According to Business Travel News (BTN), the survey of global corporate travel managers - more than two thirds of which had annual travel budgets of at least USD10 million and a third of over USD15 billion - found that virtual meetings would on average replace 27% of 2022 travel volume.

This year the respondents said that figure would be 44% and is projected to fall to 19% in 2023. Many observers have put the anticipated loss of corporate travel to technology substitution at around the one fifth level, although some still believe that figure could ultimately be much higher.

The BTN report into the survey findings says most respondents expected virtual meetings "to continue to cannibalise a significant portion" of their travel volume in 2023. Approaching two-thirds (63%) said virtual meetings in 2023 would replace 11% to 50% of their organisation's travel volume -a wide range. More than a quarter (27%) projected they would replace less than 10%, while only 7% projected virtual meetings wouldn't replace any travel in 2023.

According to BTN, when asked why virtual meetings are replacing travel volume, nearly three-quarters of respondents cited that they represent "a more efficient use of employees' time," while 72% cited "the cost reduction virtual offers". More than half noted Covid-19 concerns (~59%) and cited environmental concerns and sustainability considerations (~50%), while over two-thirds noted higher engagement and participation in meetings and conferences (39%).

As can be expected given the global imbalance in COVID-19 control of infections, vaccination programmes and varied government mobility protocols - including border restrictions and/or quarantine and isolation requirements - the top reasons for replacing travel with virtual meetings varied based on geography. Interestingly, notes BTN on the survey results, European companies considered environmental concerns as the most important reason to replace travel much more than US-based companies (25% versus 5%).

But, what does this mean for travel managers as we start to look ahead into 2022? It appears, reports BTN, that the projected shift to virtual meetings will be reflected in "slashed 2022 travel budgets". More than half (52%) the Morgan Stanley survey respondents expect their organisation's travel budget to be reduced by between 11% and 50% (again, a very wide margin!) from 2019 levels. On average, travel managers expect their 2022 travel budgets to be reduced 17.5% from 2019.

BTN says the Morgan Stanley research shows that just 4% of respondents projected their organisation's travel budget would recover to its 2019 level in the second half of 2021, around one in five (17%) forecast that to happen in the first half of 2022, a similar level (19%) in the second half of 2022, in 2023 (20%) and 2024 (16%), with nearly one quarter projecting their pre-covid budgets would never recover.

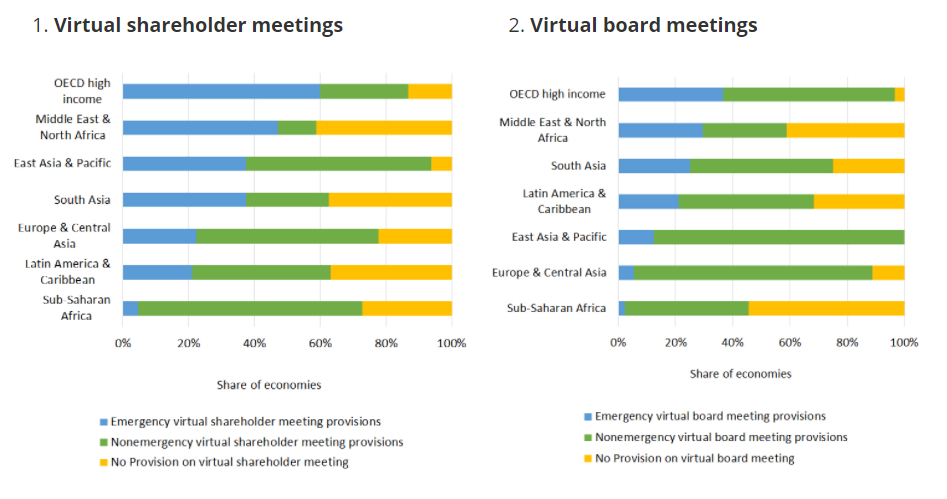

Recent research by The World Bank has highlighted the trend towards virtual meetings becoming even deeper integrated into business. It has become more accepted that internal meetings rather than external meetings will be more regularly substituted by virtual technology and that is even seeing new legal frameworks introduced to allow shareholder and board meetings to operate remotely.

Since the onset of the pandemic, The World Bank says 45 economies have introduced provisions through emergency legislations to expand the possibility of using electronic means and legal tools to allow companies to hold virtual shareholder meetings, while 26 introduced such provision for board meetings. Most of these emergency measures were instituted by OECD high-income economies.

Among these, some adopted provisions on virtual meetings solely as a temporary measure in response to the COVID-19 pandemic. For example, virtual meetings of shareholders were temporarily allowed in Australia and the United Kingdom until 31-Mar-2021, and are allowed in Austria, Germany and Switzerland until the end of 2021. Whether these temporary measures will be translated into mandatory regulations to encourage virtual meetings as a matter of best practice going forward, remains to be seen.

The World Bank research into the topic notes that "a transition towards virtual meetings must make sure that the needs of all constituents are met in a fair and well-balanced manner". If these requirements are met then we will certainly still see big decisions at businesses being made virtually well into the future leaving an indelible mark on business travel.