The 'Business travel during COVID-19: A survey of UK businesses' research highlights the large reduction in domestic business travel across the UK since the pandemic began - only 35% of businesses that took part in the survey said they had continued conduct business travel during the pandemic.

This has resulted in a reduction in the proportion of employees travelling for business. Before the pandemic, an average (mean) of 40% of staff travelled for business and this reduced to 28% of staff in companies that continued to make business trips during the pandemic.

Similarly, there has been a reduction in the frequency of business travel. Before the pandemic 76% of businesses said staff travelling for business did so on average at least monthly, and 40% said they did so at least weekly - this reduced to 62% and 32% respectively amongst companies that continued to make business trips during the pandemic.

With rail and air services reduced to skeletal levels and concerns mixing with other travellers the research also shows an increase in car (private vehicle or hire car or company car) as the main mode for business trips and a reduction in long distance rail and domestic air travel.

Use of private car as the main mode increased significantly - an average (mean) of 43% of trips used car as the main mode during the pandemic, compared to 29% of trips before the pandemic. Use of long distance and inter-city train services as the main mode decreased significantly from 15% of trips before the pandemic to 8% during the pandemic. Domestic airline services also decreased significantly, from 14% of trips pre-pandemic to 9% during the pandemic.

However, looking ahead at projected demand for business travel after the pandemic there are signs of an expectant return to some normality.

When asked to assume that "Covid-19 is controlled to the point that all restrictions on business and the public have been lifted", a situation that the UK now finds itself domestically, companies anticipated that travel will recover to slightly lower levels than pre-pandemic, with a similar mix of modes.

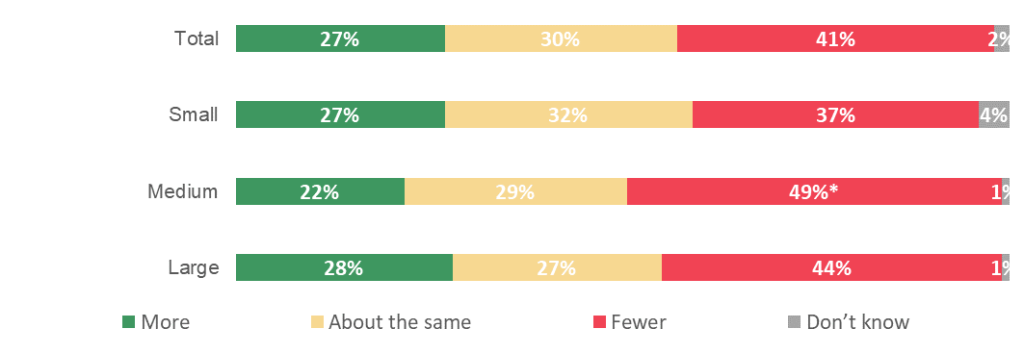

As highlighted in the chart, below, two fifths (41%) of companies expected to make fewer business trips than before the pandemic (27% somewhat less, 14% far less) and over a quarter (27%) expected to make more business trips (19% somewhat more, 8% far more). Nearly a third (30%) expected to make the same level of business trips.

Companies expected the proportion of employees travelling for business and their frequency of business travel to return to just below pre-pandemic levels with an average of 38% of employees within their companies to be travelling for business (versus 40% before the pandemic). Only 1% said no employees would be travelling for business after the pandemic.

Similarly, a third of companies (34%) expected staff who travel for business to do so on average at least weekly (versus 40% before the pandemic) and 65% at least monthly (versus 76% before the pandemic).

Interestingly, assuming restrictions are no longer in place, companies expect to be using a similar mix of main modes as before the pandemic - i.e. a return to long-distance rail and domestic air travel, and a reduction in the proportion of car journeys compared to levels during the pandemic.

Companies expected an average (mean) of 33% of trips to use car as the main mode (versus 29% pre-pandemic), 13% using long-distance rail as the main mode (versus 15% pre-pandemic), 11% using domestic airline (versus 14% pre-pandemic).

In terms of other modes, companies expected an average (mean) of 10% of trips to use local trains as the main mode (versus 14% pre-pandemic, 11% during the pandemic), 7% using local buses (versus 6% pre, 4% during), 5% using taxi (versus 3% pre, and 5% during), and 3% using other modes including cycling and walking (versus 3% pre, and 5% during).

Among the biggest threat to the return of business travel though is technology substitution. We continue to estimate how much corporate travel will be lost in this manner, but it is expected that domestic business trips will be more heavily impacted than international visits.

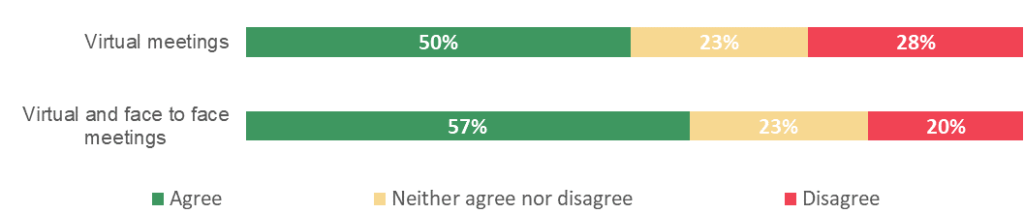

The UK Department of Transport research shows that over nine in ten companies (93%) said they had replaced domestic business trips with virtual meetings during the pandemic - 44% said they had replaced all trips, 41% half or more, 8% less than half, and 7% none - and half of all companies (50%) agreed that meetings which have only virtual attendees are an adequate replacement for face-to-face meetings (over a quarter (28%) disagree and nearly a quarter (23%) neither agree nor disagree).

The chart from the report, below, illustrates the extent to which completely virtual meetings and mixed virtual/face-to-face meetings are seen by companies as an adequate replacement for face-to-face meetings.

Furthermore, nearly six in ten companies (57%) agree that blended meetings (which have both virtual and face-to-face attendees) are an adequate replacement for exclusive face-to-face meetings, with one in five (20%) disagreeing and nearly a quarter (23%) neither agreeing nor disagreeing.

Business types most likely to have replaced any of their business trips with virtual meetings included large businesses (98%), medium sized businesses (97%) and businesses in London (84%). Essential services businesses were most likely to say they had replaced all business trips with virtual meetings (55%), while manufacturing & construction businesses were most likely to say they had not replaced any business trips with virtual meetings (16%).

What this all means for the future of business travel within the UK remains unclear. While restrictions have been removed, many employees continue to work remotely and mean virtual technology remains an essential part of business communication.

Things may quickly change though. A survey of 150 businesses by HR software provider CIPHR found that 97% will let staff work from home at least some of the time now lockdown is over. However, as many as 68% of British firms are contemplating pay reductions for employees who decide to work from home permanently. In fact, some major employers have already announced changes to pay based on working location.

It is certainly far to early to even consider using the word 'normal', not even 'the new normal'. There is still a long way to go until then.