The findings from a survey of US adults that participate in airline and hotel rewards programmes by financial advisers Bankrate highlights that such programmes, originally conceived to nurture consumer loyalty, are clearly no longer as effective as when they were introduced.

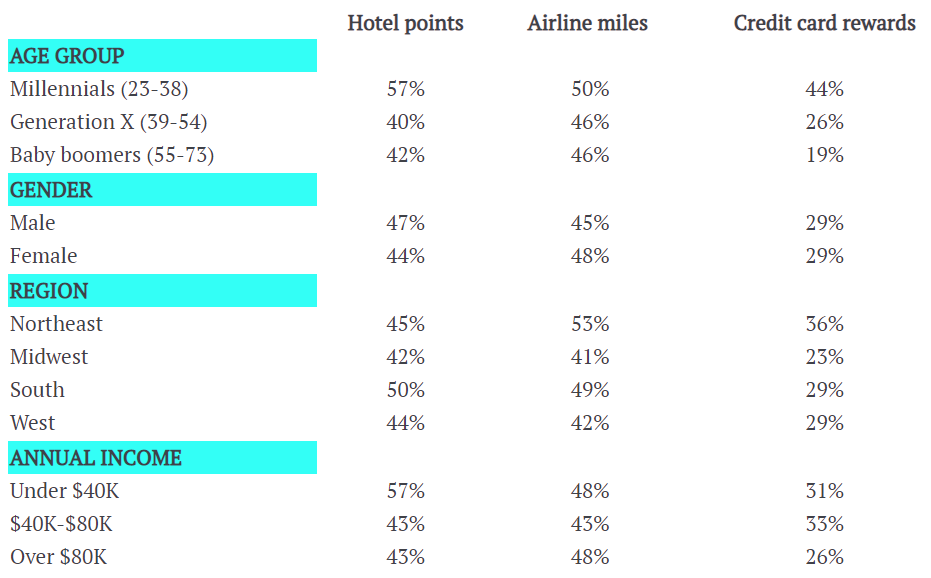

Like many changes to historical industry mindests, it is changing consumer demographics that are influencing the evolution. The survey found millennials were the most likely generation to lose rewards to expiration policies: 57% were found to have lost hotel points, 50% have forfeited airline miles and 44% been deprived of credit card rewards for this reason. For older adults, theses same totals were 41%, 46% and 22%, respectively.

It also found that generally most loyalty programme participants don't know how many points/miles they have collected. Just one quarter (25%) were able to list how many hotel points they have, less than a third (29%) knew their frequent flyer mile total and just one in three (33%) reported their credit card rewards balance.

TABLE - The findings from the Bankrate survey offers a statistical breakdown of how many consumers have let their rewards expire, by demographic Source: Bankrate

Source: Bankrate

The survey also discovered there is also a lack of awareness regarding how these rewards are valued. More than half of US adults (53%) admitted they had no idea how much 10,000 rewards points/miles are worth. Bankrate notes that the correct answer is generally in the USD100 to USD199 range - roughly 1 to 2 cents apiece - but less than one fifth (18%) of Americans know that, while 16% overestimated the value and 14% underestimated it. The latter included 8% who thought those points were worth USD1,000 or more!

Despite confusion over the actual value of rewards, they can still be significant. The Bankrate survey highlights that two-thirds of Americans (66%) have credit card points, 57% possess hotel rewards and 56% collect frequent flyer miles.

Among those who reported their balances as part of the survey, the averages were 34,065 airline miles, 22,893 hotel points and 15,941 credit card points. Even at the low end of the valuation range (1 cent per point/mile), that means the average frequent flyer account balance is worth about USD341, the average hotel points hoard equals approximately USD229 and their average credit card rewards stash is approximately USD159.

Key findings of the survey included observations that people from younger generations are generally more likely to lose their rewards to expiration than their older counterparts; that men and women seem equally likely to let their points, miles or rewards expire; and that consumers making under USD40,000 a year are the most likely to let their points, miles or rewards expire.

When it comes to geography, the results suggested that consumers in Northeast USA are most likely to let their points, miles or rewards expire, while consumers in the Midwest are the least likely to let them expire, followed in order by the West and the South.

The Bankrate survey was conducted on its behalf by YouGov and was based upon a sample size of 2,558 adults through an online dialogue between September 25-27, 2019. It highlights that habits are changing, but suggests that "more education and diligence" on the matter of expired rewards are required in order to "avoid untold millions of dollars in rewards are going to waste because they're allowed to expire".

It is obvious that a lot of people are sitting on airline, hotel and credit card rewards that are worth a significant amount of money, but consumers "need more education about the potential value of their rewards and how to redeem them for maximum value," according to the Bankrate findings.