Summary:

- St Louis could open the door to bids for a long-term public-private partnership (P3) lease of the city's Lambert International Airport;

- Investors and operators are said to be interested in the lease, but public opposition is growing and could block any proposed deal;

- If successful the privatisation of Lambert International would be a landmark project and could be the catalyst for more such deals across the US.

The City Budget Director, Paul Payne, said in late Nov-2018 that the city may issue a formal request for qualifications (RFQ) early in 2019. One of the attractions is that the airport owns a lot of excess property with real estate development potential.

On the other hand, according to reports in local media in late Jan-2019, a group of local activists is hoping to force a public vote on any deal to privatise the airport. By signing the activists' pledge, elected officials and candidates are vowing that they will vote against any privatisation deal.

While there is not actually any deal on the table currently, with a city-hired firm actively seeking one, and demands for a public vote recently coming to nothing, the 'STL Not for Sale' group, which uses a giant pig as its logo, has decided to increase the pressure. Trades Unions appear to be in favour of a P3 deal.

In May-2017 St Louis submitted a preliminary application requesting the FAA to reserve a slot for the Lambert International Airport in the 1996 Airport Pilot Privatisation Programme, seeking "the potential to improve airport revenue through 'private partner innovation, diversification and improved use of land assets'". It is those land assets that seem to be particularly attractive to potential investors.

The specific rationale for considering a P3 lease was to unshackle the airport's asset value in order to invest in other St Louis infrastructure; not a new concept where airport privatisation has in the past been considered by US cities, but a worthy one.

The City would retain full ownership of the airport, while daily operations would be turned over to a private sector operator that would lease the facility. The Department of Transportation granted preliminary approval and opened the door to Lambert International becoming the second medium hub airport to join the programme after San Juan's Luis Muñoz Marín International, in Puerto Rico.

There was immediate public concern, arising initially out of a lack of public understanding of what privatisation means and entails. After a lengthy period (to Jan-2018) the city selected advisers for the privatisation procedure, to evaluate proposals. But then the city's Board of Aldermen called on the Board of Estimate and Apportionment to reject the selection.

Eventually, in Jun-2018 the consultants were approved, the City changing its tune slightly to insist that the purpose of exploring the opportunity for a third party to manage and operate the airport was "to determine if airline and other related services can be improved for our residents, businesses and visitors, and how the City can make the airport a stronger asset to improve our economic development future".

In addition, any final agreement with a private operator to manage and operate the airport would require approval from the Board of Estimate and Apportionment, the Board of Aldermen, the FAA and a majority of the airlines that operate at the airport. The 'Double Super Majority' requirement means 65% of all the airlines serving the airport must approve airport lease deal terms and also airlines representing at least 65% of the annual landed weight at the airport.

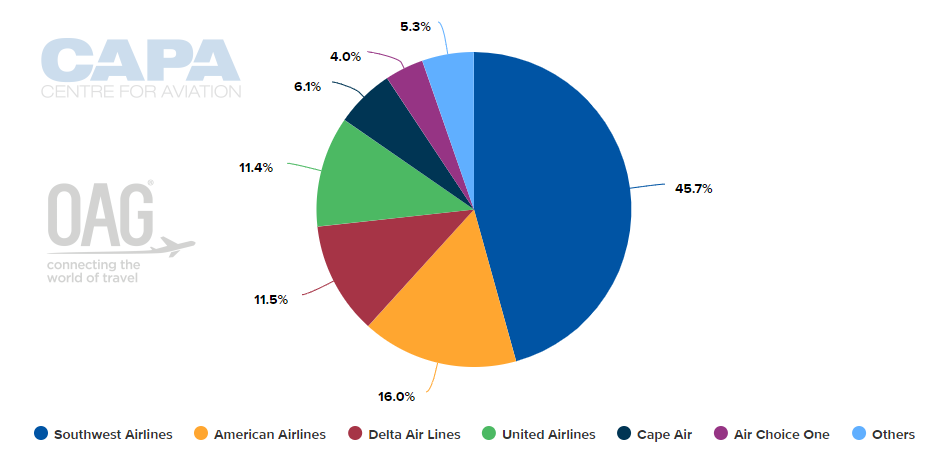

As can be seen in the chart below, no single airline at Lambert International has 65% of the movements (which is the closest approximation to landed weight that is available). So no single airline could block a lease, although collectively they could, but based on this data that would involve at least three airlines and would have to include Southwest Airlines.

CHART - Southwest Airlines is the largest operator at St Louis Lambert International Airport by movements with a 45.7% share of flights Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Feb-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Feb-2019)

In Aug-2018 an airport advisory group met for the first time, tasked with developing the process by which the city government will seek and review bids from private investors. Legal and financial advisers outlined an 18-month timeline for the process. At the same time a survey was initiated to gauge public opinion on the proposal, surveying 20,000 residents.

Should the privatisation go through, it would be the largest one to date, with 75% more passengers than San Juan. It could have a catalytic effect on other cities with unmet infrastructure needs and a large airport asset from which they receive no direct financial benefits.

But what are the chances of privatisation being successfully concluded? In the CAPA - Centre for Aviation Airport Privatisation & Finance Review 2018 the likelihood of the transaction being completed in 2018 was given as just 4/10, rising to 7/10 for the current calendar year.