However clearly localised travel has still been taking place as Uber has remained the top expensed brand for US business travellers in the first half of 2020, although it has seen an unsurprisingly significant decline in usage.

This is according to the Certify SpendSmart report for the first half of 2020. The report analyses the most recent business expense and vendor ratings data from Certify users. The findings offer valuable insights into key spending trends for financial professionals and suppliers to the travel market.

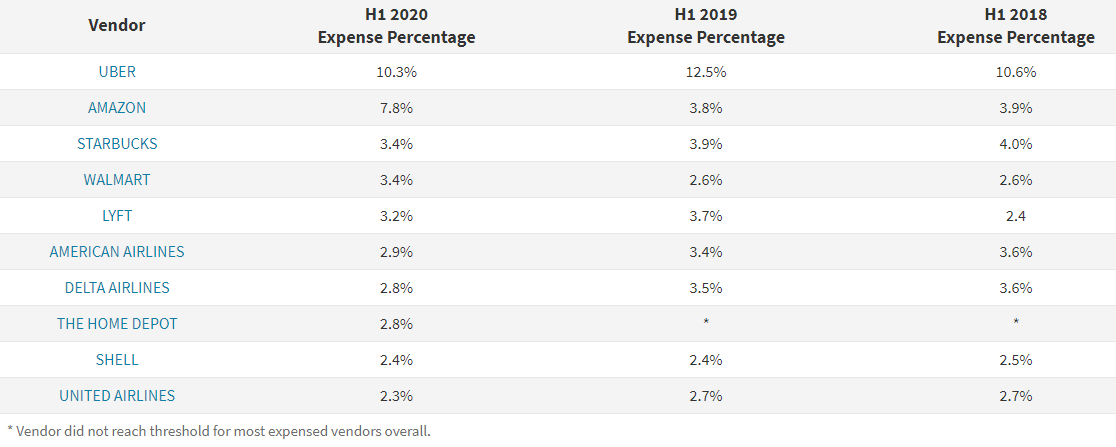

Uber has been the top vendor for the past few years but their percentage of expenses has dropped from 12.5% in 1H 2019 to 10.3% for 1H 2020. That is still way ahead of the other ride hailing brand Lyft, which dropped from 3.7% in 1H 2019 to 3.2% for 1H 2020.

CHART - The most expensed vendors overall in 1H 2020 sees some interesting changes to levels seen during the same period in 1H 2019 and 1H 2018 with the impact of Covid-19 clearly evident on behaviourSource: Certify

One of the fastest growing brands is Amazon which jumped +105.3% from 3.8% of expenses in 1H 2019 to 7.8% in 1H 2020, reflecting the increase in demand for e-commerce as home working became the new norm requiring delivery of equipment and supplies. Walmart has also jumped up the rankings and into the top five most expensed brands, pushing American Airlines and Delta Air Lines out of the top five as the requirement for air travel dropped.

With the major shift to home working, the miscellaneous category took over from ride hailing as the most expensed category with 16.5% of all transactions. Miscellaneous also topped the average expense cost at USD135.93, an increase of USD31.85 over 1H 2019. Supplies also increased by +82% compared to 1H 2019, again indicating the need for office equipment.

Behind miscellaneous as the second most expensed category is meals with 15.8% of transactions. The average spend at USD45.39 increased by USD7.18 over 1H 2019; ride hailing was the third most expensed category although the average cost dropped by USD1.31 to USD27.12.

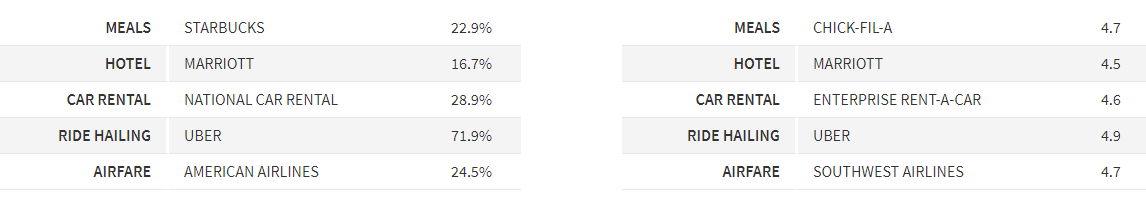

Unsurprisingly, air fare expenses dropped in 1H 2020 with American Airlines and Delta Air Lines down by five and six percentage points respectively. The most expensed airline was American Airlines with 24.5% of expenses, followed by Delta at 23.8%. The highest average cost however was Delta at USD414.05 with Southwest the highest placed for user ratings.

CHART - The most expensed brand (left) and the brands most loved (right) by category provides some insights into business traveller preferencesSource: Certify

As the need for flights decreased so the requirement for video conferencing took off in a big way to replace in-person meetings with a +213% growth in 1H 2020. Zoom accounted for 90.8% of receipts for the category increasing +301% compared to 1H 2019. With all those video conferences, the need for food to be delivered also increased with a +110% growth in the expense category over 1H 2019. DoorDash maintained its position as the most popular vendor growing +122.8% over 1H 2019 with 36% of the category.

Scooter rentals, which had seen a huge jump in 2019, are back down again for the 1H 2020 with a -58.9% decline.

Estimates for 2020 are now forecasting a drop in revenue for the business travel sector, with an USD820.7 billion loss for the year. It's a gloomy picture for the travel sector and with no-one forecasting a pick up anytime soon, the second half of the year is unlikely to reverse the current trend. The winners clearly are the e-commerce and home delivery giants with airlines having to take a back seat, for now.