In the United States of America there are numerous sentiment studies that are providing some insight into traveller intent. Right now they still suggest a relatively slow recovery in leisure travel and that could have implications for the corporate travel sector. As Mr Franke warned airlines: "If your model is skewed towards the business side… you're going to be behind recovery".

The ULCC has historically performed better than legacy models coming out of international consequential events, such as 9/11 or SARS… Each airline has to understand their passenger base, passenger model, who are their passengers and what would that passenger be looking for and adapt their plan to meet passenger need," he added.

So what have some of these studies highlighted this week. Well, the latest findings of the Travel Intentions Pulse Survey (TIPS), conducted by MMGY Travel Intelligence, revealed that only a third (36%) of US travellers intend to take a domestic leisure trip in the next six months.

This is Wave IV of the TIPS from the first week of May-2020 and continues a series of research that has been commissioned by the US Travel Association, since the end of March to measure the impact of Covid-19 on US leisure and business travellers. It is a biweekly view of 1,200 US residents who have taken an overnight trip for either business or leisure in the past 12 months.

When asked about travelling after the pandemic subsides, the research found the preference is to still travel domestically and closer to home. Over half (57%) said that following the pandemic they are more likely to book travel to US destinations, and 43% expect to travel to destinations closer to home.

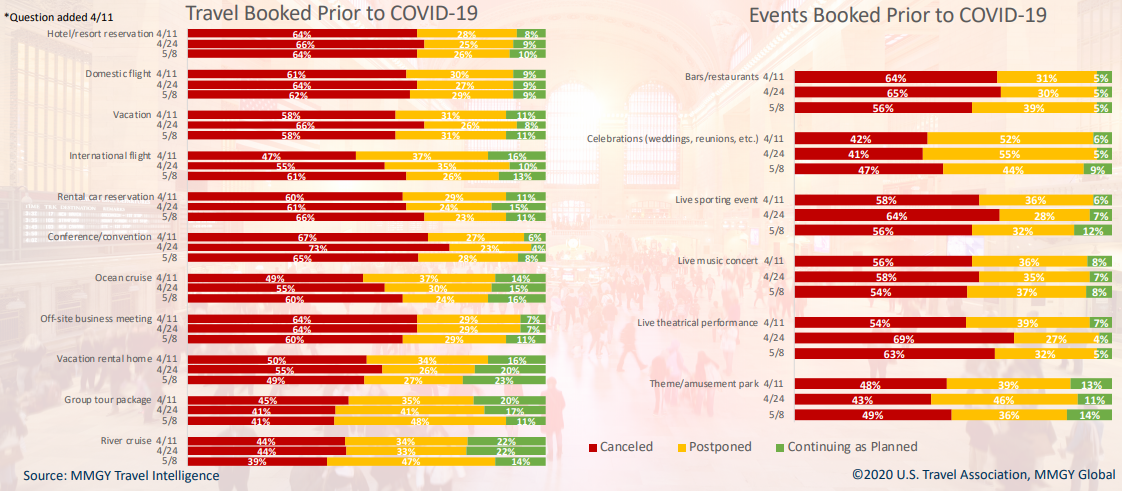

Positively there is still some intent to travel. Approximately one-third of travellers remain committed to postponing, rather than cancelling, scheduled travel for the months ahead. Activities with the longest booking windows, such as vacation rental homes and cruises, are the most likely to remain unchanged, according to the survey findings.

CHART - Approximately one third of US consumers maintain travel hopes by postponing rather than cancelling trips Source: Travel Intentions Pulse Survey (TIPS)

Source: Travel Intentions Pulse Survey (TIPS)

Additional findings from Wave IV edition of the survey was that the likelihood to travel and stay in a hotel increases as travellers get older. However, younger travellers are more likely to engage in travel activities such as attending a concert or a sporting event during the next six months.

While the youngest respondents' (age 18-34) concerns about contracting Covid-19 declined slightly in this edition, the concern they expressed about others in their household contracting the virus increased from 63% in Wave III to 69% in Wave IV.

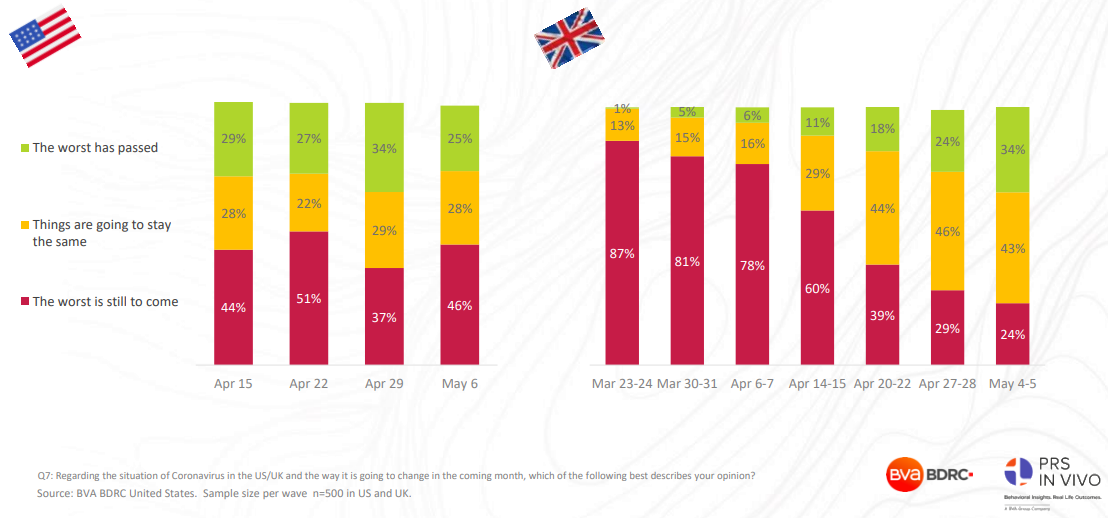

Another insight, the Covid-19 US Sentiment and Purchasing Intent Survey by international research company BVA BDRC reveals a worrying significant rise in US citizens who believe that the worst is yet to come in the coronavirus pandemic. The fourth weekly report in the series highlighted an almost ten percentage point shift in this measure, up to 46% from 37% last week. Only one on four (25%) of the population believe that the worst has passed.

CHART - With headlines continuing to be dominated by Covid-19, an increasing number of Americans believe the worse was still to come, a stark contrast with Britons, who have steadily felt that the worse has passed Source: Covid-19 US Sentiment and Purchasing Intent Survey

Source: Covid-19 US Sentiment and Purchasing Intent Survey

There was also a similar shift in the level of people believing that a 'close to normal' life will not now happen until 2021 - 27% of people polled this week versus 18% recorded in each of the previous two weeks' figure.

Despite this, Americans' expectation that they will plan and book a US vacation in the next one to three months remained stable, though one-third of were unable to specify any timeline for their next domestic trip. International travel plans fared less well with a slight downward trend for booking intentions in the next six months. However, there was an increase from 31% to 37% of people who did not want to put any timeline on their next international trip.

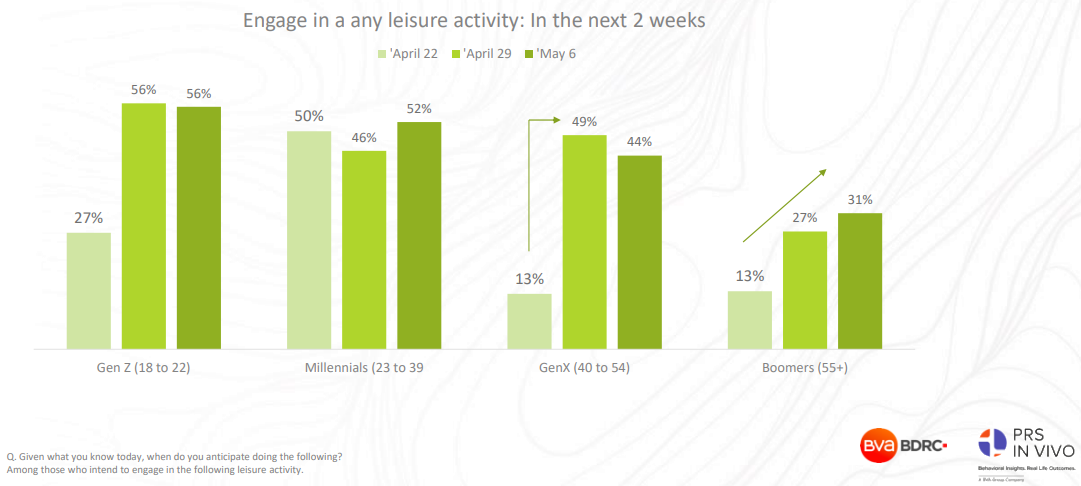

The research shows that the Boomer generation, those between 55 and 75 years of age are going to be the toughest age group to convince to return to pre-Covid-19 levels of domestic and international travel, hotel stays, days out or trips to museums and cultural venues.

CHART - Intent to engage in a leisure activity is highest among GenZ and Millennials, while GenXers only reported a surge in leisure activity in late Apr-2020; lower levels of Boomer leisure intent illustrates the higher level of caution and likely anxiety among these consumers to engage in public activities Source: Covid-19 US Sentiment and Purchasing Intent Survey

Source: Covid-19 US Sentiment and Purchasing Intent Survey

To convince Boomers to visit, venues almost two thirds (64%) want venues to offer sanitising hand gel or wipes, 61% insist on enhanced cleaning of public areas, controlled number of visitors (53%) and enforced social distancing (49%).

Despite a rise in anticipation that the worst is yet to come and the feeling that normal life will take longer to resume, more US consumers are anticipating resuming some of their general leisure activities within the next one-three months.

A third (34%) of all Americans anticipate going to a restaurant in the next month, up from just 20% this time last month; 46% plan on going shopping or visiting a mall in the next three months; while 35% have confidence in making plans to go on a day out to a visitor attraction within the next three months. Amongst the general population, compulsory face masks for visitors get a vote from 36% whilst 35% want to see staff wearing face masks to make them feel more comfortable.