Summary:

- Qatar Airways' Doha - Cardiff service appears already to be under review with CEO describing the route as experiencing "disappointing" results;

- Investigations suggest that fewer passengers than anticipated are using the route, but freight volume is performing to expectations;

- The final decision on the route could see Cardiff become a benchmark for whether UK small airports can sustain non trans-Atlantic long haul services;

- As per other parts of the aviation sector we could in the future see a generalised minimum annual figure benchmark which could drive initial decision-making for medium and long haul route growth.

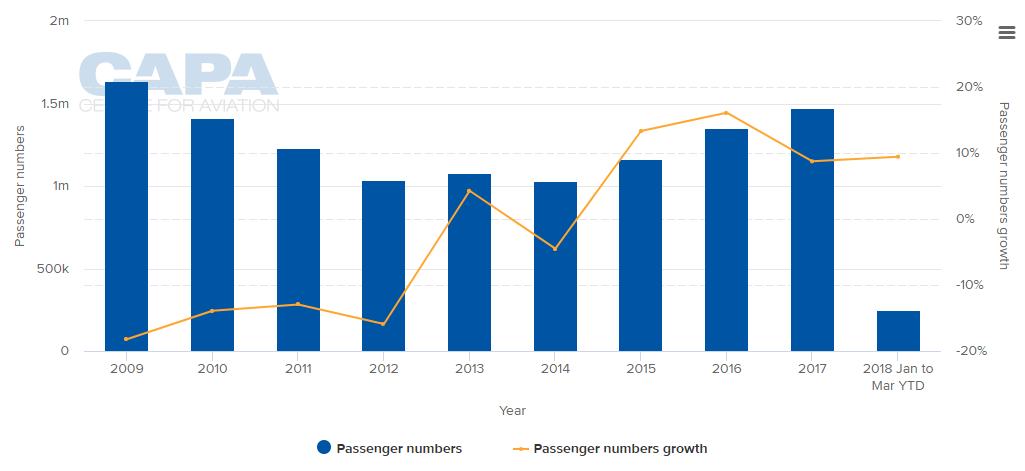

However, the airport, which went back into public ownership in 2013, has rallied strongly in the last three years. It now has 36 non-stop routes and has attracted or retained airlines such as Flybe (which has one third of the seat capacity), TUI Airways (formerly Thomson Airways), Thomas Cook Airlines, Vueling and KLM. Traffic increased by 16.1% in 2016, 8.9% in 2017 and by 9.4% in 1Q2018. There is a good mix of business models.

CHART - Traffic at Cardiff Airport has been on the rise the last three years, but annual levels are still below those seen in the late 2000s Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

Plans for a new, and expanded, terminal, a multi-storey car park, a hotel and an improved integrated transport facility have been laid out in its 2040 draft master plan, which has just been published.

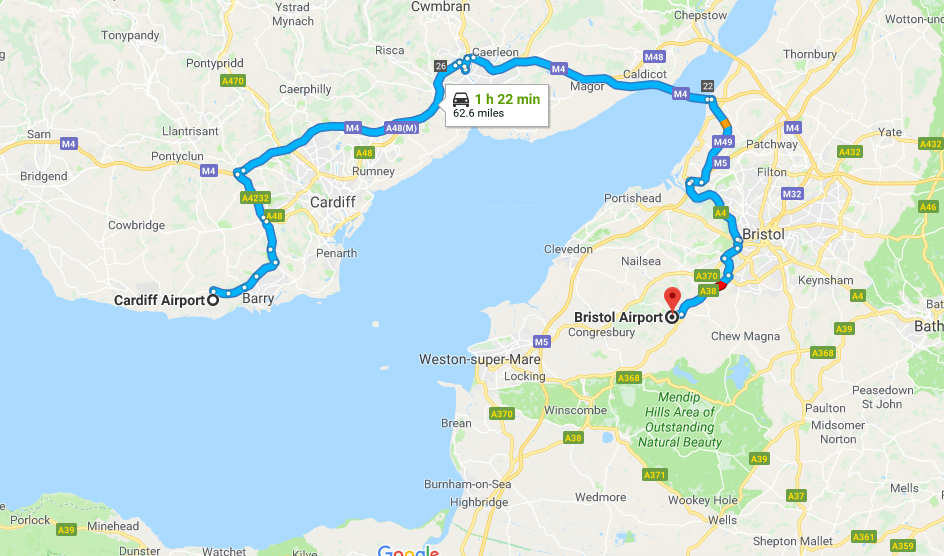

Even so, the five-times weekly mid/long-haul Doha service came as a surprise, when Cardiff is only 50 miles, mainly by motorway, from the larger and fast-growing Bristol Airport (8.3 million passengers in 2017), whose 2,000m runway can handle long haul flights and it can accommodate the Boeing 787, which is being used by Qatar Airways at Cardiff.

Of course, there are many factors underpinning airport selection, such as the overall catchment area, which in Cardiff's case is the whole of Wales, population 3.1 million. There is an overlap though between those of Cardiff and Bristol. The pros and cons of the route were discussed in a previous The Blue Swan Daily report: New Qatar Airways' Middle East connection is a vital one for Cardiff Airport, Wales and further afield

MAP - Cardiff Airport is located just over 60 miles away by road from Bristol Airport across the Bristol Channel inlet that separates South Wales from Devon and Somerset in South West England Source: Google Maps

Source: Google Maps

One of the key selling points for the route was research which indicated that almost a million passengers from the west of Britain have to travel to London airports each year to use Qatar Airways' network of flights there. However, that does not take into account the volume of originating traffic from Doha and elsewhere on the airline's network, which is likely to be slimmer, and that of onward connections from Cardiff, which is likely to be almost non-existent.

Neither does it take account daily services and far greater frequencies from the London airports, also from Birmingham, even Manchester, which are all accessible mainly by motorway from South Wales.

The second surprise though was an announcement by Qatar Airways' CEO Akbar Al Baker, to the extent that the service, which only commenced in May-2018, was experiencing "disappointing" results, which is typically a polite euphemism in the business. He did add that the route would be "given time" and that there was no problem with the airfreight business, which has been performing "absolutely well", with "a lot of demand."

It is fairly unusual for an airline CEO to comment publicly on a route so early. Whether or not the route survives and thrives will be determined over the next year or so but the quandary raises the question of whether an airport can be too small to justify intercontinental service.

Norwegian for example has ended or severely reduced transatlantic low cost services between small airports in Europe and in the US such as Cork, and Hartford Bradley, and moved swiftly to do so.

There are hard numbers that support decisions in this industry. Private sector airport financiers for example usually baulk at investing in airports with less than five million passengers per annum. The primary rule of thumb for building an air-rail link between an airport and downtown is 10 million ppa.

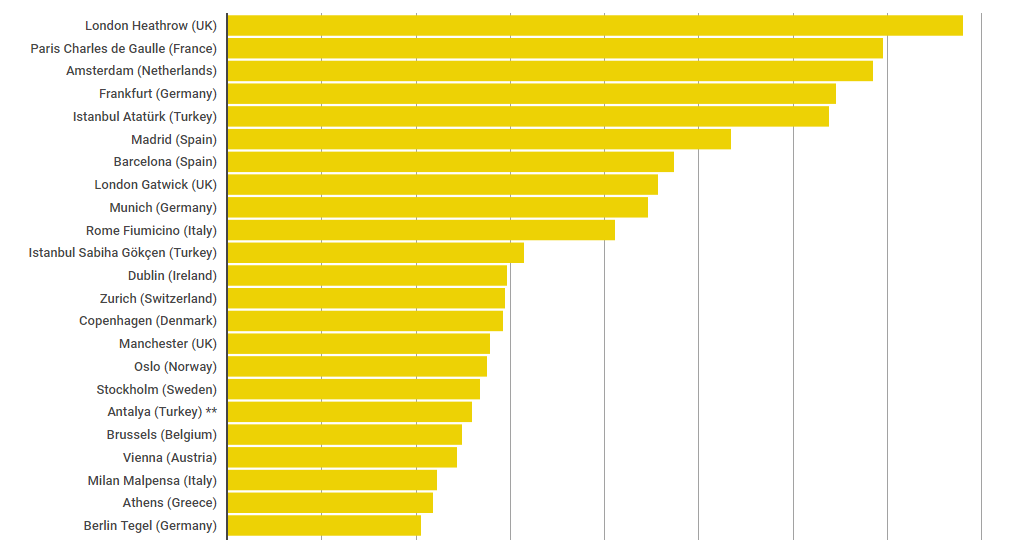

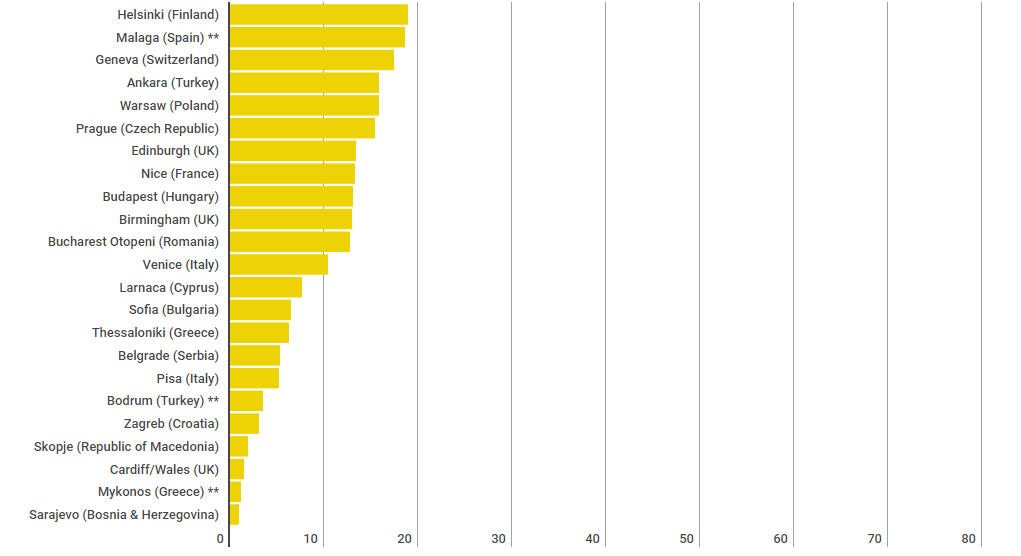

The Blue Swan Daily has conducted some research into passenger numbers at each of Qatar Airways' airports in Europe to see how Cardiff compares to other European markets it serves. It is not actually the smallest by this measure - that honour goes to Sarajevo and Mykonos - but the difference in each case is 0.5 million passengers or less.

TABLE - Qatar Airways' European route network extends to just under 50 airports and only six of them saw less than five million passengers in 2017

Source: The Blue Swan Daily and CAPA - Centre for Aviation airport profiles (Notes: *Airport with less than 5mppa; **Seasonal route)

Source: The Blue Swan Daily and CAPA - Centre for Aviation airport profiles (Notes: *Airport with less than 5mppa; **Seasonal route)

Qatar Airways is clearly keen on the British Isles (the UK and Ireland), with six destinations, twice as many as in any other country except Turkey, where it has fierce competition with Turkish Airlines. As with Gulf rivals Emirates Airline and Etihad Airways it has tapped in to the desire of many Britons to use their local airport and to avoid the travel to Heathrow if at all possible and it offers a variety of destinations in the CIS countries and South and Southeast Asia with one en route change which are otherwise difficult to access, as well as a growing network in North Asia and East Africa.

That network is very comprehensive and bearing in mind South Wales' trading history one can well understand the rational by which the decision to serve Cardiff was made. The lack of competition compared to say Newcastle, where Emirates is well established, would also have come into the equation when selecting a new British city.

Even so, Mr Al Baker's comments hint that a reappraisal of the route's prospects is already being made. It is to be hoped that it does survive because it was intended also to act as a catalyst towards the introduction of other long haul routes, such as across the Atlantic. Since Continental axed its Bristol - New York Newark flight in Nov-2010 there has not been a scheduled transatlantic service in the West British region.

As for the main thrust of this article; perhaps long haul airlines should introduce the 'five million' minimum passenger rule for airports they covet as a starting point in their calculations. If that figure is good enough to determine investment from the money men then it is one they might also take into account.