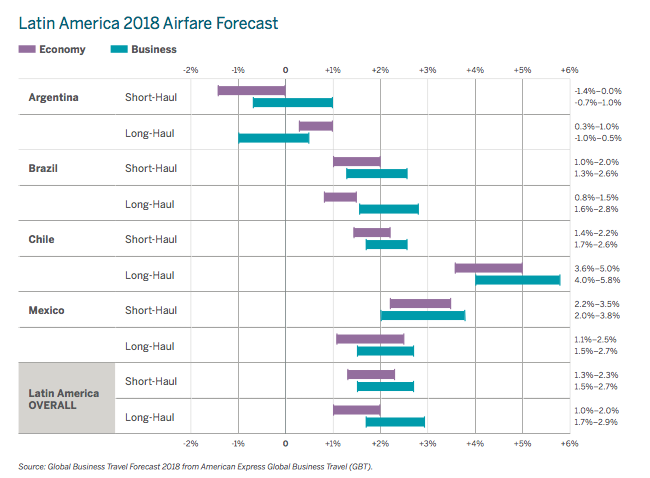

A new Global Business Travel Forecast for 2018 prepared by American Express shows that, overall, business and economy fares should grow in Latin America during 2018, with Brazil, Chile and Mexico showing positive growth in each category.

American Express stated Chile's economy looks to strengthen in 2018, propelled by rising copper prices, improved economies in Argentina and Brazil and increased internal consumption. One dampening effect on the outlook is significant capacity growth, particularly on a regional basis, that is limiting price increases on short-haul airfares. ULCC JETSmart debuted in Chile during 2017 and the country's second largest airline, Sky, has transitioned to the LCC model. Despite some pressure on regional routes, the forecast shows healthy growth in fares on long-haul routes from Chile in both economy (3.6% to 5%) and business fares (4% to 5.8%).

Although Brazil's GDP is forecasted to grow 1.5% in 2018, its recovery remains tentative, driven by political uncertainty over upcoming presidential elections and governmental austerity measures. Generally, capacity cuts in Brazil have failed to match decreases in demand, and even though passenger numbers have started to grow, excess capacity remains an issue. "While 2018 should offer a welcome improvement over 2017, the combination of political instability, fierce competition and lingering overcapacity should limit fares to only modest increases," said American Express.

CHART - Fares across Latin America are generally on the rise, driven by growth in Chile long haul fares  Source: American Express Global Business Travel Forecast

Source: American Express Global Business Travel Forecast

Change is sweeping across Argentina's aviation industry, with planned new low cost capacity by Norwegian and new longer haul routes introduced by LATAM Airlines Group, Copa, and Avianca. But the American Express forecast shows that increases in capacity should outstrip demand, and the result is airfares will likely remain flat or only increase slightly in 2018.

American Express predicts flatter capacity in Mexico during 2018 should result in slight to moderate pricing gains. A ramp up of service to the US by Volaris, Interjet and Aeromexico through its joint venture with Delta is leading to capacity growth in international markets. Prices on long haul flights will only see limited increases in 2018 given that back drop of higher capacity, according to the forecast.

Overall, Latin America's prospects are brightening, said American Express; however, question marks remain on the horizon. "...ongoing political concerns and fierce competition will result in only mild price increases for the region in 2018".