It has been a great solution for the short-term, an emergency measure in critical circumstances, but business travel is resilient and will return, after all despite being an accomplished substitute technology cannot actually replace the value of face-to-face meetings to make business happen and build relationships.

Collaboration and adaption has been key to surviving this unprecedented health crisis for business and will be key to understanding and shape of the future for business travel. It is against this backdrop that Amadeus engaged in discussions with nearly 100 C-level executives from business travel agencies around the globe during 3Q 2020 to find out their views on the current situation, the pace of recovery and factors that will shape the recovery. We also asked about their top priorities, needs, and business strategy to help accelerate the recovery.

The report 'Reboot. Recharge. Rethink Business Travel' illustrates that business travel agencies believe the revival in business travel will vary across sectors and will accelerate revenue diversification and digitisation in the industry.

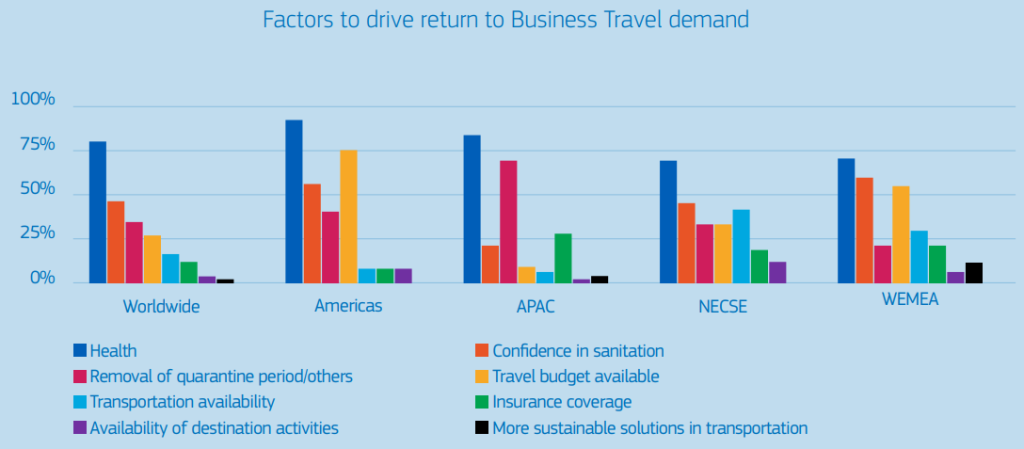

Above all, business travel agencies' imminent challenge is to survive. Given very low business demand, they face significant cash flow concerns and a need to tightly manage costs. Health, safety and traveller wellbeing are the main drivers for recovery, and the report identifies business travel agencies are facing new demands coming from both travellers' individual needs and corporations' enhanced focus on duty of care and security.

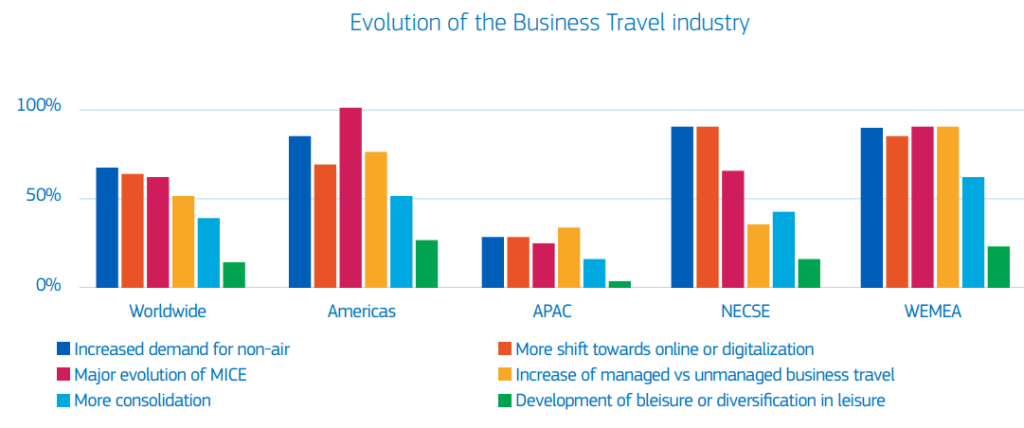

The findings suggest the new world of business travel will see an increased demand for a broader range of content, in addition to personalisation and end-to-end trip servicing. It will also accelerate digitalisation and self-service. Collaboration will be an essential tool to accelerate recovery and build a more resilient and sustainable industry in the minds of the business travel agencies.

Business travel agencies' main recovery strategies will be to enhance operational efficiency and accelerate revenue diversification, while the guiding principle for business travel will be a stronger traveller focus and a frictionless end-to-end travel experience. Business travel agencies also see technology as the key enabler to operational efficiency and delivering differentiated customer service.

While these key findings were the consensus at a global level there were also notable differences by region. For example, in Europe, Middle East & Africa, the findings show a stronger consensus that leisure will recover first versus the worldwide figure (67% vs 49%).

In Western Europe, Middle East and Africa (WEMEA), SMEs are foreseen as the fastest industry actors to recover, followed by the Marine industry. Northern, Eastern, Central and Southern Europe (NECSE), agree SMEs will recover first, but feel large corporations/multinationals and the companies evolving in the energy sector will be second to recover., according to the report.

In the Americas, business travel agencies are more optimistic regarding the time it will take for travel to resume: 33% believe it will accelerate in the second half of 2021, compared to the global figure of 46% predicting that more significant recovery will happen in 2023.

This region also strongly believes (67% compared to 49% worldwide) leisure is driving this recovery. In the business travel sector, respondents from the Americas foresee a faster recovery for the energy sector, and a slower one for SME, compared to the global average.

Meanwhile, in Asia Pacific, the report finds more optimism that business travel will resume first (38%) or at the same pace as leisure (47%). While the majority of executives across the globe agree that the marine industry will be quicker to resume business travel, it is voiced much stronger in this region than in the rest of the world (70% vs 51%).

In terms of how business travel will likely evolve, this region's business travel agencies see a growing demand for hotels and insurance content primarily, followed by car rentals and new types of content. But the most voted evolution is the shift from unmanaged to managed travel, as there is an increased need for information to help navigate the pandemic, such as quarantine requirements, schedule changes and route management tied to the introduction of travel bubbles.