Within Asia specifically, the cross border JV model has allowed major LCC groups such as AirAsia, Jetstar, Lion Air, and to a lesser extent VietJet, to accommodate foreign ownership restrictions by taking branded minority stakes in local airlines. Some LCCs have even formed their own groupings to take advantage of cross selling opportunities.

But, many questions remain...

- What are the opportunities and limitations of each partnership model from a cost, revenue, traffic and brand awareness perspective?

- Under a multi airline group structure, how does the parent company strategically manage each of their airline brands?

- Can a non aligned LCC survive without being part of either a branded group or LCC alliance?

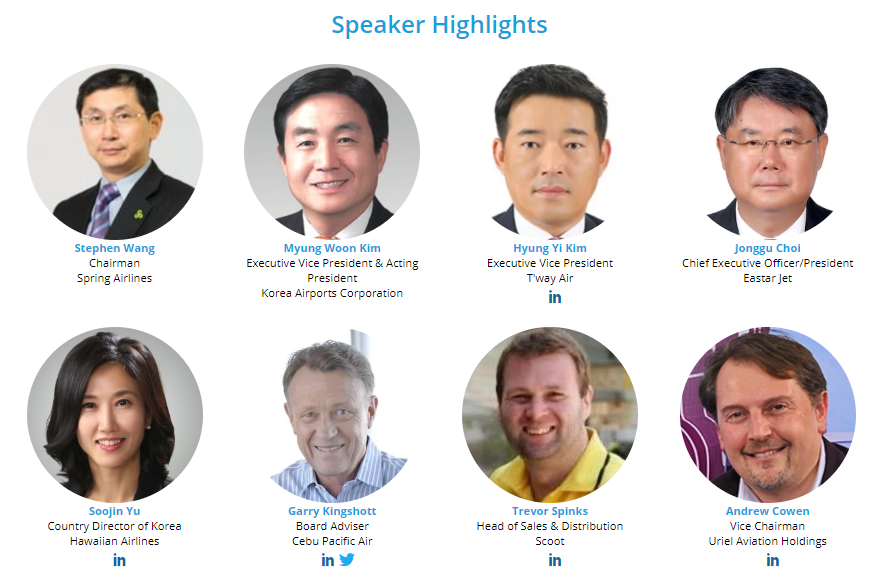

This will be one of the major topic areas discussed at the forthcoming CAPA- Centre for Aviation LCCs in North Asia event which makes a return to Seoul, South Korea for its 2018 edition on 11-Jun-2018 and 12-Jun-2018.

Understanding aviation markets is CAPA's great strength and passion and this year's agenda includes a variety of topics sure to generate interest. FSC-LCC partnerships, cross border JVs and LCC alliances in North Asia continues the morning programme of the Seoul forum on 12-Jun-2018.

It's hardly a secret that the airline industry is facing myriad challenges, notably in the marketing and distribution areas, as companies with personalised data, and the analytics and artificial intelligence to go with it, become greater threats to the stability of the traditional airline model.

Despite lacking the seat penetration rate of peers in other markets, with about 11% of seats within North Asia operated by LCCs compared with 56% in Southeast Asia and 40% in Western Europe, LCCs are beginning to flourish in this region. The LCC model may now be well understood here, but the operating environment is increasingly complex, competitive and interconnected. Long haul low cost, full service airlines adding LCC subsidiaries, and many other developments are high on the agenda.

This high-level aviation event, hosted at The Grand Hilton Seoul, around 15 minutes from downtown Seoul, is a forum for debate and discussion of strategic issues facing the LCC industry in North Asia.

FIND OUT MORE… visit the CAPA LCCs in North Asia 2018 homepage to find out more about this not-to-be-missed opportunity to discuss relevant issues impacting the aviation sector and learn meaningful insights from your industry peers.