Air travel has risen by +4% with TSA screenings up to a new peak of 832,000 recorded on Sunday 09-Aug-2020. The latest seven day average, through to 11-Aug-2020, rose to over 700,000 which is the highest since the start of the pandemic, although still -72% below the levels for the same week in 2019.

Nine states and territories experienced travel spend losses exceeding -50%. Hawaii and the District of Colombia suffering the worse, with losses exceeding -70%. The number of states now posting weekly losses of less than -40% increased again from 20 states to 28 states, of which eight states have reached weekly losses of less than -30%. These are: Mississippi, South Dakota, Wyoming, Montana, Alabama, Idaho, Connecticut and Delaware.

Since the beginning of Mar-2020, the Covid-19 pandemic has resulted in over USD330 billion in cumulative losses for the US travel economy. The continual depressed level of travel spending has caused a loss of USD42.3 billion in federal, state and local tax revenue since 01-Mar-2020.

The first full week of Aug-2020 has seen USD12.1 billion in travel spending losses, putting the month on track for a loss of USD47 billion, which would mark the best result since the pandemic began, as losses of USD83.5 billion and USD76.9 billion were recorded for Apr-2020 and May-2020 respectively.

Regionally, travel spending losses for the week ending 08-Aug-2020 dropped down to USD2.3 billion in the Northeast, USD1.6 billion in the Midwest and USD3.3 billion in the West. The South saw a slightly larger decrease to USD3.4 billion.

This equates to cumulative losses over the past 23 weeks for the regions of USD66.4 billion in the Northeast, USD51.5 billion for the Midwest, USD112.1 billion for the South and USD100.4 billion for the West. The Midwest (down -44%) and West (down -49%) recorded just one percentage point improvements, while the South (down -41%) saw a more substantial two percentage point improvement. The Northeast (down -53%) after months of trailing the other regions, narrowed the gap with a three percentage point improvement.

Car travel last week remained at roughly the same level as it was in Feb-2020 before the pandemic, at -0.7% lower. However while significantly improved from the lows of -73% seen in Apr-2020, these levels are still way below what would normally be seen in a normal August.

According to ADARA's Traveler Trends Tracker, which taps into real time travel data on travel-related consumer behaviour, including hotel volume and flight bookings for both business and leisure travel, the trend in domestic air and hotel bookings for future travel has improved. Bookings are up from -70% to -68% year-on-year but with some vast regional differences.

Domestic bookings to Montana (-7%) shows by far the lowest year-on-year decline and performed significantly better than the previous week (-14%). Bookings to Wyoming (-9%) and South Dakota (-15%) were also improved. Domestic bookings to New York (-83%), Hawaii (-80%) and Massachusetts (-79%) saw the highest declines. International bookings for future travel to the US improved slightly, up from -79% to -77%.

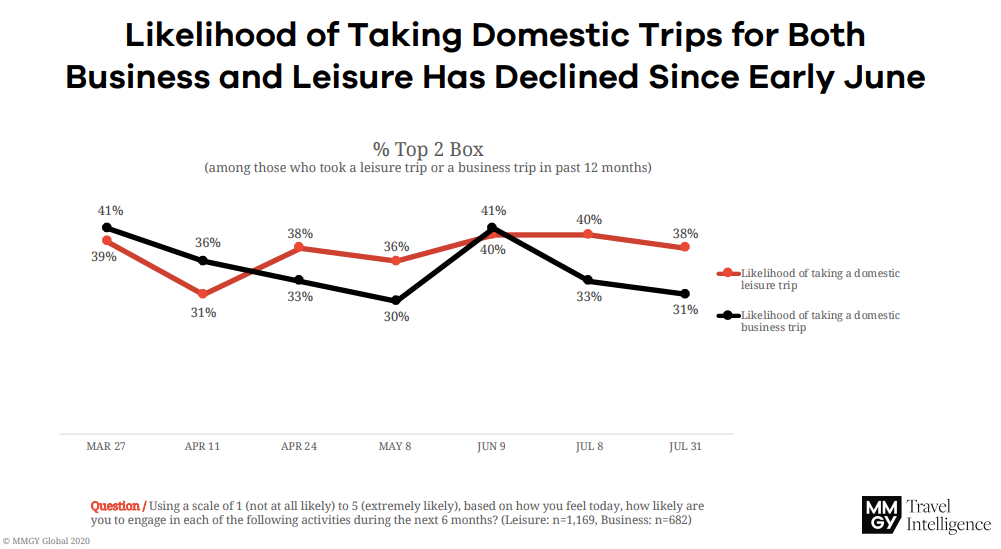

CHART - The latest wave of the TIPS survey shows a reducing likelihood of respondents taking a business trip during the next six months Source: Travel Intentions Pulse Survey (TIPS)

Source: Travel Intentions Pulse Survey (TIPS)

According to the latest wave of the Travel Intentions Pulse Survey (TIPS), respondents indicated that the likelihood of their taking a business trip during the next six months has declined significantly since early Jun-2020. Among those who took a business trip in the past 12 months, 31% now say they will likely do so again in the next six months, compared to 41% who said so in early Jun-2020.

The likelihood of attending a business meeting or convention during the next six months has also declined. Respondents indicated that likelihood of attending an off-site business event declined from 22% in early Jun-2020 to 17% in late Jul-2020. The likelihood of attending any conference or convention declined from 20% in early Jun-2020 to 13% in late Jul-2020.