It's hardly a secret that the airline industry is facing myriad challenges, notably in the marketing and distribution areas, as companies with personalised data, and the analytics and artificial intelligence to go with it, become greater threats to the stability of the traditional airline model. The main summit theme this year is "Airlines making money: a vision of the future", with the underlying theme of disruption and change.

AGENDA - View the full CAPA Airline Leader Summit agenda.

LIVE STREAM - CAPA - Centre for Aviation are pleased to offer a free live stream of the Airline Leader Summit. To access, visit centreforaviation.com during the event hours.

JOIN THE CONVERSATION! Follow the CAPA Airline Leader Summit on Twitter and if you have any comments on the topics being explored at the Summit then join the debate: #CAPASummit.

Friday 03-May-2019

13:30 - CAPA Airline Leader Summit: Making Money 2019 … DONE!

A big thank you from all of the CAPA - Centre for Aviation team to everyone who attend the CAPA Airline Leader Summit: Making Money 2019 at the Powerscourt Resort & Spa, south of Dublin, as well as all the sponsors and event partners that made it possible. We hope you enjoyed all the insightful discussions whether in attendance in Dublin, via our live stream or from following the blog.

Look out for our post-event coverage - starting next week on The Blue Swan Daily with main discussion insights and continuing with the publication of our CAPA TV video interviews.

Friday 03-May-2019

13:00 - In the spotlight... photographs from this morning's sessions

Friday 03-May-2019

12:45 - UP NOW...Working with unions to achieve optimal outcomes

Airlines have limited options in removing costs in the face of downturn. One area for action is to revise network operations, even fundamentally redirecting strategy, particularly where new market directions are emerging, such as the impact of new aircraft types and new entrants. For this, management must ideally seek the engagement of labour, to ensure effective implementation.

With a great majority of costs both external and largely uncontrollable, reducing that one third of costs that relates to labour inevitably also comes under the microscope. In a reducing market there is often much pain to be shared, but intelligent and rational - ideally consensual - courses are available. These should take account of the short term need for action as well as providing that the patient will be healthy when it emerges from whatever surgery has been necessary to ensure survival.

Friday 03-May-2019

12:15 - UP NOW... Working with lessors and OEMs to find mutually beneficial compromises

There are ways of finding tailored options for working together through more challenging times. These imply relieving current financial burdens while preparing the way for a more valuable post-downturn relationship.

Some fresh thinking around the financial aspects of running an airline is urgently required. From payments to high finance, transformation is taking place in the way airlines tackle this side of their business. But who is ahead of the curve?

Friday 03-May-2019

11:50 - It's been a busy morning's agenda... time for a refreshment and networking break

We have been taking the opportunity during the event's networking breaks to record CAPA TV video interviews with many of our delegates. These will all be published on our CAPA TV channel in the coming weeks.

Friday 03-May-2019

11:20 - Join the debate - via #CAPASummit

https://twitter.com/CAPA_Aviation/status/1124255720327852035

https://twitter.com/ALDistrExpert/status/1124253307063689216

https://twitter.com/CAPA_Aviation/status/1124252911792476160

Friday 03-May-2019

11:00 - UP NOW... Airline partnerships, immunised JVs, open skies and the role of competition bodies

As airlines are shackled to their nationality, globalising the product means a need for partnerships in one form or another. This in turn means interpreting existing and future attitudes of regulators in key markets, notably towards immunised JVs, but also lesser forms of presence-enhancing partnerships.

Friday 03-May-2019

10:50 - Join the debate - via #CAPASummit

https://twitter.com/CAPA_Aviation/status/1124248239790854146

https://twitter.com/PaulByrne66/status/1124248264616960000

https://twitter.com/CAPA_Aviation/status/1124245922643312640

Friday 03-May-2019

10:20 - UP NOW... Limiting the fallout from Brexit on the North Atlantic and in Europe

Even as the US and UK have reached an agreement to keep air services at status quo after the continued Brexit deadlines, the uncertainty swirling around Brexit and the UK and European partners of US airlines could also create challenges in the North Atlantic. It is an example of how trade and aviation are becoming even more entangled in the current operating environment.

One of the many unanticipated consequences of the uncertainties raised by Brexit is increased regulatory scrutiny of North Atlantic airline joint ventures. Members of these JVs are allowed to coordinate schedules and prices only with regulatory immunity from competition rules.

In Oct-2018 the UK's Competition and Markets Authority (CMA) launched an investigation into the JV inside oneworld between British Airways, Iberia, Finnair and American Airlines. The JV had been approved by the European Commission in 2010 after JV members gave commitments to release slots to competitors on six city pairs: London-Dallas, London-Boston, London-Miami, London-Chicago, London-New York and Madrid-Miami.

The commitments expire in 2020, after the UK's scheduled exit from the EU, and five of the routes touch the UK, hence the CMA's investigation ahead of their expiry.

- How will open skies in the EU-UK market and across the trans-Atlantic evolve as Brexit comes into effect?

- Are the region's airlines, including new entrant disruptors who have been able to flourish due to advanced aircraft technology and the pre-Brexit liberalised environment, at risk of operating under more restrictive norms?

- Could Brexit provide a catalyst to reform the entire bilateral system that underpins aviation governance?

Friday 03-May-2019

10:15 - A4E: 'Airspace inefficiencies cost EU economy EUR17.6 billion in 2018'

Airspace inefficiencies cost the EU economy EUR17.6 billion in 2018, reports Thomas Reynaert, MD of airline lobbying group A4E during his keynote address at the CAPA Airline Leader summit.

https://twitter.com/CAPA_Aviation/status/1124240704933376000

https://twitter.com/CAPA_Aviation/status/1124240487060267008

Friday 03-May-2019

10:10 - UP NOW... Costs and Benefits of EU Aviation Policy

Friday 03-May-2019

10:00 - Travacoin: 'Disrupting the way we deal with disruptions'

Travacoin aims to "change the way airlines reimburse and interact with passengers… forever," says its CEO, Brian Whelan. The company is a real life application of Blockchain and highlights how it is already adding value to travellers and airlines alike. Find out more at Travacoin is a payment solution which will enable airlines to compensate and refund passengers using a Blockchain based payment system.

Friday 03-May-2019

09:50 - Join the debate - via #CAPASummit

https://twitter.com/LisaAkeroyd/status/1124231841165213698

https://twitter.com/A4Europe/status/1124221885082947584

https://twitter.com/PaulByrne66/status/1123981257640239104

Friday 03-May-2019

09:45 - UP NOW... Helping airlines manage compensation payouts for delays

Friday 03-May-2019

09:30 - Blockchain is expected to be a USD10 billion market by 2021

Some data insights from Lory Kehoe, managing director of ConsenSys in his presentation...

- Expected USD10 billion Blockchain market by 2021

- 10% percent of global GDP will be stored on blockchain by 2027

- Blockchain businesses raised USD20 billion in funding for 2017 - up from USD7 billion in 2016

- 83% of executives believe trust is the cornerstone of the digital economy

- 33X growth for Blockchain Jobs on Linkedin - fastest growing role for the 2nd year running

- Blockchain patents have grown by 200% between 2015 and 2017

Friday 03-May-2019

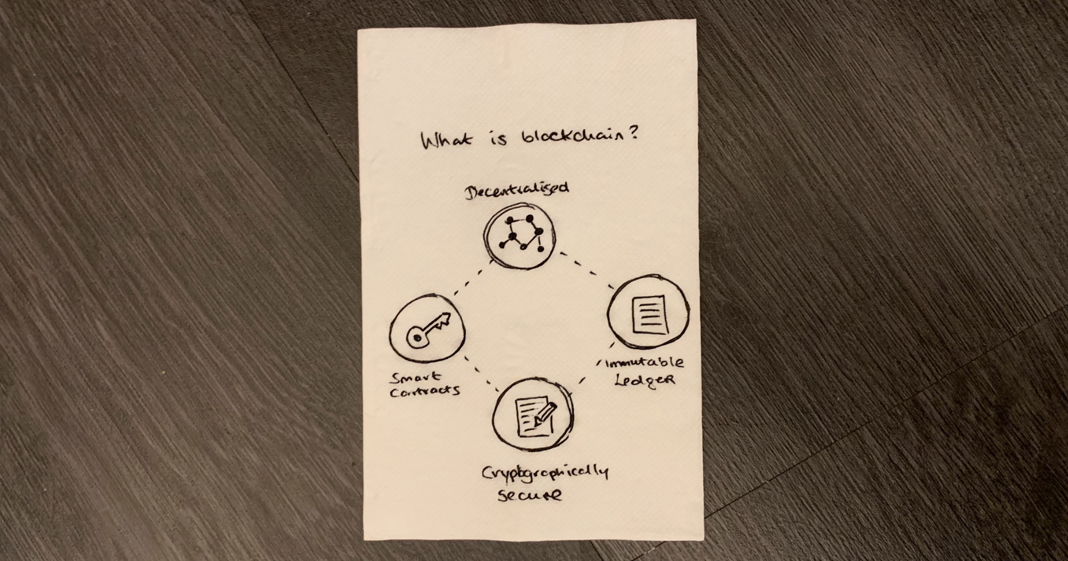

09:20 - Blockchain is 'highly disruptive' due to its 'point-to-point' nature

"Blockchain challenges the status quo," according to Lory Kehoe, managing director, ConsenSys, "and that is why it is such a big opportunity." Just like how new generation airliners are disrupting the market by allowing new point-to-point air services, it is bringing a "point-to-point" nature to doing business. "That makes it highly disruptive and is why people talk about it as the new Internet," he adds.

Blockchain is about "exchanging value on a person to person or business without going through an intermediary," he explains. While there is a "huge amount of noise" around blockchain, he says "some is warranted, some is not".

"Blockchain isn't years away, its here, now, today. It's a gamechanger no doubt about it," he adds.

Friday 03-May-2019

09:05 - UP NOW... Blockchain: what it is and why it matters

Blockchain's role in reshaping the way businesses are run is gradually being appreciated. While frequently associated with various cryptocurrencies, its significance runs much deeper than popular cryptocurrency investment. Yet it has limitations at this stage - for example, is it ready yet to introduce changes in the distribution systems? Perhaps not, but…

Friday 03-May-2019

08:45 - Photo highlights from our fun filled CEO Dinner Debate

https://twitter.com/CAPA_Aviation/status/1124216894293139456

Friday 03-May-2019

08:30 - Insights from the opening day of the CAPA event agenda

CAPA - Centre for Aviation research analyst Hugh Davies was working away at the back of all of yesterday's agenda producing News Briefs for CAPA Members. Here's some of the stories now online to subscribers.

CAPA chairman: US carriers 'are like millennials, they like to stay at home'

CAPA - Centre for Aviation chairman emeritus Peter Harbison, speaking at the CAPA Airline Leader Summit, stated (02-May-2019) US carriers "are like millennials, they like to stay at home". He argued US carriers' "stay at home and be profitable" strategy is only a short term one.

Amazon Web Services: Loyalty programmes a 'huge source of customer data'

Amazon Web Services head AWS Travel Massimo Morin, speaking at the CAPA Airline Leader Summit, stated (02-May-2019) loyalty programmes are a "huge source of customer data, but there are other components". He continued: "For passengers it is personalisation and removing the spam. You need to make correspondence that makes them feel special, feel recognised and want to come back".

Skyscanner 'filling 24 Airbus A320s an hour' in Europe

Skyscanner senior director, strategic partnerships Hugh Aitken, speaking at the CAPA Airline Leader Summit, said (02-May-2019) the company is "filling 24 Airbus A320s an hour" in Europe as it handled 3.6 billion searches, more than 230 million redirects and more than 39 million passengers in the past 12 months. Skyscanner is "one of the most frequently visited" brands globally in terms of indexed search volume, he boasted, fourth behind Airbnb, Bookings.com and Ryanair.

Volantio CEO: IAG a 'great example' of managing procurement, differentiating risk

Volantio CEO Azim Barodawala, speaking at the CAPA Airline Leader Summit, argued (02-May-2019) airline management is not necessarily the issue to implementing technology and innovation, but "road blocks" can include legal and procurement hurdles. He noted IAG is a "great example" of an airline changing the way they do procurement, manage start ups and differentiate risks.

Friday 03-May-2019

08:00 - We are prepared for another day of debate and discussion

Another morning enjoying breakfast to the sound of birds singing in the Irish sunshine, although the weather is forecast to change during the day. After yesterday's wide ranging discussions, we have almost four hours of content this morning and into the early afternoon including three keynote addresses to kicks things off looking at blockchain, travel competition and European Union air transport policy.

Friday 03-May-2019

07:00 - Welcome to day two at the CAPA Airline Leader Summit

It's an early start and the agenda doesn't kick off for a couple of hours but the CAPA team are on site to make sure everything is ready on what is sure to be another interesting day of discussions as we continue the 'Making Money' theme.

Friday 03-May-2019

00:30 - McGills is buzzing… but it is good night from us!

We have just left and delegates are still enjoying the hospitality of Travelport in the McGills bar at Powerscourt as they unwind after the day's programme. Join us tomorrow morning for another day of debate and discussions. Topics during the morning session include…

- Blockchain: What It Is and Why It Matters

- Keynote: Helping airlines manage compensation payouts for delays

- Keynote: Costs and Benefits of EU Aviation Policy

- Limiting the fallout from Brexit on the North Atlantic and in Europe

- Airline partnerships, immunised JVs, open skies and the role of competition bodies

- Working with Lessors and OEMs to find mutually beneficial compromises

- Working with unions to achieve optimal outcomes

Thursday 02-May-2019

22:00 - Hey Jude - where was your first job?

The laughter rocked around Powerscourt this evening as the CAPA Powerscourt Dinner Debate looked at the early careers of our industry leaders on the top table. It was enlightening and humorous in equal measure as Peter Bellew once again had to 'play for his pudding"! A fly on the wall could tell so many stories. Unfortunately for you all, what happens at Powerscourt, stays at Powerscourt!

Thursday 02-May-2019

19:15 - The tables are set and the drinks are flowing!

The tables are set and the pre-dinner drinks are flowing ahead of the CAPA Powerscourt Dinner Debate, which will commence shortly.

Thursday 02-May-2019

17:45 - At the end of the day!

A busy day's programme comes to an end with people in high spirits with the networking area still packed with delegates talking about insights from the day's discussions. Tonight we have the Powerscourt CEO Dinner Debate. This is a closed session so unfortunately we are closed for business and cannot provide any updates on the blog.

Thursday 02-May-2019

17:30 - Norwegian is 'changing its focus from growth to profitability'

Tore Østby, EVP strategic development, Norwegian Air Shuttle, says that after year's of "crazy growth" that has "put pressure on the airline", it is now "changing its focus from growth to profitability". He says there is a "focus on profitability and cash flow" and a "continuous effort to reduce costs". The airline is now working with an "optimisation of the base structure and route network based on 12-month profitability criteria" and will "divest aircraft not required for the company's commercial needs".

Thursday 02-May-2019

17:20 - 'Sorry pal, but you won't last more than 30 days'

Tore Østby, EVP strategic development, Norwegian Air Shuttle shares an image that was published in the media from Norwegian's early days (Sep- 2002).

Thursday 02-May-2019

17:15 - Airline Keynote: making low-cost long-haul work

Thursday 02-May-2019

17:10 - Join the debate - via #CAPASummit

Thursday 02-May-2019

17:00 - Key quotes from the airline conglomerate panel discussion

"The airline within an airline concept was especially liked in the US - United had ted, Delta had Song, US Airways had MetroJet, But they have all disappeared."

John Byerly, Consultant

"I think the multi-brand airline concept is here to stay."

Prof Rigas Doganis, Chairman, European Aviation Club

"The cost differentiation is a critical factor."

Andrew Herdman, Director General, AAPA

"We have a situation where a third party can own a nuclear plant, but you can't own a majority stake in an airline."

Jim Callaghan, Partner, Croon Callaghan Aviation Consulting

"There are dis-economies of having multiple brands."

Andrew Herdman, Director General, AAPA

"Economic theory may send us one way, but marketing may send us the other with brands."

Prof Rigas Doganis, Chairman, European Aviation Club

Thursday 02-May-2019

16:45 - What are the drivers of airline conglomerate formation?

Prof Rigas Doganis, Chairman, European Aviation Club and aviation academic text author is certainly the man to answer this question. He says: "The assumed benefits of larger enterprise size and wider network spread create strong pressure for airline mergers and airline conglomerates are created when full mergers are not possible or desirable."

He says these are split by framework, where nationality rules force airlines merged financially to create conglomerate businesses; where nationality rule allows cross-border expansion of own brand only through creation of multiple subsidiaries; through a search for revenue benefits through equity alliances; or via multi-brand conglomerates.

Thursday 02-May-2019

16:30 - UP NOW... The role of the airline conglomerate - making it a foundation for durability

There are one or two examples of effective airline groups, notably IAG. But other opportunities exist. The regulatory system limits options where international airlines are concerned, so an element of creativity is necessary - but that can lead to problems, as is evident from the present issues in Air France-KLM. Domestically the regulatory constraints don't constrain multi-brand operations in the same way, yet few airlines have embarked on the opportunities that flow. Qantas/Jetstar is a prime example.

Thursday 02-May-2019

16:20 - Skyscanner: There is a 'downward pressure on fares'

Hugh Aitken, senior director, strategic partnerships at Skyscanner says company data shows a clear "downward pressure on fares" but Russia "was an exception" year-on-year due to hosting the FIFA World Cup. So, how does Skyscanner see the European market? Mr Aitken says there are "no massive green shoots yet, however market is stable." There has however been "downward pressure on fares" which is "pretty universal" but with "small pockets of optimism". He adds that "demand appears to be there," however there has been a "shift in destinations being searched" with a "resurgence of Turkey, decline in Spain".

Thursday 02-May-2019

16:15 - Skyscanner is filling 24 A320s an hour in Europe

Hugh Aitken, senior director, strategic partnerships at Skyscanner says that with 3.6 billion searches, more than 230 million redirects and more than 39 million passengers, Skyscanner is "filling 24 Airbus A320s an hour" in Europe. "We would be the fifth or sixth largest airline in the world if we flew aircraft, but we don't want too," he adds.

Thursday 02-May-2019

16:10 - UP NOW... Exploring the European Market and mobile-optimised offerings for today's traveller

Thursday 02-May-2019

15:50 - Key quotes from the relationships panel discussion

"It's about the bad day rather than the good day."

Peter Bellew, COO, Ryanair

"We have come up with a programme at the airport to incentivise ground handlers and improve on time performance and get all the parties [ground handlers and airlines] better working together. "

Stephen King, Head of Airline Relations, Gatwick Airport

"In business, there will always come the day you need a friend."

Damian Hickey, Global Head of Air, Travel Partners, Travelport

"This industry is death by Powerpoint. The question is can you still pick up the phone and call someone when you need help?"

Peter Bellew, COO, Ryanair

"Every relationship does not end in a marriage. Likewise, every business relationship doesn't have to end up as a partnership. If it didn't work, make sure you get in and out quick enough"

Damian Hickey, Global Head of Air, Travel Partners, Travelport

"We need to have a contractual relationship to underpin any trust, but need a personal relationship to work together."

Stephen King, Head of Airline Relations, Gatwick Airport

"There is plenty of sky out there. If someone has failed to adequately train their staff to manage it, that is not the fault of the airlines."

Peter Bellew, COO, Ryanair

"We have core general contracts and then individual contracts with partners that support our interests, our counter-party interests and the airlines we support."

Gabrielle Hoffman, Managing Director, Europe & Head of Global Commercial Strategy, UATP

"We are going to see a downturn of some scale over the coming years."

Peter Bellew, COO, Ryanair

"We work hard in our business so we can satisfy more partners."

Stephen King, Head of Airline Relations, Gatwick Airport

"There are some aspects of our business that needs a firm relationship, but that doesn't spread across all activities."

Damian Hickey, Global Head of Air, Travel Partners, Travelport

"There are a core of 40 airports where we have a one-on-one relationship. It works both ways. Sometimes they need a dig out."

Peter Bellew, COO, Ryanair

Thursday 02-May-2019

15:30 - Join the debate - via #CAPASummit

https://twitter.com/AlesiaMccomish/status/1123943287281397760

https://twitter.com/PaulByrne66/status/1123950098063548416

https://twitter.com/OpenJawTech/status/1123951793631846401

Thursday 02-May-2019

15:10 - UP NOW... Developing more productive relationships with airports and other partners

By virtue of its very nature the airline industry is highly dependent on partnerships of one kind or another. In times of stress, reliance on these partners - and enhancing shared goals - becomes a high priority. These partners range from all parts of the supply chain, notably airports, to fellow airlines, agencies, payment providers and many more.

- Have you got the right partnerships?

- Who you do business with can be a key determinant of success or failure.

- Undergoing a transformation can put pressure on business partners, suppliers and other stakeholders.

Thursday 02-May-2019

15:00 - Adding context to the Ryanair chocolate fountains and Ed Sheeran comment

Ryanair's boss Michael O'Leary would have been delighted with Kenny Jacobs' comment. But there is a real serious issue behind his comment beyond being a great soundbyte. Passengers want reliability, and he believes they are being let down by the industry. Here's more from the CAPA - Centre for Aviation twitter feed.

https://twitter.com/CAPA_Aviation/status/1123949625830985730

https://twitter.com/CAPA_Aviation/status/1123949910888525824

Thursday 02-May-2019

14:55 - Ryanair talks chocolate fountains and Ed Sheeran

You would never expect Ryanair to ever add chocolate fountains at boarding gates or have Ed Sheeran performing live onboard, but Kenny Jacobs, the airline's CMO, makes an excellent observation on what the customer really wants during a panel discussion at the CAPA Airline Leader Summit.

"You could have chocolate fountains at the boarding gate or you could have Ed Sheeran live onboard. The most important thing to customers is reliability and that is about on-time performance."

Kenny Jacobs, CMO, Ryanair

As for those 'frills', he adds: "I never said they would be free!"

Thursday 02-May-2019

14:50 - Key quotes from our ancillaries panel discussion

"We used to call ourselves the little brother of ticket revenue, but that is changing."

Kim McDonnell, head of proposition, easyJet

"The industry is too excited by data. We don't have as much data and never will have as much data as retailers."

Kenny Jacobs, CMO, Ryanair

"As an industry we keep looking into the future. We don't often look at getting the present right."

Noel Connolly, SVP, Head of Global Sales, Airline and Hospitality, CellPoint Mobile

"We have a lot of data and we have to be responsible how we use it."

Kim McDonnell, head of proposition, easyJet

"It needs to be the right offer for the passenger, but that must also be the right offer for the airline."

Alessandro Ciancimino, Vice President and Regional General Manager of Europe, Sabre

"Let payments not just be a cost but an enabler for the passenger."

Noel Connolly, SVP, Head of Global Sales, Airline and Hospitality, CellPoint Mobile

"The LCCs have definitely driven ancillary revenues hard."

Kenny Jacobs, CMO, Ryanair

"We will increasingly see a channel shift from desktop to mobile."

Noel Connolly, SVP, Head of Global Sales, Airline and Hospitality, CellPoint Mobile

Thursday 02-May-2019

14:30 - How do you get the offer right for the passenger?

Joe Leader, CEO, Airline Passenger Experience Association (APEX), shares his views on what airlines need to do to better appeal to customers as he acknowledges that APEX is seeing increase in five star airlines charging for ancillaries. He says airlines must "make passengers feel like a winner every time", warns "if you don't take the leadership position someone else along your value train will", and highlights that "everyone wants to upgrade their experience, but each passengers has a different price point threshold and that can differ per journey."

Thursday 02-May-2019

14:10 - UP NOW... Innovation in generating ancillary revenues

Large strides have been made in generating non-ticket revenues. Yet technological advances are making wider opportunities available. Not only new forms of distribution, but also using more straightforward methods such as incentivising staff and expanding the use of inflight WiFi to generate totally new sources of income. A focus on enhancing customer experience rather than a reliance on unbundling also provides more attractive relationships.

Capturing more of the passengers' travel wallet: Capturing more of the passengers' travel wallet not only improves an airline's own economics but makes it more relevant to the passenger and hence improves their stickiness/loyalty (e.g. premium passengers are not just looking to reduce their air spend but their entire travel spend so if if airlines can leverage their buying power with hoteliers and other suppliers and offer good value bundled travel packages to their passengers through their holidays brand)

Maximising ancillary revenues: Given ancillary revenues are typically not part of the initial purchase decision they are more resilient than air fares. But they must be merchandised (right offering to the right person at the right time and at the right price) rather than merely being passively offered.

Thursday 02-May-2019

13:15 - It's time for lunch… but lots more to come this afternoon

It's been a busy morning of discussions. It's now time for lunch, but there's so much more to come. First up after the break will be a panel discussion on innovation in generating ancillary revenues and that will be followed by a session on developing more productive relationships with airports and other partners.

Thursday 02-May-2019

13:00 - join the debate - via #CAPASummit

https://twitter.com/LisaAkeroyd/status/1123911344661630976

https://twitter.com/OpenJawTech/status/1123914579602477056

https://twitter.com/PaulByrne66/status/1123913871952162817

Thursday 02-May-2019

12:45 - insights from the NDC panel discussion

"We don't need any more leaderboard airlines. We have a set criteria and feel that the 21 we now have is right."

Yanik Hoyles, Director, Industry Distribution Programs, IATA

"We are using NDCs now for ancillaries. We are at the beginning of this world."

Mauro Oretti, Vice President Customer Experience & Commercial, SkyTeam

"The biggest change we have seen in this industry across this decade is the customer."

Bryan Porter, Chief Commercial Officer, OpenJaw Technologies

"We have transformed the industry from a price base to an offer base. That is revolutionary."

Jim Davidson, President & CEO, Farelogix

"Our investment this year in technology is the highest it has ever been. In 2020 it will be even more."

Mauro Oretti, Vice President Customer Experience & Commercial, SkyTeam

Thursday 02-May-2019

12:25 - What a difference a year makes... or not!

Ahead of the discussion, Ian Heywood, global head of new distribution at Travelport, highlights how much the industry has changed since he presented at last year's CAPA Airline Leader Summit. The answer... maybe not really that much!

Last year 43 airlines were certified to IATA NDC level 3 and 4, now its 56. 54 IT companies and aggregators were NDC certified, now 63. Those 20 airlines who aim to have 20% of their transactions via NDC by the end of the year 2020 has grown to 21 with the addition of Qantas. "Why there's not more, I don't know," acknowledges Mr Heywood.

Travelport itself is currently working with around 40 airlines. It is NDC live with five airlines, with four more in production. Mr Heywood hopes to have 20 live by the end of 2019.

Thursday 02-May-2019

12:10 - UP NOW... Accelerating investment in innovation and technology

As innovations affecting distribution increasingly challenge the status quo, opportunities abound for those airlines which have the flexibility and insights to understand the trends and the ability to adapt rapidly.

This can take the form of direct investment in resources and skills, as well as securing strategic technology partnerships with forward looking operators. The result: better merchandising opportunities and more effective marketing, at a time when players like google are taking on a dominant role.

Successfully delivering the 2020 vision

- What is the end point?

- What are the complexities of the process?

- What impact will this have on your bottom line?

Thursday 02-May-2019

12:00 - Join the debate - via #CAPASummit

https://twitter.com/BarbaraMorenoF/status/1123900163532185601

https://twitter.com/WesleyCharnock/status/1123902217923198976

https://twitter.com/sandeeprrao1991/status/1123883004189904896

https://twitter.com/BarbaraMorenoF/status/1123888097773654017

Thursday 02-May-2019

11:45 - Summit insights - key quotes from our second panel discussion

"You need the right offer at the right time for the right traveller. Understand your traveller and engage before, during and after travel."

Massimo Morin, Head, AWS Travel, Amazon Web Services

"We are running out of golden bullets. if the market stays stagnant it becomes more difficult. The Saudi Government wants us to grow quickly and boost profits. They can be mutually exclusive."

Richard Nuttall, VP Sales, Saudia

"There will always be a player with the lowest fares, but if you manage to gain unique experience from your customer, it can become a very powerful base to support customer loyalty."

Ole Lindner, Manager Passenger Experience Design, Lufthansa Group

"It is much more about how a brand makes you feel through the experience. That is going to be much more memorable than points or miles."

Azim Barodawala, CEO, Volantio

"The loyalty programme is a huge source of customer data, but there are other components. For passengers it is personalisation and removing the spam. You need to make correspondence that makes them feel special, feel recognised and want to come back."

Massimo Morin, Head, AWS Travel, Amazon Web Services

"You want to be agile, but everything costs money. If you want to be free with innovation, nothing happens. Innovation for innovation's sake, you can't do. It all gets muddled."

Richard Nuttall, VP Sales, Saudia

"As you use data to understand customers better, airlines can communicate with the passenger better."

Azim Barodawala, CEO, Volantio

"Frequent flyer programmes have tended to refocus on high travel premium travellers."

Evert de Boer, Managing Director, On Point Loyalty

"If someone can check-in online on their mobile we get a better NPS score. It is something that is good for the customer and good for the airline as well as we don't need as many resources at the airport."

Richard Nuttall, VP Sales, Saudia

"We need to reimagine the frequent flyer programme to better deliver on what the customer requires."

Massimo Morin, Head, AWS Travel, Amazon Web Services

Thursday 02-May-2019

11:20 - UP NOW... Improving the stickiness of the airline product through innovation

Combating commoditisation is a constant battle. But there are many peripheral areas - most effectively around FFPs - available to airlines to expand their offerings. The list is long, and there are many variations on the theme, all of them involving direct additions to revenue, but more importantly capturing the loyalty of the passenger.

Thursday 02-May-2019

11:00 - CTM: 'Qantas' non-stop Perth - London has changed my booking habits'

Some interesting insights from Laura Ruffles, Global COO, Corporate Travel Management with her own personal experiences of travelling between Australia and the UK. The English executive, who works in Sydney says she now uses the airline's Perth - London Heathrow Boeing 787 Dreamliner flight.

"When it was launched there were lots of questions from corporates about the length of time on the aircraft," she says, "but Qantas has looked at the well-being aspect for the traveller across the whole journey."

Here's a story we produced earlier this year on ultra long haul experiences on The Blue Swan Daily.

https://corporatetravelcommunity.com/as-project-sunrise-discussions-continue-new-qantas-research-reveals-what-customers-really-want-on-ultra-long-haul-flights/

Thursday 02-May-2019

10:45 - Summit insights - key quotes from our first panel discussion

"Type of meetings and reasons are changing. But, face to face engagement is still as important as ever."

Julia Fidler, Global Employee Experience Lead, Microsoft

"Service is important but technology and data drives everything."

Laura Ruffles, Global COO, Corporate Travel Management

"Corporate travel is screwed up. There are too many intermediaries."

Dr Zhihang Chi, Vice President & General Manager, North America, Air China

Travel and well being "coming into a whole new level of importance" in corporate travel.

Johnny Thorsen, Vice President, Travel Strategy & Partnerships, American Express

"TMCs? As long as they can perform a function and add value, I will pay for them."

Dr Zhihang Chi, Vice President & General Manager, North America, Air China

"Traditional desktop is still our top channel, but mobile grows every month"

Laura Ruffles, Global COO, Corporate Travel Management

"The world is opening up and you have to be ready for data sharing. If you don't you will be run off the road."

Johnny Thorsen, Vice President, Travel Strategy & Partnerships, American Express

"It is about mobile - most of our travellers want information in their hand."

Laura Ruffles, Global COO, Corporate Travel Management

"Alliances don't necessarily work to support corporate travel. Business travel is the crown jewel of our business so everyone is so protective."

Dr Zhihang Chi, Vice President & General Manager, North America, Air China

"Business travel pretty much remains within the three buckets - those cost focused, those points focused and those experience focused."

Julia Fidler, Global Employee Experience Lead, Microsoft

"It is about making better informed decisions When we put in details about the on time performance of flights, we saw a big change in bookings."

Laura Ruffles, Global COO, Corporate Travel Management

Thursday 02-May-2019

10:20 - UP NOW... Addressing the corporate and business travel markets more effectively

There are no more valuable market segments than the repeat travellers in corporate programmes and SMEs. Yet airlines have mostly failed to capitalise fully on these opportunities. Imagination, innovation and new technology are opening up new avenues for exploitation.

Understanding the needs of these segments more effectively - because they are part of the same economic environment and also feeling the pain - will pay dividends, both in the short and long term.

In a downturn, corporate travellers are increasingly vital but what do they want?

Corporate travel is the lifeblood of full service airlines and an increasingly high yield source of business for LCCs and hybrids. What's more, in a downturn, it's a more reliable and consistent source of traffic when leisure demand becomes more fickle.

Thursday 02-May-2019

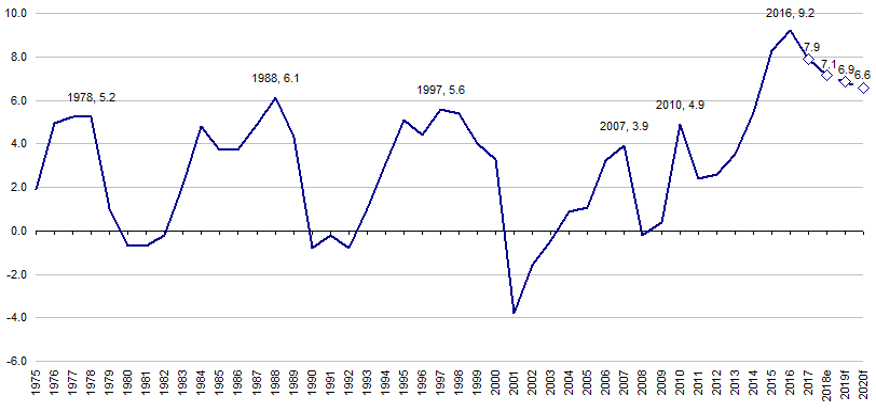

10:15 - CAPA '... but this is the best downturn we have ever had!'

CAPA's chief financial analyst Jonathan Wober concludes that with an outlook where "growth is slowing, but still reasonable", a "favourable" operating profit cycle, but with supply and demand balance "tilting down" and oil "up from 2016 low" it means margins "are falling, but still above previous peaks".

CAPA's world airline operating margin model predicts falling margins, but above previous peaks.

[perfectpullquote align="full" bordertop="false" cite="" link="" color="" class="" size=""]"The aviation industry is in a downturn...but this is the best downturn we have ever had!"

Jonathan Wober, chief financial analyst, CAPA - Centre for Aviation[/perfectpullquote]

Thursday 02-May-2019

10:00 - CAPA: 'The aviation industry is in a downturn'...

"It's economics so it's all about supply and demand," jokes Jonathan Wober, chief financial analyst at CAPA - Centre for Aviation at the start of his presentation, but that was the only bright spot as he started to talk about freight traffic declines, a weak outlook for freight, and falling world trade volumes, all of which is directly correlated to world GDP.

"Global GDP outlook is slowing," he says, down to a +2.7% forecast for 2019, down from 3.1% in 2018. "This slowing GDP growth is expected to take place in most economies globally," he adds, but "global growth is still reasonable".

What does this all mean for airlines? Well, Mr Wober highlights that airline margins are at historically high levels, helped by better RPK growth and better capacity discipline. He highlights that supply and demand balance is fundamental, but there is another crucial factor... oil. "Oil price fell between 2014 and 2016, but has risen again," he says. "Oil price is important for air fares and total unit costs and aircraft retirements are driven by fuel."

Thursday 02-May-2019

09:50 - UP NOW... CAPA - Centre for Aviation's Economic & Financial Aviation Outlook

Jonathan Wober, chief financial analyst at CAPA - Centre for Aviation is delivering a compelling review of latest global economic and trade trends, and what's in store for 2019/20. I've seen the presentation and you'll walk away with numerous insights.

Thursday 02-May-2019

09:40 - The tide's going out for the US airline majors in international markets

Peter Harbison explains "the tide's going out for the US airline majors in international markets". He says that domestic seat capacity is growing "reasonably well" for a mature market; domestic airlines are "highly profitable, accounting for half of the world's airline profits". He adds: "But hiding inside ATI-immunised JVs and not growing is a recipe for long term demise."

According to Mr Harbison, the US international airline strategy suffers from two major challenges..."The protected domestic market is so profitable that it is too tempting to not venture outside and a narrowly focused mantra that limits rational debate about what is genuinely productive for the long term future of the US majors."

US airline majors' "shyness" about expanding internationally raises important issues about options for their future international growth strategy," says Mr Harbison in his summit address. As the majors rely very heavily on closed JVs and this is a time when the protection from competition that JVs offer is starting to decline, JVs are unlikely to offer comprehensive options in the long term," he explains.

"US airline strategy suffers from some major challenges," says Mr Harbison, "the long-term outcome is to stay home and be profitable."

[perfectpullquote align="full" bordertop="false" cite="" link="" color="" class="" size=""]"Like the Millennials, US airlines are staying at home."

Peter Harbison, chairman emeritus, CAPA - Centre for Aviation[/perfectpullquote]

Thursday 02-May-2019

09:30 - Some insights from Peter Harbison's opening presentation…

On… Chinese international capacity growth

"Double digit international growth is continuing - although still relatively small base."

On… Chinese airline growth

"Since 2016 the number of international Chinese airlines doubled - to 29."

On… Beijing's new airport

"The opening of Beijing Daxing, the city's second airport, later this year will offer greater opportunities for airlines to commence international operations from the capital."

On… India's arrival on the world stage

"India's international market is growing at double digit rates - still off a low base. 50 million middle class can afford to fly internationally - only 20 million have."

On… airlines in India

"Painful though it is, Jet Airways' demise was part of a necessary surgery. Air India remains a market spoiler."

On… the Gulf airlines

"In the Gulf, things are changing too. Emirates slowing to catch its breath but flydubai has big plans too. Meanwhile, Etihad is contracting, Qatar Airways is growing and Saudia is spreading its wings. New technology is the game changer."

On… Middle East growth

"While the rest of the world is growing steadily or rapidly, the Middle East has stalled. Even Africa - off its lower base - is outshining it."

On… Emirates Airline

"Following its remarkable expansion earlier this century, it tapered its growth recently. But it clearly has no plans to stand still."

On… Etihad Airways

"It has fundamentally changed strategic course over the past two years. It has a new strategic course."

On… flydubai and the Boeing 737MAX

"20% of flydubai's flights are over five hours and will increase as its planned 250 737 MAXs come into operation. The MAX is vital to flydubai's future with over 230 more on order."

On… new single-aisle airline variants from the Gulf

"Today, the emergence of long haul narrowbody aircraft is opening. From Saudi Arabia and from the other Gulf points, MAXs and neos can reach any point in Europe and India and almost any in Africa."

Thursday 02-May-2019

09:20 - The global airline balance is changing - irreversibly?

Peter Harbison highlights the good, the bad and the ugly of aviation.

GOOD: The US economy appears strong and relatively resilient. The stock exchange is breaking records

GOOD: China catastrophe scenarios have not materialised and the economy appears to be faring reasonably well

GOOD: Interest rates in many developed countries remain at historically low levels

BAD: IMF, World Bank and others downgrading the global economic outlook

BAD: IATA freight report 3-Apr-2019: "The negative impact of the softness in global trade and economic indicators is becoming increasingly evident in the recent air freight outcomes. Ongoing trade tensions continue to weigh upon the industry."

BAD: Political instability in Libya, Yemen, Venezuela, UK/Brexit

BAD: Rising nationalism and protectionism

BAD: Trade wars, economic fragility of Italy, Greece, Turkey and Iran

BAD: Chinese and German economies slowing

BAD: Resulting economic planning instability

BAD: Aviation: 787 RR engines; 737 MAX, Brexit impact on Airbus

BAD: Anticipated end of the positive economic cycle - whether or not correct, creates underlying reluctance of lenders

BAD: Extremely low interest rates limit governmental intervention options

UGLY: Fuel!

Thursday 02-May-2019

09:10 - UP NOW... CAPA's Industry Outlook - The world is changing: towards a new world order

Thursday 02-May-2019

09:05 - 'Start Me Up' and away we go!

CAPA - Centre for Aviation chairman emeritus Peter Harbison takes to the stage to welcome delegates to the CAPA Airline Leader Summit in Ireland with a message of thanks to our hosts, sponsors and dignitaries in the audience. We are all set for a couple of days of enlightening insight and lively debate.

Thursday 02-May-2019

08:55 - The live Stream is now LIVE

Remember, if you are not at Powerscourt you can follow all the agenda discussions via the CAPA Airline Leader Summit LIVE STREAM on the CAPA - Centre for Aviation website.

Thursday 02-May-2019

08:50 - The countdown commences… prepare for take-off

It is just ten minutes until the opening of the CAPA Airline Leader Summit. The Rolling Stones are on pause ready for CAPA executive chairman emeritus Peter Harbison to take to the stage for his welcome address.

600 seconds… 599 seconds… 598 seconds….

Thursday 02-May-2019

08:30 - The Blue Swan Daily industry insights

https://corporatetravelcommunity.com/mobile-is-key-to-boosting-guest-experiences-say-hoteliers-nine-in-ten-say-technology-platform-is-critical-to-improving-guest-experience-and-cultivating-loyalty/

https://corporatetravelcommunity.com/advito-believes-the-air-rfp-is-dead/

Thursday 02-May-2019

08:00 - Registration is now open!

Delegates are now starting to arrive at the conference location to a warm welcome from the CAPA team.

Thursday 02-May-2019

07:00 - The calm before the storm

It is just a couple of hours until the formal agenda starts on day one of the CAPA-Centre for Aviation Airline Leader Summit at the Powerscourt Resort & Spa in Enniskerry, to the south of Dublin. All is quiet in the conference hall and networking areas, although the CAPA team have been beavering away for a couple of hours ensuring a smooth delivery of today's programme.

Wednesday 01-May-2019

20:00 - What's in store on day one of the CAPA Airline Leader Summit?

What will tomorrow bring? A packed schedule of enlightening discussions unrivalled in coverage of the top strategic issues affecting the aviation and travel markets. A full day of discussions is in store with events kicking-off at 09:00 with welcome introductions and a market overview presentation from CAPA's Peter Harbison. Whether you are with us in Ireland, watching the live stream or following us via this blog, make sure you are in position.

It's hardly a secret that the airline industry is facing myriad challenges, notably in the marketing and distribution areas, as companies with personalised data, and the analytics and artificial intelligence to go with it, become greater threats to the stability of the traditional airline model. Understanding aviation markets is CAPA's great strength and passion and the event agenda in Ireland includes a variety of topics sure to generate interest and deliver lively debate.

Alongside industry, economic and financial outlooks from the CAPA team and a keynote address from Norwegian, some key insights will be afforded on the aviation and wider travel sector.

Topics under discussion will include:

- Move over millennials: Make way for Gen Z (and boomers)

- Addressing the corporate and business travel markets more effectively

- Improving the stickiness of the airline product through innovation

- Accelerating investment in innovation and technology

- Innovation in generating ancillary revenues

- Developing more productive relationships with airports and other partners

- Exploring the European Market and mobile-optimised offerings for today's traveller

- The role of the airline conglomerate - making it a foundation for durability

CHECK OUT the full event AGENDA

Wednesday 01-May-2019

18:00 - It is all taking shape ahead of tomorrow's summit launch

Wednesday 01-May-2019

17:00 - Can't make it to Ireland? Don't worry! Follow the live stream!

https://twitter.com/CAPA_Aviation/status/1123497375476211712

Wednesday 01-May-2019

16:00 - Agenda Insights: Capturing more of the passengers' travel wallet - innovation in generating ancillary revenues

Large strides have been made in generating non-ticket revenues. Yet technological advances are making wider opportunities available. Not only new forms of distribution, but also using more straightforward methods such as incentivising staff and expanding the use of inflight WiFi to generate totally new sources of income. A focus on enhancing customer experience rather than a reliance on unbundling also provides more attractive relationships.

https://corporatetravelcommunity.com/capturing-more-of-the-passengers-travel-wallet-innovation-in-generating-ancillary-revenues/

Wednesday 01-May-2019

15:00 - Agenda Insights: Accelerating investment in innovation and technology will be key for delivering a 2020 vision

As innovations affecting distribution increasingly challenge the status quo, opportunities abound for those airlines which have the flexibility and insights to understand the trends and the ability to adapt rapidly.

This can take the form of direct investment in resources and skills, as well as securing strategic technology partnerships with forward looking operators. The result: better merchandising opportunities and more effective marketing, at a time when players like google are taking on a dominant role.

https://corporatetravelcommunity.com/accelerating-investment-in-innovation-and-technology/

Wednesday 01-May-2019

14:00 - Agenda Insights: Addressing the corporate and business travel markets more effectively - there are few more valuable segments

There are few more valuable market segments than the repeat travellers in corporate programmes and SMEs. Yet airlines have mostly failed to capitalise fully on these opportunities. Imagination, innovation and new technology are opening up new avenues for exploitation. Understanding the needs of these segments more effectively - because they are part of the same economic environment and also feeling the pain - will pay dividends, both in the short and long term.

Corporate travel is the lifeblood of full service airlines and an increasingly high yield source of business for LCCs and hybrids. What's more, in a downturn, it's a more reliable and consistent source of traffic when leisure demand becomes more fickle.

https://corporatetravelcommunity.com/addressing-the-corporate-and-business-travel-markets-more-effectively/

Wednesday 01-May-2019

13:00 - Join the debate - via #CAPASummit

https://twitter.com/joepleader/status/1123402653877374976

https://twitter.com/volantio/status/1123613466756046856

https://twitter.com/AmadeusITGroup/status/1123166960949301248

Wednesday 01-May-2019

12:00 - Delivering insights on all the industry's key talking points

For almost 30 years CAPA - Centre for Aviation has been delivering market intelligence, research and data solutions that support strategic decision-making at hundreds of the most recognised organisations in global aviation. Its unrivalled reputation for independence and integrity underpins the commitment of a global team of experts who deliver a wealth of insightful analysis on the latest developments and trends affecting commercial aviation.

Here are just some of the recent insights available to CAPA members…

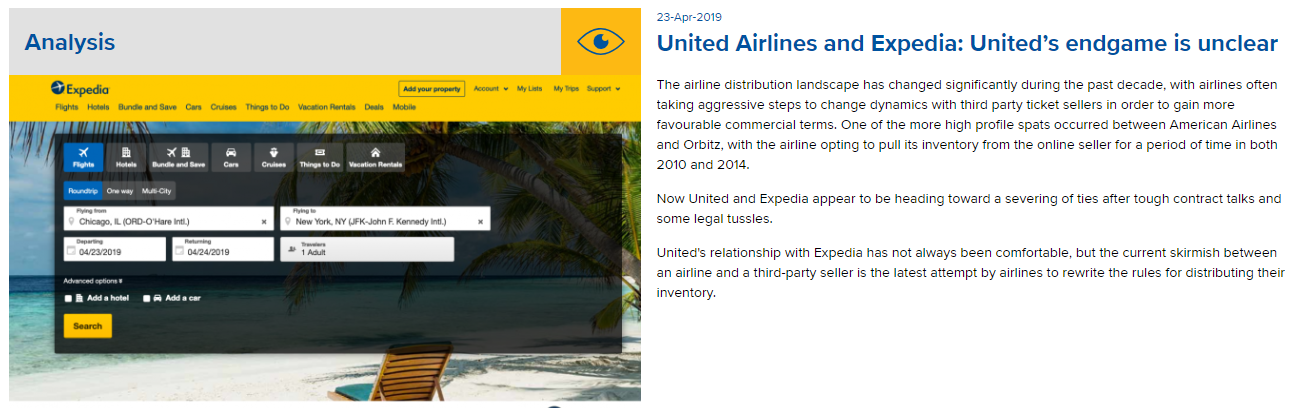

United Airlines and Expedia: United's endgame is unclear

The airline distribution landscape has changed significantly during the past decade, with airlines often taking aggressive steps to change dynamics with third party ticket sellers in order to gain more favourable commercial terms. One of the more high profile spats occurred between American Airlines and Orbitz, with the airline opting to pull its inventory from the online seller for a period of time in both 2010 and 2014. Now United and Expedia appear to be heading toward a severing of ties after tough contract talks and some legal tussles. United's relationship with Expedia has not always been comfortable, but the current skirmish between an airline and a third-party seller is the latest attempt by airlines to rewrite the rules for distributing their inventory.

Virgin Atlantic SWOT: 2019 a pivotal year for the 35 year old airline

Virgin Atlantic is due to take delivery of its first Airbus A350-1000, the first of 12 on order, on 1-May-2019 (source: CAPA Fleet Database). The A350s will fulfil Virgin's aim of operating only twin engine aircraft by 2021, completing the exit of its ageing four engine Boeing 747 and A340 aircraft. This process has been under way over the past four years, with Boeing 787-9s replacing part of the older fleet. A more modern fleet should provide benefits in terms of cost efficiency, customer experience and the economic feasibility of new routes. After reporting its fifth net loss in seven years in 2018, Virgin certainly needs to improve its performance. Virgin Atlantic reaches its 35th birthday in 2019, in a pivotal year for the UK's second largest widebody operator. Its majority control by Sir Richard Branson's Virgin Group is set to end with the completion of the sale of a 31% stake to Air France-KLM. In addition, the widening of Virgin's North Atlantic JV with its 49% shareholder Delta to embrace Air France and KLM is also expected to complete this year. In addition, the regional airline Flybe's network will be taken under the Virgin Atlantic brand. This report considers Virgin Atlantic's strengths, weaknesses, opportunities and threats.

Wednesday 01-May-2019

11:00 - What's going on behind the scenes at Powerscourt

The exhibition area is starting to take shape ahead of tomorrow's formal agenda.

Wednesday 01-May-2019

10:00 - The spring sun shines over the stunning summit venue

The Great Sugar Loaf Mountain is visible across the valley, between the tall elegant beech trees. The avenue slopes down, through woodland, before revealing the elegance of Powerscourt Hotel Resort & Spa, with its breathtaking views. Located on the famous Powerscourt Estate, one of Ireland's finest estates, with its historic house, beautifully manicured garden and its waterfall, the highest in Ireland, you may be just half an hour from Dublin but it could be a million miles away.

Outstanding among luxury five star hotels in Ireland and set amidst one of the most scenic and historic estates in the country the 194-room resort showcases Palladian-style architecture and offers guests a host of amenities. Recently named AA Hotel of the Year, two championship golf courses, a 30,000-square foot luxury spa by ESPA, a signature restaurant and traditional Irish pub are among this luxury hotel's distinctive attractions.

Wednesday 01-May-2019

09:00 - Did you follow events from the CAPA Middle East & Africa Aviation Summit in Dubai?

From Dubai to Dublin, The Blue Swan Daily team is currently en route from the growing Gulf metropolis to the leafy fields of County Wicklow. They may face a culture shock - and temperature shock too - following their arrival in the Republic of Ireland, but a couple of pints of Guinness with delegates are sure to prepare them for tomorrow's agenda. If you missed the action from the Dubai event you can view our live blog from Dubai.

https://corporatetravelcommunity.com/blog-live-from-dubai-insights-from-the-capa-middle-east-africa-aviation-summit/

Wednesday 01-May-2019

08:00 - Dia dhuit ar maidin! Welcome to Dublin

Good morning from the stunning Powerscourt Hotel Resort & Spa, located in County Wicklow and the venue for this seventh successive year for the CAPA - Centre for Aviation Airline Leader Summit. The CAPA event team are all on site working hard to prepare everything for the event, which opens tomorrow morning. This year's event looks at 'Making Money'.