"Moving to a more holistic view of the traveller journey, considering before, during and after the trip, is essential for understanding the post COVID travellers," explains Euromonitor International in 'Understanding the Traveller Journey: Critical for a Sustainable Recovery' a new e-book based upon its 'Voice of the Consumer' travel survey.

The research highlights that there is understandably a staycations boost as international travel bans persist. International tourism spending fell by -75% in 2020, and the outlook for 2021 points to a significant reduction on pre crisis levels according to Euromonitor's Travel Forecast Model, based on UNWTO data. Similarly, people are reconnecting closer to home with day trips, albeit there are some differing trends based on age and income.

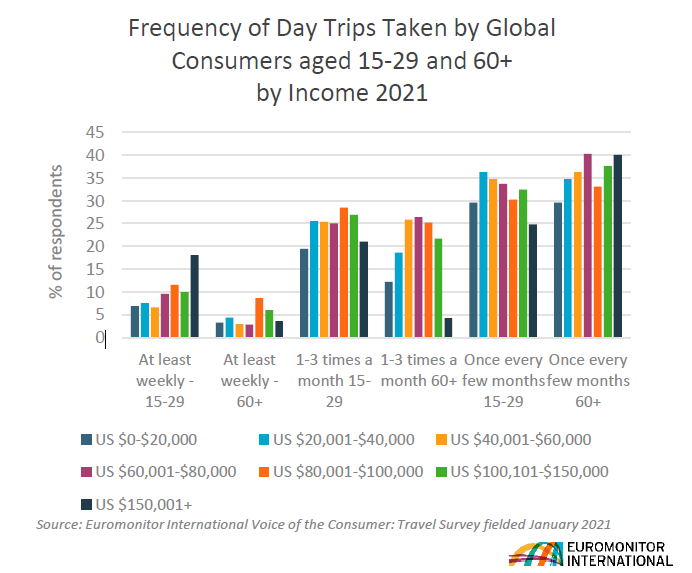

The survey found that younger people aged 15-29 and earning over USD150,000 go on at least weekly day trips, discovering what is closer to home. For older people aged 60+, "there is less interest in taking frequent day trips," according to the report. There preference is to take a day trip closer to home every couple of months, "clearly not due to income" but instead "a result of the pandemic and health concerns".

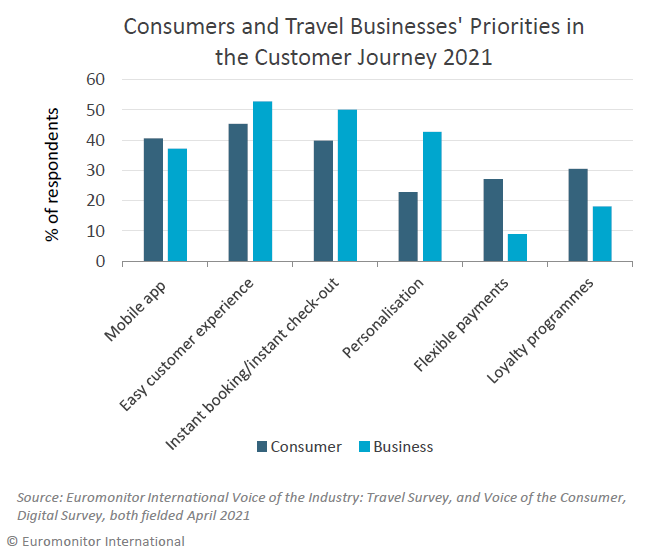

The research does illustrate what Euromonitor International identifies as a "disconnect between consumer expectations and business priorities". It found that 45% of consumers value an easy customer experience, and 41% are looking to have use of a mobile app, useful across the stages of the customer journey to help deliver a consistent and seamless experience.

"As companies slowly emerge from the crisis, the importance of engaging and building relationships and emotional links with the end consumer becomes vital for market players," says the report. "Hyper personalisation is the tool that can bridge that gap and optimise content, products and services for changing demands."

But the survey found that flexible payments and loyalty programmes are more important to consumers than businesses may realise, since businesses appear to not be prioritising these areas, according to their own survey responses.

The pandemic has provided the time to stop and think about our priorities and alongside better understanding environmental issues has also shone a harsh light on inequalities. It is "vital" that travel brands and destinations fully embrace the need for diversity and inclusion in their products, services and marketing strategies, says the report.

The research found that globally, nature and outdoors activities have increased for white / Caucasian consumers between 2019 and 2021 as the pandemic brought health and wellness to the fore. Elsewhere, Hispanic / Latino consumers showed a strong preference for immersion in culture, where this is a strong social sustainability element, while relaxation was highest ranked for all groups, with Black consumers showing a strong preference for all inclusive with its quality value positioning.

The 'Voice of the Consumer' surveys have also provided some insights into changing booking patterns. This latest report highlights that China is by far the most mobile-first country when it comes to booking travel with more than half (56%) Chinese consumers are booking their trips on a smartphone in 2021, with the 50% threshold also been surpassed in Vietnam and 40% in Saudi Arabia. However, mobile travel bookings for Germany, Belgium and the UK remain very low, less than one in five (<20%) and where computer and tablets continue to take the biggest share of bookings.