US Travel calculates the gap will further cut the US' share of the total long haul travel market to 10.4% in 2023 compared with 13.7% in 2015. That 3.3 percentage point decline would translate into a loss to the US economy of USD78 billion in visitor spending and 130,000 US jobs, according to the association.

"International inbound travel is the No. 2 US export, and making its pace of growth a national priority could be a difference-maker in helping to keep the country out of a recession," said US Travel Association President and CEO Roger Dow.

The association also warned that the normally robust US domestic market is softening in 2020, with domestic travel projected to grow just +1.4% in 2020, which the slowest pace in four years. That decline is further "stoking fears of an economic slowdown and underscoring the importance of bolstering the international side", the association concluded.

According to Mr Dow, right now, the country is "not capturing the full economic potential of overseas travel," but he suggests there are "some turnkey policy solutions that could help to address that." Among these, he identifies, would be the congressional reauthorisation of the Brand USA tourism marketing organisation.

US Travel describes Brand USA as a "crucial program for ensuring the US remains competitive in the race for international tourism dollars and their resulting economic benefits". Brand USA's marketing efforts over the past six years have brought 6.6 million incremental visitors to the US, generating USD47.7 billion in economic impact and supporting nearly 52,000 American jobs annually, according to studies.

For now, most US airlines have a positive view on domestic demand, but trade tensions and general economic uncertainty will continue to cast doubt on how long demand will remain robust, and pricing traction could come under pressure in 2020 as the Boeing 737 MAX presumably returns to service. There is some concern that could create a disruption in the supply-demand balance.

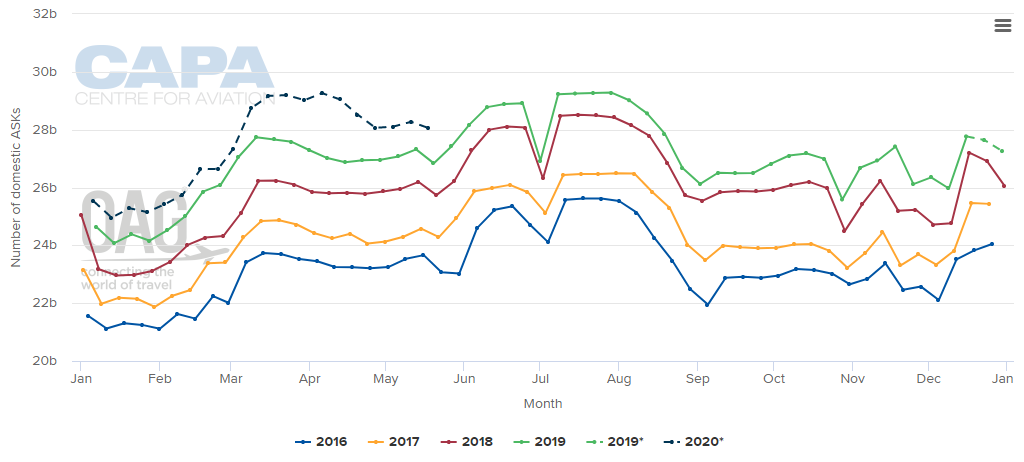

Analysis by CAPA - Centre for Aviation of OAG data show a projected increase in US domestic ASKs for early 2020, driven in part by airline estimates that the MAX should return to service sometime in 1Q2020.

CHART - Advanced schedule data suggests domestic ASKs in the US will be up slightly in early 2020, continuing a recent trend. That growth will shallow as we go through 1Q but will widen again as we move into 2Q Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG