Summary:

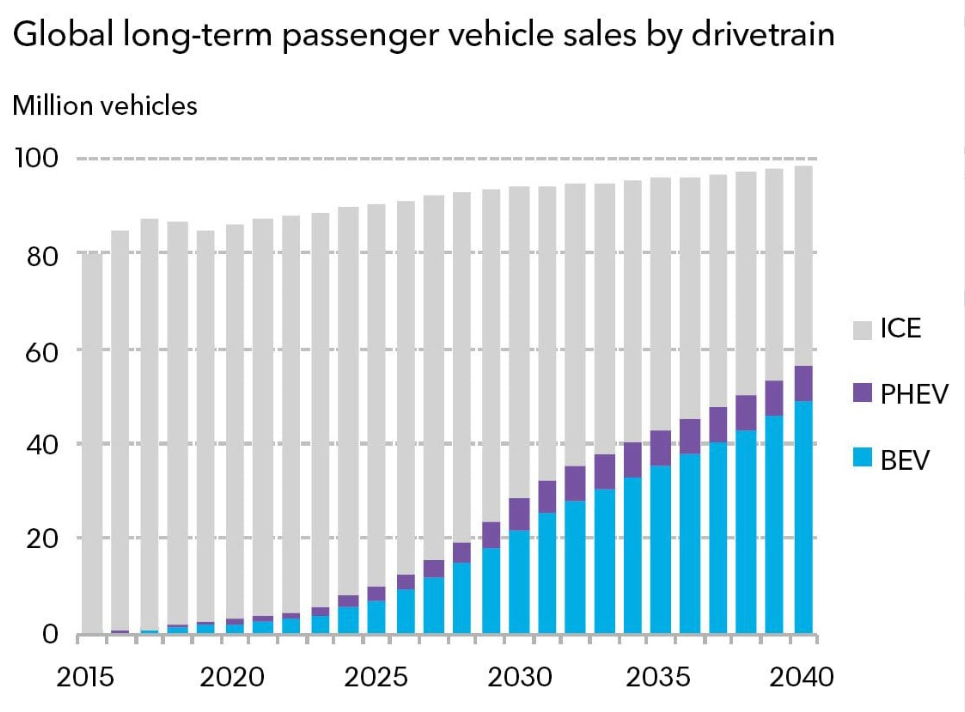

- Electric vehicles are expected to make up 57% of the global passenger car sales by 2040 driven by falling battery costs and changing consumer habits, according to a new report;

- New EV models will increase competition and likely drive down costs;

- EVs nonetheless still lag heavily behind ICEs, mainly due to charging infrastructure restrictions.

According to BloombergNEF, EVs are expected to make up 57% of the global passenger car sales by 2040. It notes sale of internal combustion engine vehicles (ICE) has reached a peak and won't recover unless EV sales falter or larger emerging markets such as China or India invest in ICE segments.

Falling battery prices and stricter emissions are key drivers of EV uptake. Lithuim ion battery pack costs have decreased nearly 85% to USD176 between 2010 and 2018, reducing costs for manufacturers which can then be passed on to the consumer, making vehicles more affordable.

As urban sprawl becomes a more serious issue in large cities, governments are putting in place regulations to curb the use of higher noise/CO2 emitting vehicles. This is the case in London, where Transport for London rolled out the enhanced Ultra Low Emissions Zone in Apr-2019 to reduce the number of vehicles in congested central London.

CHART - Global passenger vehicle sales by drivetrain: BEVs are expected to beat ICE sales by 2040 Source: BloombergNEF

Source: BloombergNEF

There has also been an explosion of new EV models and manufactures in recent years, which continue to offer increased battery life while reducing costs. Hence competition between manufacturers is increasing and will likely drive more affordable units.

Telsa launched its Model 3 variant in Jul-2018, which is currently around half the price of its mainline Model S and has made over 200,000 deliveries since its inception in 2017. BMW, Chevrolet and Volkswagen are all new entrants to the EV market, respectively releasing the BMW i3, the e-Golf and the Bolt EV, which is comparable in price with the Tesla Model 3 though boasts around 80 miles shorter range.

But although EU sales are up enormously in recent years, EVs still lag behind their ICE counterparts, suggesting there may be a bit of an EV overhype currently. It seems at the very least optimistic that EVs will ever surpass ICE sales in the current climate.

This comes back to challenges regarding capacity and infrastructure to support EVs. The European Automobile Manufacturers' Association (ACEA) highlights 2% of new cars registered in the EU in 2018 were EVs. However, half of all EU member states have an EV market share lower than 1%, meaning EV sales are far behind in lower income EU countries where charging infrastructure is lacking.

So where and how are over 40 million EVs worldwide going to charge up? Deloitte has estimated that the UK alone will need around 28,000 public charge points and must invest a further GBP1.6 billion in the infrastructure between 2020 and 2030.

This is in both AC and DC chargers, the latter able to charge up vehicles around four to five times faster than AC but which require far greater energy to do so. Either way, this will be inconvenient for drivers who wish to charge up using 'en route' charge points, akin to today's petrol stations, which will have ultra-fast charging capability but will still require a much longer stop than filling up on fuel.

The other infrastructure issue is energy required to power the charging stations. The rise of electric batteries requiring a charge will inevitably put more of a burden on a country's national energy grid, but there are contingencies for this. One of these includes the concept known as 'Vehicle to Grid', which aims for EVs connected to the grid to charge to release power back into the grid. This will help to 'balance' the national electricity network by taking advantage of the charge of an EVs battery, and could possibly allow EV owners to earn money by doing so the same way surplus solar energy is sold back to energy companies.

Ultimately , the biggest challenge for EV uptake is… us. The consumer drives the market. If the cons of owning an electric vehicle outweigh the pros, then uptake will grind to a halt. The industry therefore has to get the infrastructure right for the EV market to surpass combustion engines.