If the sum of GBP220 million is accurate, and allowing for the unknown amount of debt, that would make the earnings multiple on this transaction 26.5x on EBITDA of GBP8.3 million in the year to Mar-2017, which is a little more in keeping with the 16-17x average of the last few years though still high.

LBA is a small/medium sized airport serving a metropolitan region of 2.4 million people and a wider catchment area of possibly 6-7 million for certain services, in which the main city, Leeds, is one of the UK's leading financial and legal centres. Accordingly its traffic profile is a little different from other UK airports of a similar size, where traffic can be almost exclusively 'low-cost'.

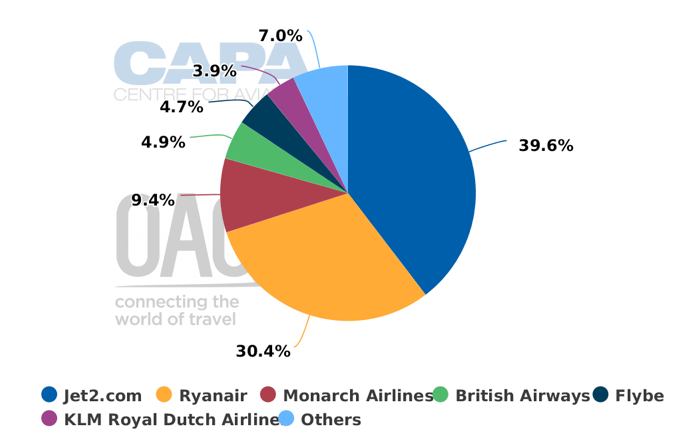

The chart below has been impacted by the collapse of Monarch Airlines, which had almost 10% of seat capacity, having established a base at LBA in 2012 (see previous report).

Leeds Bradford Airport, total system, seats, for all business models, week commencing 16-Oct-2017

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

It shows that while there is a considerable LCC presence (70% combined capacity) from Ryanair and from Jet2.com, which is now ranked along with Thomas Cook and TUI in the UK for package holidays, the contribution of full service carriers such as British Airways and KLM, hybrid airlines such as Flybe and regional carriers like Eastern, which has 11% of movements but only figures in 'Other' in the traffic chart, is significant. BA, KLM and Flybe collectively have 13.5% of capacity, which compares very favourably with, say, Liverpool Airport, which serves a similarly sized area, but where low-cost accounts for all but 0.06% of the capacity.

It is the British Airways Heathrow service in particular which is the jewel in LBA's crown. Introduced in 2012 and expected to be axed so that BA could use its slots for long-haul flights from Heathrow, it has survived although it has seen a schedule reduction from four to three times daily. It is the only new BA domestic service from Heathrow to be introduced in many years.

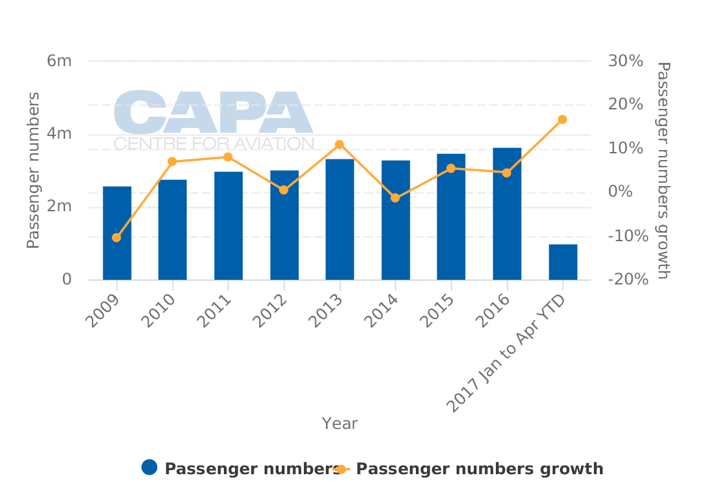

Passenger traffic has been rising steadily since 2010 with the single exception of 2014. What is noticeable from the chart below is that growth has increased spectacularly in the first eight months of 2017, to almost 17%, only the second time it has got into percentage double figures (the previous occasion was 2013, +11% for the year).

Leeds Bradford Airport annual traffic: passenger numbers from 2009 to 2017

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority - Leeds Bradford Airport traffic year ends in December

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority - Leeds Bradford Airport traffic year ends in December

Some may wonder why Bridgepoint hasn't sold it previously, for example during 2013. But such organisations always play the long game and sell when the time is right for them. With traffic booming, but 'uncertainties' still on the horizon, that time is evidently now. The interesting thing is that they are selling to another cautious fund manager, AMP, which has around AUD100 billion (USD 79 billion) in funds under its management and airport investments already at three Australian airports including Melbourne Tullamarine, as well as Newcastle International Airport in the UK.

Newcastle, on Tyneside, is the one that stands out; the only non-Australian investment prior to this one. AMP has 49% of the capital there, the other 51% being collectively owned by what is known locally as the 'LA7', seven municipal authorities in the area. Newcastle is only 100 miles from Leeds along the A1 (M) motorway and the airports' catchment areas overlap to the south and north respectively. The airport that lies between them, Durham Tees Valley, is largely inconsequential now even though it has gained some new domestic services this week.

AMP is unlikely to sell its stake at Newcastle despite this self-created rivalry in northeast England and despite Leeds-Bradford having acquired the services of Newcastle's Aviation Development Director less than two months ago. There is no reason to suggest that relations between AMP and the LA7 are anything other than good, traffic growth is almost equally strong as at LBA (+14.6% in the period Jan to May-2017) and there is a convincing traffic mix between low cost, regional and full service carriers.