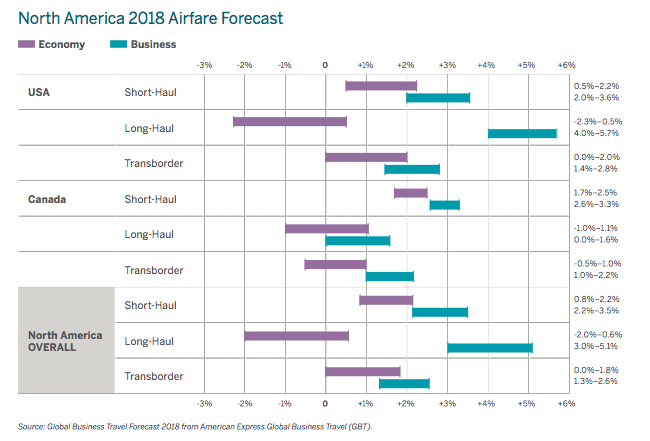

Increases in long-haul business fares for North American airlines should fall between 3% and 5.1%, driven by growth in US premium fares of 4% to 5.7%.

Overall, America Express believes the increase in premium fares is being bolstered by stronger corporate demand. However, the forecast was released prior to US stock markets dropping precipitously beginning on 2-Feb-2018.

American Express also warns long-haul business class fares will vary by route, noting trans-Pacific fares "will be under significant rate pressure". Conversely, Latin America is forecasted to show gains from earlier cut-rate pricing.

Even as domestic demand in the US should continue to increase in 2018, American Express believes "intense competition and capacity growth will result only in modest rate increases, with a particular weakness in economy fares". Indeed, short-haul economy fares in the US are only projected to grow 0.5% to 2.2% year-on-year in 2018.

CHART - Increases in long-haul business fares for North American airlines should fall between 3% and 5.1%, driven by growth in US premium fares of 4% to 5.7% Source: American Express Global Business Travel Forecast

Source: American Express Global Business Travel Forecast

"Faster growth of domestic capacity, which has largely focused on up-gauging existing routes and improving connectivity, has resulted in increased competition between legacy carriers on a number of connecting and non-stop routes," American Express concluded.

The forecast shows projected growth in short-haul, economy fares in Canada for 2018 is 1.7% to 2.5%. American Express stated a robust Canadian economy and a strong CAD should translate into slight increases on shorter flights.

American Express expects capacity growth to outstrip demand in some long-haul markets from Canada, which will create challenges in airlines gaining pricing traction on those routes. Long haul economy fares could drop by 1%, or post modest growth of 1.1%.

Growth in premium fares could help offset some pressure North American airlines are experiencing in economy pricing on long-haul routes. However, rising oil prices and a recent cloud of uncertainty created by plunges in US stocks could temper some of the bullishness US airlines have recently expressed for their corporate outlooks.