One of the successes of the Low Cost Carrier (LCC) sector across the world has the stimulation effect of lower fares. The introduction of additional point-to-point market pairs, coupled with cheap tickets has attracted many away from the poor ground infrastructure to the comfort and speed of air travel. Across Latin America, the difference in travel time and comfort is particularly significant.

Executives at Mexican ULCC Volaris recently stated the airline increased passenger volumes by 12% year-on-year to 18.4 million, and first time flyers switching from buses represented one third of that growth. "…these are new passengers that we are adding to the pipeline, and it's really creating a differentiated growth for Volaris, which explains why we need to keep on growing the way we're growing", they declared.

Mexico has a population of approximately of 129 million people, and Volaris has calculated 38 million Mexicans have never travelled by aircraft. During 2018, roughly 1.1 million passengers took Volaris' flights for the first time, and the airline expects to register a similar volume in new travellers in 2019. Volaris has calculated the bus markets in Mexico represents more than 3 billion passengers, "and we believe we can take away a share of those customers".

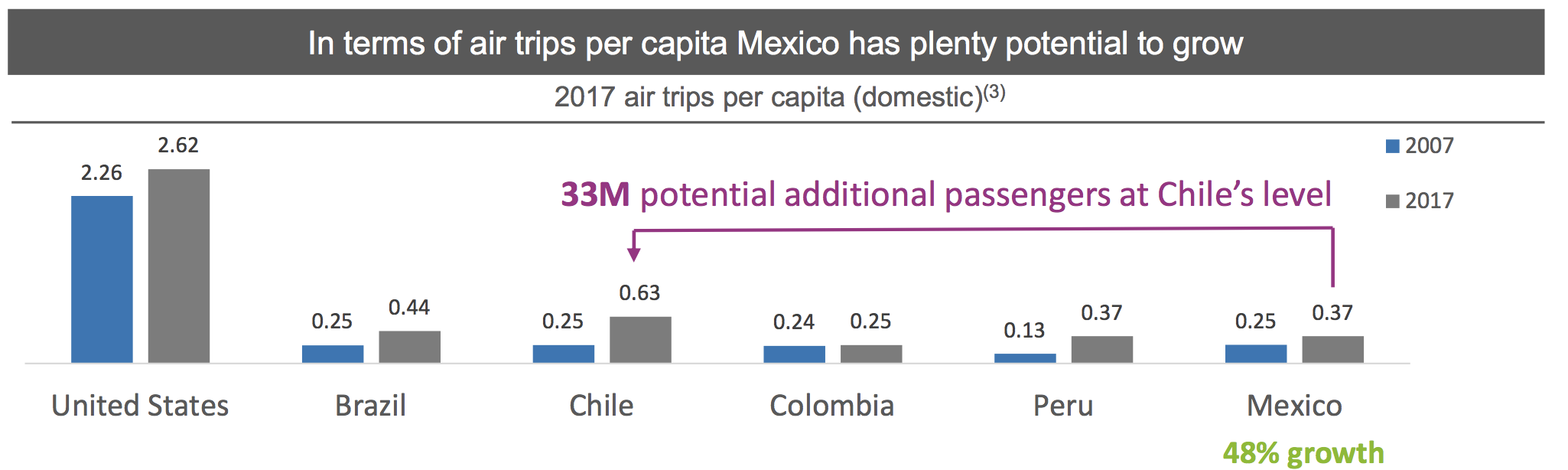

Data compiled by Volaris show Mexico's domestic passengers grew from 25 million in 2011 to 45 million in 2017, and domestic trips per capita were just 0.37 in 2017. Those statistics show ample opportunities remain to stimulate traffic in the market.

As part of its route development strategy Volaris has looked closely at the demand levels on many bus city pairs beyond five hours, where it most strongly believes a well-priced but sustainable fare offering can attract customers into the air. But it is not alone.

Local rival VivaAerobus has also successfully translated bus demand into new passengers, significantly helped by it being owned by owned by the largest bus company group in Mexico, IAMSA. This has given it a bit of a competitive advantage with the ability to distribute its air tickets across the major bus stations in Mexico.