Summary:

- Virgin Atlantic has announced it will suspend its daily flight between London Heathrow and Dubai International from 31-Mar-2019 after 12 years of operation;

- The UK carrier says a "combination of external factors" had meant it was "no longer economically viable" to serve the route;

- It will now redploy its capacity and slots in more economical markets, most likely supporting its increased trans-Atlantic focus, albeit a late departure slot is not supportive of flights into North America;

- Virgin Atlantic is the third airline to depart the London Heathrow - Dubai International market in the past couple of years following Qantas and Royal Brunei Airlines out of the market.

First reported by The Blue Swan Daily content team on Tuesday evening, Virgin Atlantic confirmed the route cancellation on Wednesday afternoon saying that a "combination of external factors" had meant it was "no longer economically viable" to serve the route. It plans to continue daily flights during the current summer schedule and through winter 2018/2019 with final services scheduled to take place on 31-Mar-2019. However, some believe the route's closure may come sooner.

The airline's chief commercial officer and CEO-designate Shai Weiss, said "it's never an easy decision to withdraw a route," especially one that has been served for 12 years. But it is clear that Virgin Atlantic was finding it increasingly hard to secure sufficient yields against the capacity being dropped into the market by Emirates Airline. The United Arab Emirates (UAE) carrier has six return flights per day between Dubai International and London Heathrow, almost all flown using Airbus A380 equipment, also serving Gatwick and Stansted airports in the UK capital.

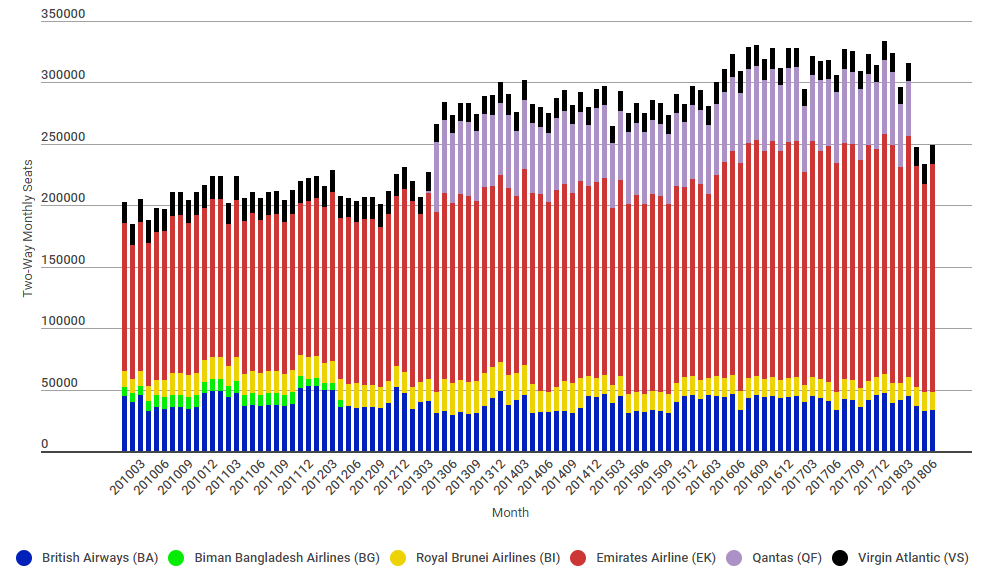

CHART - Following the departure of Qantas from the market between London Heathrow and Dubai International earlier this year Emirates Airline now accounts for almost three quarters of the available capacity (74.3% this month) and will grow to an estimated 85% when Royal Brunei and Virgin Atlantic end their own flights Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The Blue Swan Daily spoke to John Grant from MIDAS Aviation last week to get his thoughts about Virgin Atlantic's motivation behind the route closure, part of a trend that has already seen Qantas pull out of the Dubai - London market in favour of routing aircraft via Singapore or direct with its new Perth - London rotation, and in recent weeks Royal Brunei Airlines revealed it would end the Dubai stop on its Bandar Seri Begawan - London service.

The loss of two direct London services to Dubai in the last few weeks is "hardly earth shattering news," says Mr Grant. "Indeed, it's more of an 'at last' moment," he explains. With regard to the Virgin Atlantic decision he describes it as "perhaps realisation at last that as an airline you should play to your strengths, and in this case the word 'Atlantic' should have given a real clue to the problem; either that or a quick look at a map!"

At best Virgin Atlantic were a small part player in the market with just over 4% share, and any argument about onward network contribution to their US network is "equally hollow", according to Mr Grant given the depth of service offered by Emirates from Dubai. Similarly, Mr Grant questions the airline's long term backing of another of its non trans-Atlantic routes, a long-standing link down to Johannesburg in South Africa.

"In similar fashion you have to wonder where Johannesburg fits into the network, a long sector and lengthy aircraft layover must make the route challenging although the 'protection' of a market still with regulated frequency may be the saving factor," he explains.

While it may sound pretty obvious, ultimately the future for Virgin Atlantic will be based on it going back to its early days a focus on the US market. "The joint alliance with Delta, Air France and KLM provides scope for more opportunities in a remarkably strong market with solid premium content," says Mr Grant.

The question now is how will Virgin Atlantic use the Heathrow slots allocated to the Dubai service? And it is not as straight forward as it appears. The current VS400/401 schedule shows a daily 15:55 arrival in London and a 22:30 departure. While the arrival slot could be used to support its trans-Atlantic offering, the 22:30 departure would not be an option.

Looking at this week's flight schedules, Virgin Atlantic's last US departure from London Heathrow is its 20:10 VS025 which arrives in New York at 23:05. All other departures post 16:30 are to other parts of the world - 20:05 to Johannesburg; 21:50 to Delhi; 21:55 to Hong Kong and 22:30 to Lagos. Obviously, Virgin Atlantic could juggle its existing slot pool or even switch slots with its trans-Atlantic partners and this could allow new trans-Atlantic connectivity.

As per Royal Brunei's decision to take advantage of the range of its Boeing 787 Dreamliner fleet and deploy on them on non-stop flights to London following some minor reconfiguration work and the addition of crew rest areas, Mr Grant said the move may "upset some great crew stopovers" but would "increase the attraction of the service".

He added: "In truth, Bandar Seri Begwan is not the real market for Royal Brunei; Melbourne is. And for the price sensitive market that this airline appeals to; a near perfect great circle routing and quick connections in both directions makes a compelling case. Over time perhaps new connectivity to Sydney and even Brisbane would add to the proposition."

Having looked at the airlines behind the decisions we should perhaps look at how the Dubai - London market will be impacted by these network decisions. "As for Dubai, the London market remains well served," says Mr Grant. "Indeed too well served relative to the local market size," he adds.