Faced with the reality of a global recession and new waves of the virus, countries are using innovation to accelerate recovery, according to global market research company Euromonitor International's new 'Accelerating Travel Innovation after Coronavirus' report.

Responding to the global sos, travel brands and destinations went back to first principles and got creative, says the report. "Many came back fighting, showing great resilience, agility and strength in times of adversity. Innovation was a key vehicle for adapting to the new norms, accelerating digitalisation and sustainability to future-proof recovery," it explains.

According to Euromonitor International, the pandemic has sharply revealed the fault lines in the industry's business model, redrawing the global map as new priority corridors and alliances emerge post lockdown. Unchained from the past, there is "a chance to reset and correct the course of history, to chart a better path based on the universal values that unite us, rather than divide us," it says. One thing is for certain, the next few years "will not be for the faint-hearted as supply and demand recalibrate to the next normal," it adds.

Every part of the travel industry supply chain continues to be under pressure from the ongoing impact of the pandemic, with tourism demand predicted to take a minimum of three to five years to recover. This paper reveals how travel companies and destinations are jumping on innovation and embracing digitalisation and sustainability as a way to future-proof recovery.

The report highlights clear regional differences. In Europe, a strong rebound of +5% real GDP growth and a +76% increase in inbound receipts are expected in 2021, it notes, and sustainable tourism is expected to play a big part in the recovery process, with countries looking to achieve net positive impact for local communities, especially in destinations suffering from over-tourism, like Barcelona.

In Asia Pacific, it predicts recovery within three years; relatively quicker than Western Europe. Home to the world's largest population of internet users, innovation in the region is "already thriving," it notes, with concepts tackling various needs during lockdown, including customer journey, mobility and sustainable destination management. "With mobile sales accounting for 62% of all APAC online sales this year, this trend will continue apace post pandemic, it says, while it predicts by 2025, Singapore will lead online travel sales with an average spend of USD1,200 per person a year.

In the Americas, Panama and Argentina are forecast to experience a +20% CAGR in inbound receipts in 2021-2025, ahead of the US at +12% CAGR, highlights the report. It notes that digitalisation "is accelerating" with a wide range of technology incorporated into new travel concepts, including AI, automation, blockchain and the Internet of Things, to create "a safer, more sustainable and seamless travel experience. Insights from Euromonitor International show that 61% of US travel companies expect AI to impact their business in the next five years.

Meanwhile, countries in the Middle East are introducing new health and hygiene protocols to reassure people's safety, acknowledges the report. It highlights that mosques in Saudi Arabia are using ozone technology and thermal cameras for mass disinfection and temperature scanning, while, in Africa, the potential for smart connected cities is close in countries such as South Africa and Nigeria, with the acceleration in digital identity creation and rolling out 5G.

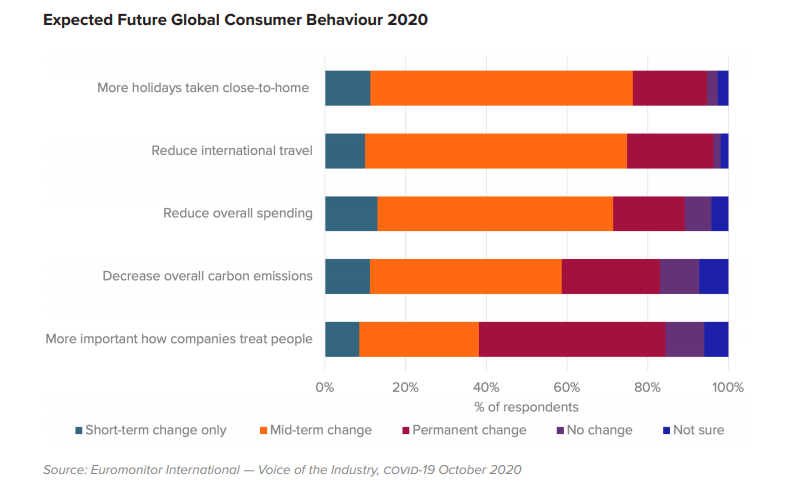

The report includes findings from Euromonitor's Voice of the Industry series which highlights a strong inverse correlation between the consumer appetite for travelling internationally and holidaying closer to home, with the latter being the preferred post-COVID travel option, particularly over the short to mid-term, with 76% of consumers choosing this option. Over the Jul-2020 to Oct-2020 period, the level of global consumers that said that they would move permanently away from international remained at over one fifth with 21% saying that they would not go back to international travel.

"Coronavirus revealed some unpleasant truths" about our former travel behaviours that we were unwilling to accept, says the report, such as its negative impact on the environment. Now, many consumers are questioning whether they will revert to their past behaviours and consumption as a matter of principle. "This message is being reinforced in certain regions, such as Scandinavia and Europe, where the emphasis is on a digital green transformation and pivoting to the circular economy," explains the report.

However, sustainable transformation is not without its challenges. Based on the results of Euromonitor's Voice of Industry Survey, the travel industry is falling behind other industries, such as consumer goods, retail and packaging, when it comes to overall engagement with the 17 Sustainable Development Goals (SDGs) that make up the UN's 2030 agenda.

In the three SDGs where travel and tourism were called out, the industry is underperforming in decent work and economic growth (goal 8) and responsible consumption and production (goal 12) whilst levels of engagement with life underwater (goal 14) remain low, says the report.

Yet, it acknowledges there are areas where the travel industry is excelling, with high levels of engagement with industry, innovation and infrastructure (goal 9) and sustainable cities and communities (goal 11), with scores of 61.5% and 66.7%, respectively. However, there is more work to be done to integrate the SDGs into recovery strategies and rethink operations.

Furthermore, it notes, 42% of the travel industry stated that they would roll back or cancel developing sustainable products and services due to covid-19, at a time when they are needed most. "Seeing sustainability as a competitive advantage is more pressing as a growing number of destinations and travel start-ups are starting with the SDGs as their blueprint, giving them an advantage over more traditional players that were built to drive volumes and return on investment to please shareholders," it adds.