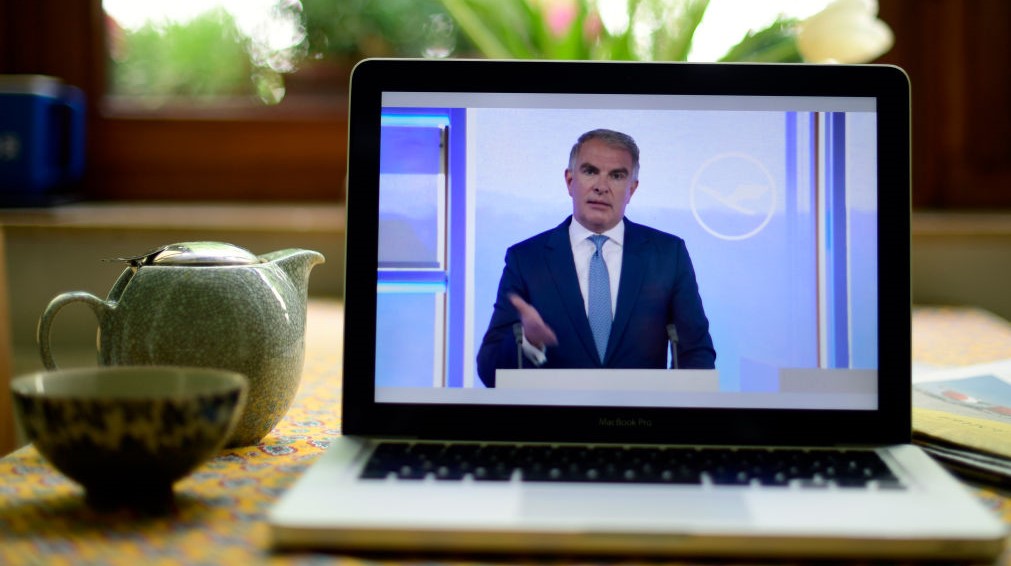

The meeting's introduction was a poignant reminder of what was, and what the company is fighting for in the coming months. Mr Spohr admitted it is a "bitter" feeling that 65 years of work building up Lufthansa's traffic volume and global network could be completely reversed in under 65 days.

"After many tough years of modernisation, we recorded the best results in the history of our company for three years in a row. Now all of a sudden all of our efforts have been annihilated by a single global event… our company is in a state of emergency," he explained.

Echoing the vision of all major airline groups in the context of Covid-19, the CEO of Lufthansa Group stressed that the company will not return to its former fleet size "for the foreseeable future". He warned it will have a "significantly smaller" structure compared to before the crisis and is now in negotiations with OEMs to delay aircraft deliveries and is reviewing its options with regards to staff cuts.

None of its airline subsidiaries will be spared from hefty restructuring. Whereas in the past Lufthansa has relied on the brand value of carriers like Austrian and Brussels Airlines for each home market, the 'new norm' may require a rethink of this strategy as Austrian and Brussels Airlines' return-to-profitability programmes are accelerated. The group will be mindful of LCCs and high-speed rail competing for what is left of post-Covid-19 European travel demand from its hubs in Brussels and Vienna.

Plans to bundle aircraft from its four airline subsidiaries into one "tourist-oriented" holiday operator in the future were also mentioned, a move which had also been hinted at before the crisis. Mr Spohr said this will allow the group to better take advantage of expected higher leisure demand post-coronavirus after a lengthy lockdown period.

Potentially, this could comprise a dramatic shift in the short haul operations of the network carriers to the Eurowings brand, with the mainline operators focusing exclusively on long haul to link their respective markets outside of Europe. But to get to this point, the company must minutely review its costs.

To date, 100 aircraft have been signalled for removal from the group's 760 aircraft fleet, prioritising older and less efficient units to reduce fleet complexity. This translates to a reduction of around 10,000 staff as of now, but it should be expected that a much larger portion of the company's 130,000 global staff will be removed as further fleet cuts are made, in line with demand forecasts and as their flow-on effects for MRO, ground handling, IT and consultancy suppliers are felt.

CHART - The Lufthansa Group airlines have collectively been operating schedules through Apr-2020 and May-2020 that are just 3% of the level seen during the same months last year  Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Lufthansa Group has said it is currently burning through EUR1 million of its liquidity reserves per hour. With over EUR4 billion in cash reserves, including credit lines and short-term loans, this adds up to a life expectancy of around five to six months without some form of external support as it exhausts its ability to repay financial liabilities and refund airfares.

State aid negotiations have stalled in certain Lufthansa markets due the environmental and ownership strings that could be attached, however in total the group is reported to be negotiating a combined total of around EUR10 billion from the Belgium, Swiss, Austrian and German governments.

Commenting on these negotiations during the AGM, Mr Spohr was very clear: "We need government support. We don't need government management". He said support from the governments, and by extension taxpayers, will be tied to clear long term profitability goals to make it "fit for the future" without the need for government oversight, and that any support will be paid back "as quickly as possible".

As is the consensus across the industry, Mr Spohr said that pre-coronavirus traffic volumes will only return by around 2023, given the expected long-term safety and hygiene concerns and a weakening of the global economy and purchasing power. In the meantime, with Lufthansa Group must, like all businesses, make some very tough decisions that will affect many thousands of direct and indirect jobs and likely disrupt German connectivity for many months, in a bid to make it through the crisis.