Avvio, which specialises in the science of direct guest acquisition for hotels, predicts that in 2022 hoteliers will experience direct cancellations in excess of 20%, as guest' expectations of booking flexibility - ushered in by COVID-19 - combines with the highly competitive market conditions and likely increase in guest loyalty programmes of OTAs as they deploy strategies to capture share.

The research, published in the whitepaper 'We need to talk about cancellations', highlights how guest behaviour is changing and that it is driving the rise in cancellations. It has been long recognised that cancellation rates on OTA bookings have been high relative to other booking channels and trending up as they provide the option of "free cancellation" rather than pushing for a deposit.

"This has led to a rise in Booking Infidelity as travellers today continue to research hotels long after their initial booking, sometimes booking multiple properties safe in the knowledge that their unwanted booking can be cancelled easily and without penalty later on," says the report.

A steady creep of the same buying behaviour is now evident on the direct channel. Avvio data shows up to 7% of direct bookers hold multiple hotel bookings for the same stay dates in 2021. Unless hotels mitigate this by adopting new strategies to retain bookings, Avvio predicts this behaviour will "grow faster in the coming years as new technologies emerge allowing a guest's booked rate to be monitored post-booking, and automated rebooking tools become more common".

The travel landscape beyond COVID-19 will certainly demand ever more booking flexibility for hotel guests, but Frank Reeves, Co-founder & CEO, Avvio warns the implications for the hospitality industry could be massive. This booking flexibility, combined with an urgent and dynamic competitive market, and the inevitable return of new and compelling OTA value propositions, "may trigger a cancellation bloodbath well in excess of 20% on the direct channel for hotels," he said.

It is generally accepted that cancelled bookings (or 'booking-wash') are a negative outcome for most hoteliers in most circumstances with the scale of the impact determined by a number of factors. Ally Northfield, managing director, Revenue by Design, describes cancellations as "the silent killers of hotel profitability" in the Avvio whitepaper, while Sean Fitzpatrick, chief executive officer, OTA Insight, acknowledges that tackling the problem of cancellations "is more urgent than ever".

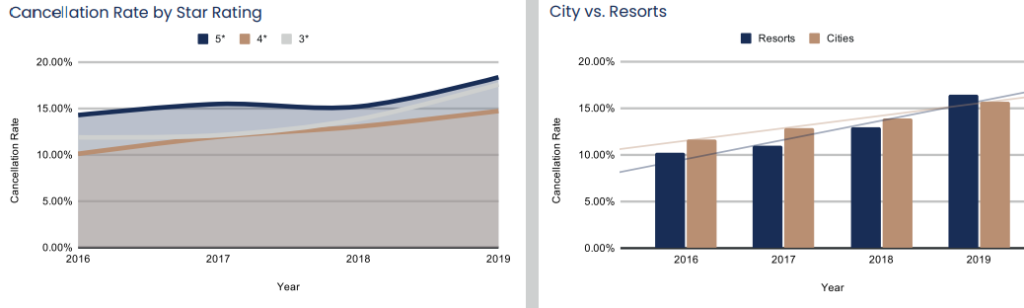

Avvio's research identifies that property type is one key variable in the cancellation mix and has a significant impact on cancellation rates. When viewed by star rating, all property classes are following the trend towards higher cancellation rates, according to its data, but five star properties have the highest cancellation rates on average with just over 16% across a 2016-2019 study period. Its research also shows that resorts overtook cities in terms of cancellations rate in 2019, peaking above 15% for the first time.