The insight, developed by its global business consulting team of aviation experts provides price forecasts for key business travel air routes, plus descriptions of the trends that are driving prices. Its view: that an air contracting strategy is required for uncertain times. "In an unpredictable world, 'nimble' air contracting can help travel buyers anticipate and effectively manage change," it explains.

Nimble contracting is a response to the evolving airline landscape evolves all the time where pricing strategies, distribution and even airline strategies are constantly changing. "Instead of revolving around a one-off RFP, a nimble programme is managed on an ongoing basis," say the Amex GBT experts.

"The client negotiates discounts and traveller services with a carrier and commits to performance goals. Then, working with the carrier as a partner, they monitor the deal to check it is aligned with the business - and that both sides are keeping their promises," they add.

Being nimble certainly provides flexibility, which is obviously even more important in uncertain times. It means a client can continue to achieve cost and traveller objectives when the business changes direction, there are changes in the industry or some kind of external shock such as a regional market downturn, trade war, geopolitical events, aircraft grounding and changing fare offers, all of which we have actually seen in the past 12 months.

"In each case, being nimble would have mitigated the impact of these events," highlights Amex GBT, noting that it can also accelerate emerging strategic priorities, especially delivering a more sustainable programme, something that is expected to be increasingly called for through the 2020s.

A nimble programme will "have a few carefully-chosen airlines," says Amex GBT, and will use tiering as a principle for managing airline relationships. For example, Tier 1 will comprise carriers, usually global carriers, who are key to the client's programme. Tier 2 will be carriers in niche markets or points of sale, and so on. "In this ideal scenario, there is strong goal performance across all the carriers. Most importantly, there will be strong relationships," it explains.

This would seem a path for the larger corporate programmes, but Amex GBT acknowledges that smaller programs, of less than USD10 million may not have the scale to negotiate with airlines, but they can still act nimble, and actively manage their programme.

"As the first step, they need to consolidate their air spend - a single, globally-controlled programme will get better recognition from airlines, and help them get a better deal on costs and traveller experience," it advises.

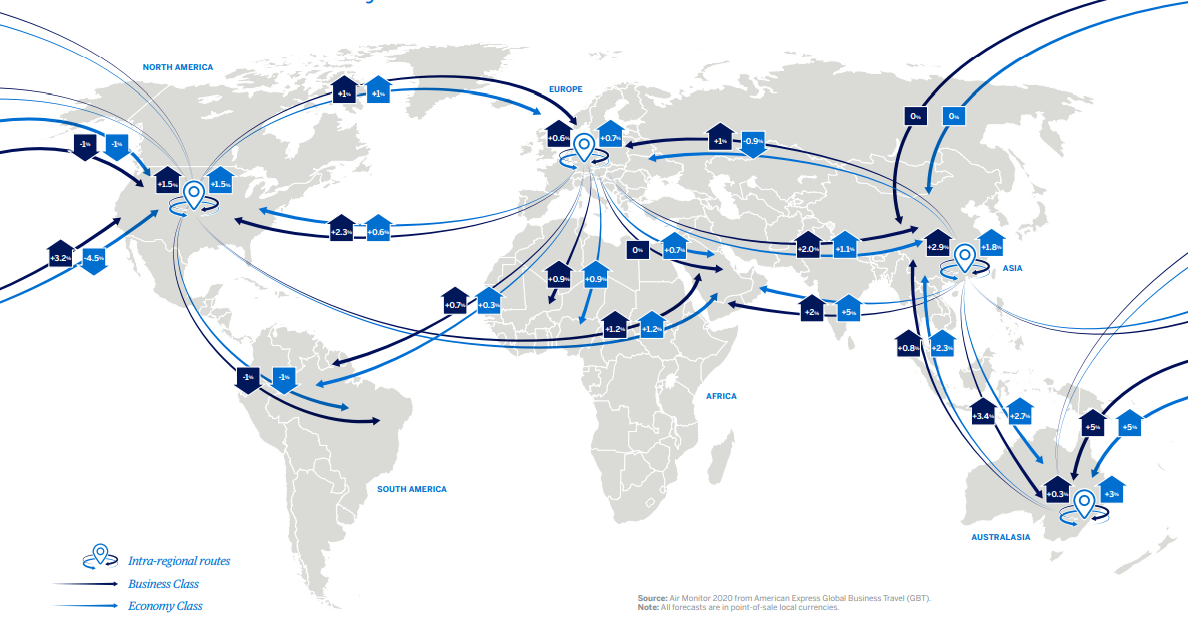

Those price forecasts from Amex GBT for key business travel routes show a general rise in fares in 2020, but significant variation across the world, with sluggish growth in developed markets such as Europe and North America and a slowdown across Asia Pacific, but still at growth rates that are high relative to other economies.

In Europe, Amex GBT says 2020 could see a "wave of consolidation" as the competitive open aviation area, high regulatory costs, and inefficient infrastructure "place significant strain on profits, causing airlines to fold or merge". These factors, it says, combined with modest growth, will mean airlines have "little scope to increase fares" in the business class cabin on intra-European routes, but in economy class, it predicts fares could rise by +0.7%.

Across North America, Amex GBT sees minimal price changes across most key routes from North America. Flights on routes to Australasia could see the biggest rises, it says, as the new American Airlines-Qantas joint venture gains traction. This could mean fares increasing by up to +5% in both business and economy cabins, it predicts.

Across the trans-Atlantic Norwegian's capacity cuts will be partly offset by Brexit to dampen average fare rises to just 1%, while within North America fares are expected to rise just +1.5%. Within Asia, "continuing (if decelerating) growth" is expected to push up fares by up to +2.9% in business class, and +1.8% in economy, says Amex GBT.