The study, completed in partnership with hotel profit benchmarking service HotStats, provides a comprehensive analysis of the UK's hotels trading performance, with a detailed review of hotel revenue, cost and profitability. Despite a slowdown in the UK economy and ongoing uncertainty following the Brexit vote, the headline results from the analysis show that for August YTD 2017, hotels have enjoyed a particularly robust trading environment, albeit with variation in performance amongst regional markets.

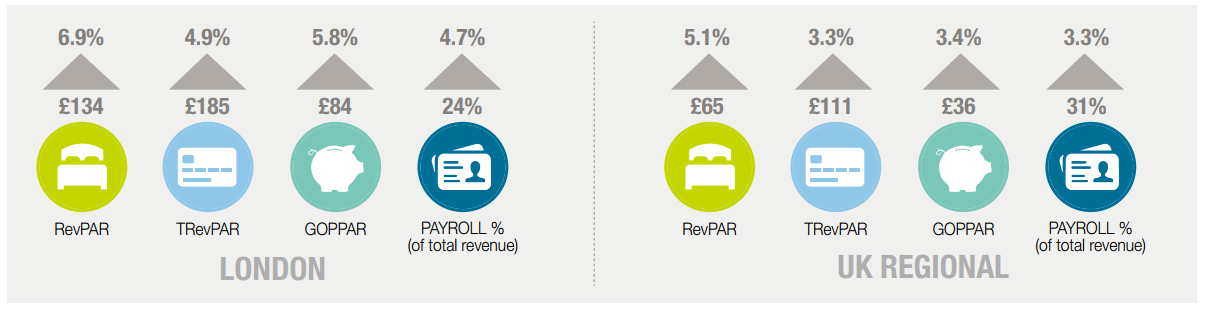

The strong RevPAR growth in London, largely driven by growth in the average room rate, combined with healthy levels of trading across regional markets has filtered down to gross operating profit (GOP), resulting in respectable growth in GOPPAR (10.1% and 4.8% respectively as at August YTD 2017). But, the headwinds of rising costs in both expenses and payroll provide a warning of challenges ahead for the industry, at a time of heightened concern over the free movement of labour post Brexit.

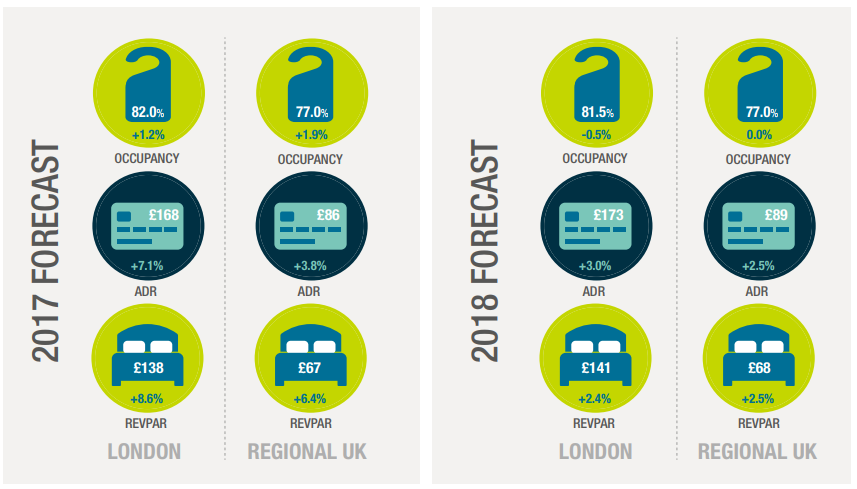

CHART - UK Hotels have enjoyed a particularly robust trading environment in both London and Regional UK, reinforced by a weak currency, resulting in a greater than anticipated boost in tourism Source: Knight Frank 2017 UK Hotel Trading Performance Review

Source: Knight Frank 2017 UK Hotel Trading Performance Review

Looking ahead to 2018, there is a growing market sentiment that the rate of growth in key trading performance indicators will be lower than in 2017, says Knight Frank. Nevertheless, the weakened pound is expected to continue to attract overseas leisure visitors, which combined with strong growth in demand from continental Europe and resilience in the domestic "staycation" market, should provide further growth potential for the UK hotel market. Knight Frank predicts growth in RevPAR and GOPPAR into 2018, albeit with a tougher trading environment, complicated further by the volume of new capacity entering the market.

According to Knight Frank, the UK hotel market has witnessed an exceptionally robust trading performance in 2017 with record RevPAR levels, achieving £89 for August YTD, up 7.4% compared to the same period in 2016. Whilst both London and Regional UK markets have recorded growth in occupancy, of 1.6% and 1.8% respectively for August YTD, London has outperformed provincial markets, with a 9.1% surge in RevPAR growth achieved through an exceptionally strong uplift in the Average Room Rate to £161.

CHART - RevPAR is forecast to grow by over 7% for the full year 2017, driven by 9% RevPAR growth in London and record high occupancy rates in the UK Provinces, with impressive gains in GOPPAR Source: Knight Frank 2017 UK Hotel Trading Performance Review

Source: Knight Frank 2017 UK Hotel Trading Performance Review

Following a weaker performance in 2016, London has benefitted from the weak pound, incentivising overseas visitors to the capital city, with strong growth recorded for long-haul markets, particularly from North America, who typically stay longer and spend more. To date, this trend in the key top line UK hotel metrics mirrors the 2017 growth forecasts announced by Visit Britain, of 6% increase in inbound visits and 14% growth in spending.

The volume of demand from international visitors in London, combined with strong leisure demand drivers in UK provincial markets, is facilitating hotel occupancy rates throughout the UK, with Knight Frank forecasting 2017 year-end occupancy rates of 82% for London and a record high 77% occupancy for the UK provinces.

This performance is particularly impressive when taking into consideration the new hotel supply entering the market. In 2017, 10,000 new hotel rooms have opened in the UK, of which 50% of new hotels opened in London, with a further 7,000 new rooms planned to open throughout the UK in the final quarter of 2017.

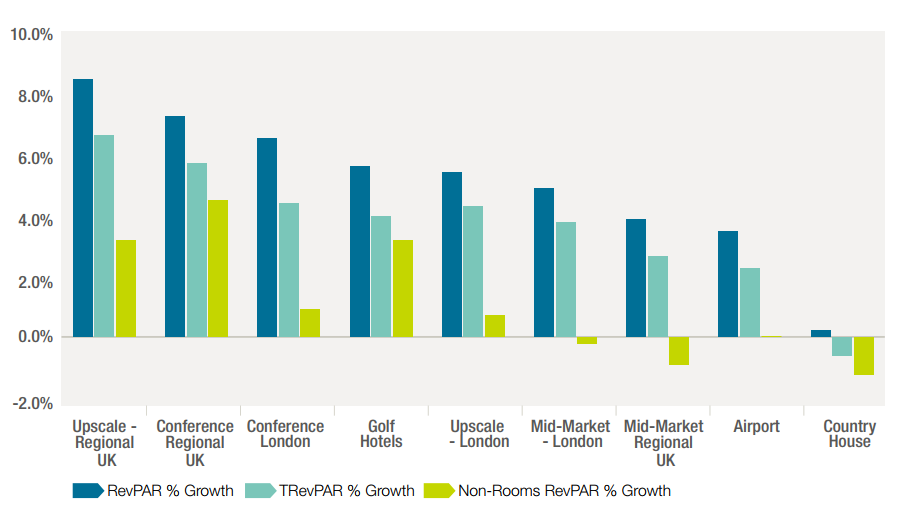

More in depth analysis of the HotStats datasets provides the ability to dissect the UK market by hotel type and size. Knight Frank analysis reveals that for the 12-month period September to August (Sept-Aug) 2016/17, UK regional hotels of less than 150 rooms have achieved RevPAR growth of 4%, below the Regional UK average growth of 5.1%. In contrast, UK Regional hotels with over 250 rooms have achieved strong growth of 7%, well above the average Regional UK performance.

CHART - Upscale market segments, including conference hotels, have performed the strongest, consolidating increased RevPAR with enhanced revenue growth from other operating departments Source: HotStats - Knight Frank 2017 UK Hotel Trading Performance Review

Source: HotStats - Knight Frank 2017 UK Hotel Trading Performance Review

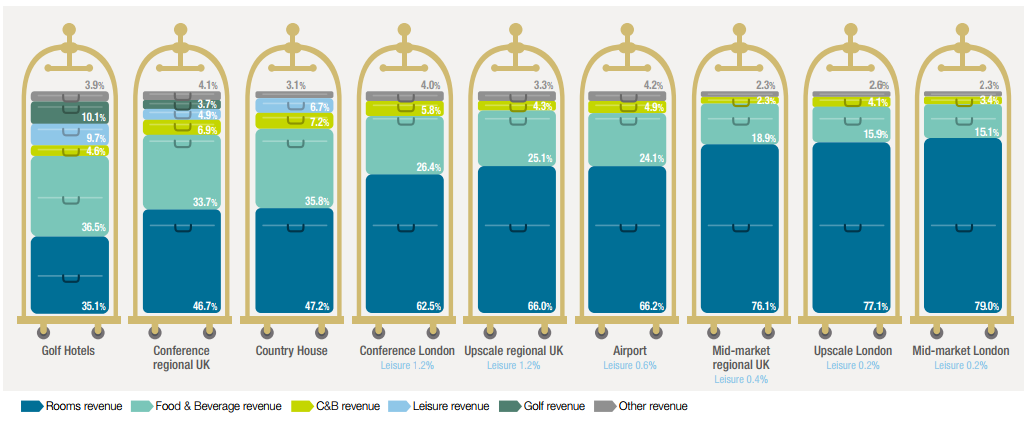

Further insights from the analysis show the rise in RevPAR outpaces growth in other operating departments, resulting in the share of Food & Beverage revenue to decline as a percentage of turnover. Through an analysis of multiple, consolidated hotel datasets comparing the revenue mix breakdown by hotel type, Knight Frank highlights there is a stark but perhaps not surprising contrast between the various sectors revenue make-up.

Golf, Country House and Conference Hotels - all operate with less than 50% of revenue generated from rooms, according to the report. Leading the pack Mid-Market hotels, both in London and regionally, together with Upscale London hotels generate more than 70% of revenues from the rooms department, with the increase in rooms revenue exceeding expense line growth, thus driving operating profits forward.

CHART - Room revenues accounted for between 35.1% and 79.0% of hotel revenues for the 12 months from September 2016 to August 2017 Source: HotStats - Knight Frank 2017 UK Hotel Trading Performance Review

Source: HotStats - Knight Frank 2017 UK Hotel Trading Performance Review

READ MORE; View the full Knight Frank UK Hotel Trading Performance Review 2017