences and conventions, even company team building initiatives and annual awards dinners. With more of us working from home - or perhaps better defined as working from anywhere - a high number of business trips in the short-term will be for internal meetings, reacquainting with colleagues.

We know that technology will continue to play a role, but the level of substituting varies depending who you ask. Some feel it will have little impact, others believe it will shift travel trends permanently. Peter Foster, CEO of Kazakhstan flag carrier Air Astana, believes it is "wrong to consider technology being a direct replacement for business travel." He says: "It is not going to happen. Personal contact is essential, especially when you are securing new business."

Now marking 15 years at the airline's helm, he tells Corporate Travel Community (CTC) that Kazakhstan as a frontier market relies on face-to-face business more than many. A frontier market is defined as a developing country which is more developed than the least developing countries, but too small, risky, or illiquid to be generally considered an emerging market. "Its nature means you need to come here and meet the people. It simply can't be done online. It needs a visit," he says.

Kazakhstan is a significant producer of coal, crude oil and natural gas, and a major energy exporter. While coal dominates the country's energy mix, renewable sources of energy are a small but growing share of Kazakhstan's electricity generation. This business and the rotation of staff meant that Air Astana has continued to see some corporate demand during the pandemic.

Mr Foster concedes that "a certain level of business travel will be gone and may not return for a long time" and acknowledges that the industry "will certainly look different". But unlike many of the world's flag carriers corporate travel has "never been a critical part" of Air Astana's business model, acknowledges Mr Foster. But, the airline is an excellent example of a business that has pivoted to adapt to changing demand trends due to Covid-19 and the travel restrictions that continue to blight air travel.

The airline now has separated its activity into six product lines - regional international, long-haul international, domestic, cargo, charter and the activity of its LCC brand FlyArystan. "These are all currently performing to a different trajectory and there is no pattern to them," explains Mr Foster.

Ahead of the pandemic Asia was a key market for Air Astana but what Mr Foster describes as a policy of "suppression rather than containment" of Covid-19 has seen the airline's activities now reduced to just one heavily restricted route into South Korea.

But, he acknowledges there is a "pent-up demand for leisure travel" and "a resilient travel market in growing economies". He says, that "if not Asia, they will travel to where they can go" and that the airline is boosting flights into markets such as Sharm-el-Sheikh and Dubai, the latter seeing "huge demand". There are also considerations for new links to markets such as the Maldives and Sri Lanka.

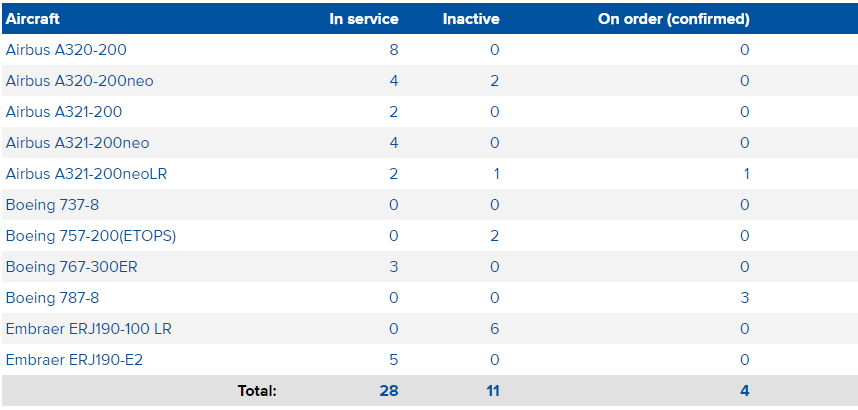

Mr Foster describes Air Astana as being "down, but not out" and in a "stable situation with regard liquidity". It has benefitted for a strong previous year performance and the dynamics of the local geography. It has used the low demand period to accelerate its fleet renewal and retire its older 757 and Embraer E-Jet fleet in favour of new Airbus A320neos - including the long-range A321LR variant - and Embraer E2s.

Meanwhile, it is deploying its widebodied 767s on a mixture of cargo work - one of its three units has been modified into a mixed passenger and cargo space in the main cabin - and to provide capacity on routes to Moscow, Russia and Tashkent, Uzbekistan where frequencies remain restricted, but where there is "massive pent up demand". The three 767s are due to be replaced in time by three 787s but Air Astana is now talking to Boeing to defer deliveries. "There is a market for widebody equipment… but not in excess of three 767s right now," explains Mr Foster.

We often talk about domestic air travel leading the recovery and that is certainly true in Kazakhstan, the ninth-largest country in the world and one where air transport is essential to support internal travel. Air Astana's LCC brand FlyArystan launched in Mar-2019 and has become a clear focus during the coronavirus outbreak. "There is no question there is a huge demand for LCCs," says Mr Foster.

From two aircraft in 2019 FlyArystan is now about to get its seventh aircraft and looking into 2021 the airline's schedule is projected to grow +650% versus 2019, a journey also been helped by the collapse of local operator Bek-Air last year. Mr Foster says there is also anecdotal evidence of an uplift in rail to air substitution with travellers feeling safer to take shorter flights than longer rail journeys.

The Air Astana business certainly looks different than it did this time last year, but then the world is a very, very different place!