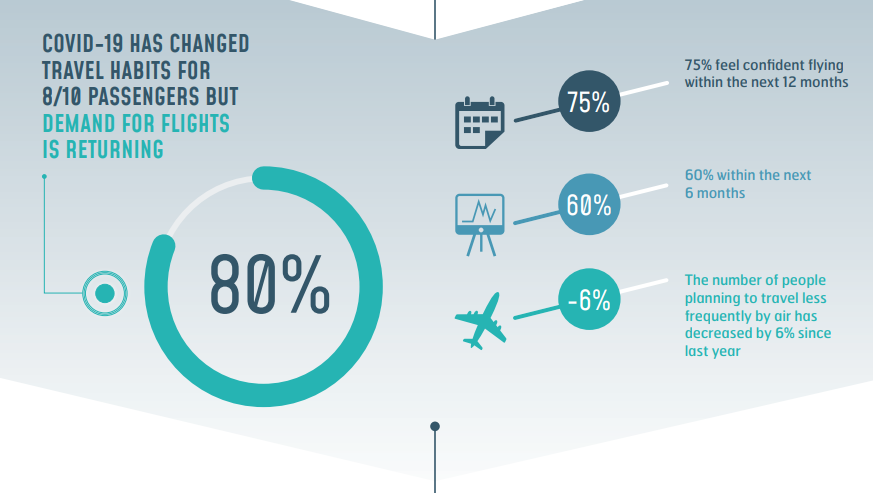

The survey, described by Inmarsat as the "biggest airline passenger survey conducted in the wake of COVID-19" certainly provides the aviation industry cause for optimism, as well as highlighting where some opportunities lie for a profitable and sustainable recovery.

It covers answers from 10,000 respondents, almost two thirds of whom (60%) would be happy to fly again by the end of the year, up to only 47% last year in the 2020 edition of the tracker. This is a clear indication that while aviation isn't out of the woods yet, there are enough reasons to feel optimistic about the future, notes Inmarsat Aviation's president Philip Balaam.

Airlines will also be reassured that the number of passengers who expect to travel less frequently has dropped by 6% in comparison to Inmarsat's 2020 tracker. However, with 84% of respondents believing their travel habits are likely to change post pandemic, the onus is firmly on airlines to ensure their service offering keeps pace with the evolving requirements of passengers.

Greeks were found to be the most confident about flying today (29%), followed by Australians and Brazilians (both 20%). Interestingly, actually taking a flight improves the confidence of passengers towards health and safety issues by 20%, showing that the experience of flying is very reassuring, according to the findings.

When it comes to COVID concerns, one in three people (37%) felt less confident taking a bus or coach compared to a flight. This was highest for passengers in Brazil (70%), India (48%) and UAE (42%). Globally, 40% of passengers felt the metro or underground was riskier than flying.

Certain barriers to flying are still evident though and primarily centre around the inconvenience and unpredictability of travel. The top three barriers globally were quarantining (51%), unpredictable border closures (41%) and confusing safety protocols (36%).

Following the pandemic, the passenger service experience was regarded as the most important factor when it comes to the enjoyment of a flight globally (46%), with the highest responses coming from India (67%), Brazil (67%), Indonesia (59%) and China (57%).

When it comes to health and safety, 84% of passengers believe that implementing COVID vaccine passports is a good idea, with 50% stating COVID passports should be implemented now and 34% stating it should only be implemented when everyone's been offered the vaccine. The remaining 16% either did not think COVID vaccine passports are fair on those who are against being vaccinated, had concerns around the use of personal data, or did not have an opinion on the matter.

The survey also indicates that greater importance should be placed on customer experience, because interacting with airline personnel was seen to help instil the most confidence for passengers during a flight. This made passengers the most confident in Mexico (55%), the US (51%), UAE (50%), Brazil (49%), Greece (42%), Canada (41%), Australia (39%) and the UK (36%).

The survey reveals that the unpredictability of flying and the seemingly large variation in rules and regulations is hampering confidence towards air travel the most. As referenced, the potential of quarantine is the greatest worry for people (51%), more so than catching the virus at the airport or on the plane (43%).

Almost two-thirds 62% would like all airlines to follow the same hygiene practices, which comes out as the most important factor for Australians (63%). A consistent set of safety standards was the most important factor for nations in Asia Pacific too, namely Indonesia, Japan and Singapore.

Digital technology improves pre-flight confidence in a number of ways, such as providing up-to-date information and updates to help reassure passengers before a journey. Digital health passports were also found to be a pre-flight confidence booster in this year's survey, with their importance rising to 47% compared to 37% in 2020.

The Greek might be the most confident about flying, but Greece is the only country among respondents surveyed that has concerns about digital health passports (36%) both in terms of personal data and fairness and 12% of passengers in the UAE, Japan, Canada and Germany felt they were unfair. Other important digital pre-flight activities include destination status alerts (39%), facial recognition security (33%) and real time luggage tracking (31%).

While onboard, digital technology helps to improve confidence by keeping passengers connected and minimising their contact with others, including cabin crew and fellow passengers. "A digital transformation was already underway in the aviation industry, but the pandemic has undoubtedly fast-tracked its implementation," notes Mr Balaam.

In addition, 41% of respondents believed inflight Wi-Fi had increased in importance after the pandemic, compared to 30% for inflight entertainment. Inflight Wi-Fi was the most important factor for the US (55%) and Canada (41%).

Globally, satisfaction with airlines' responses to the pandemic has grown to 72%, a 12% increase from last year. This is an important result for the industry, as the reputation of airlines is the key to boosting confidence levels for 50% of passengers, according to responses. In addition, more passengers said they will only travel with 'trusted' airlines, which was most pronounced in the Americas with an 8% uplift from 2020 to 32%.

The research also reveals generational differences in trust, as 28% of younger passengers (18-44yrs) said they were more likely to fly only with 'trusted airlines' compared to 20% of older passengers (45-65yrs).

The study also reveals that factors such as region and age influence the individual preferences of passengers. In the Americas, passengers report that inflight Wi-Fi, the passenger service experience and inflight entertainment are more important now than before the pandemic. In comparison, passengers in Europe, the Middle East and Africa consider free baggage and extra legroom as more important.

Younger passengers aged 18-44, the group more concerned with catching COVID according to the study, are more discerning when they select a carrier than older passengers, placing far more importance on loyalty programmes, sustainability, airport locations and ticket prices.

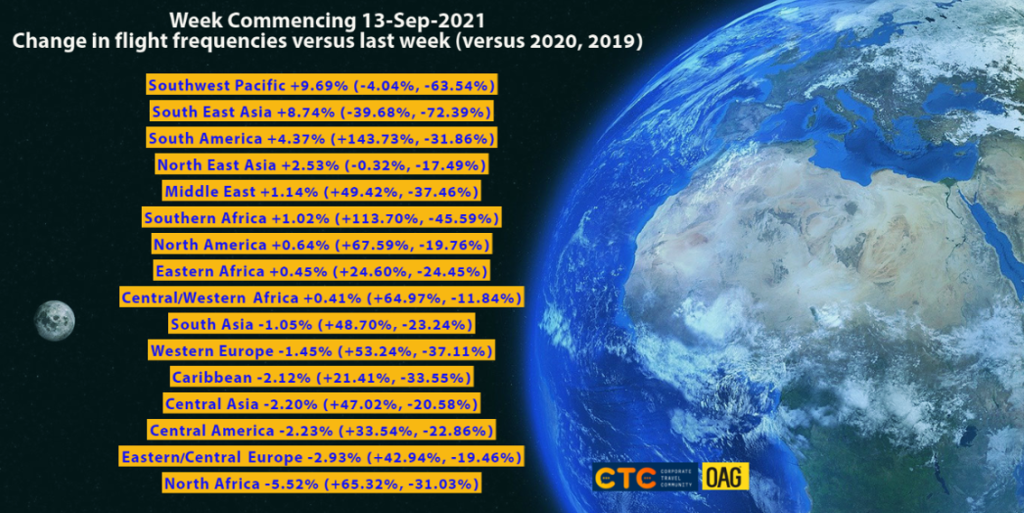

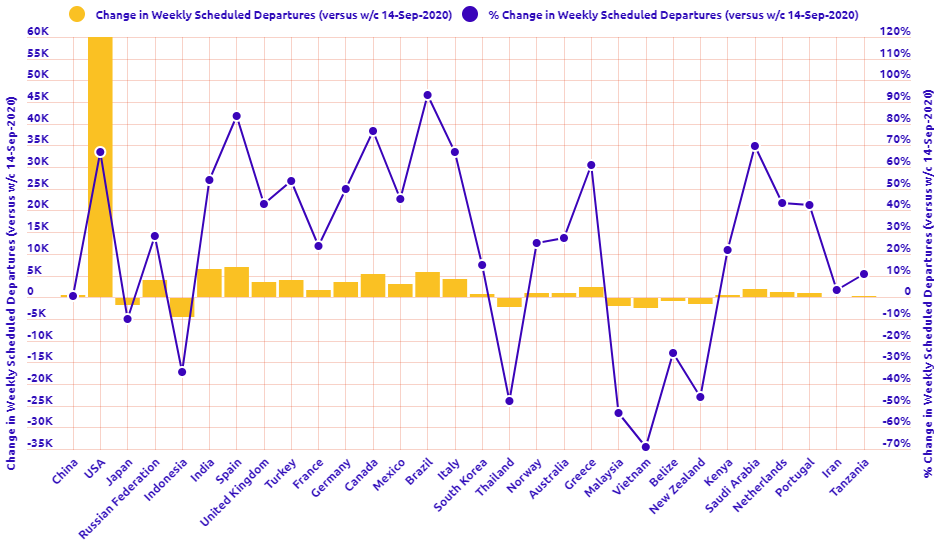

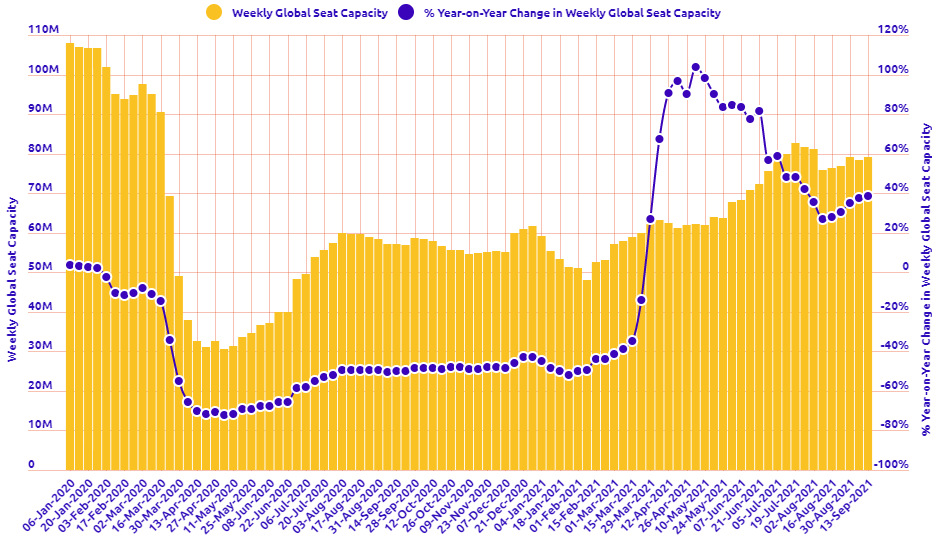

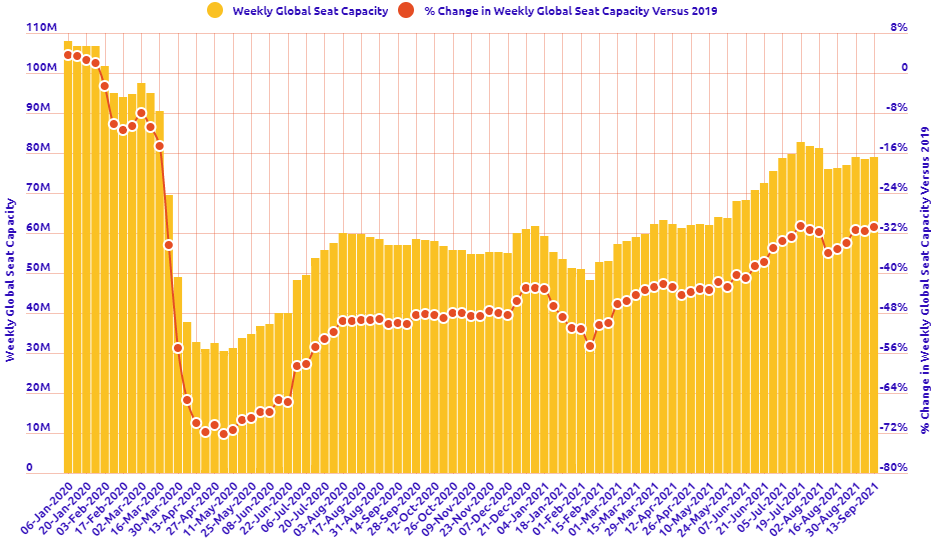

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 13-Sep-2021:

Departure frequencies up+0.71% versus last week; up+34.48% versus 2020 and down -29.97% versus 2019.

Seat capacity up +0.71% versus last week; up +38.55% versus 2020 and down -30.85% versus 2019.

CHART: Week-on-week change in flight departures by region

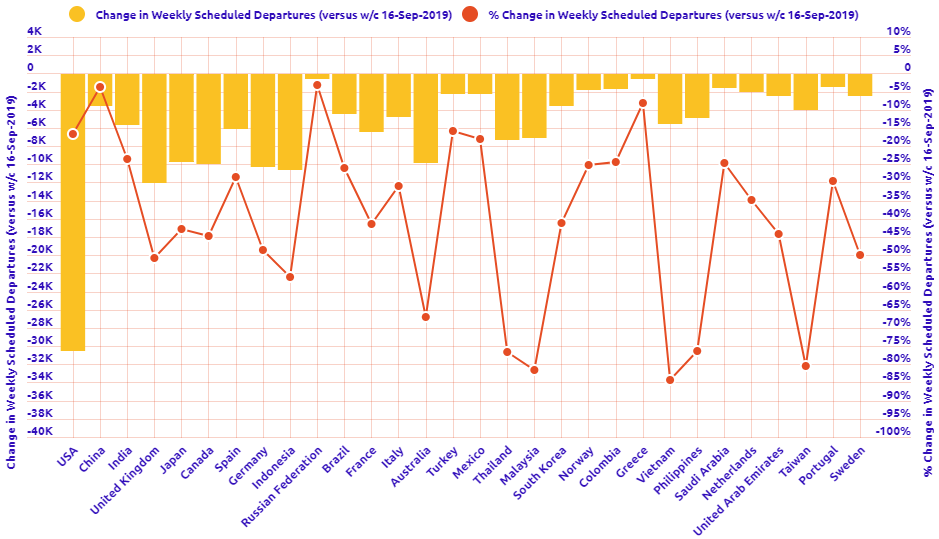

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019

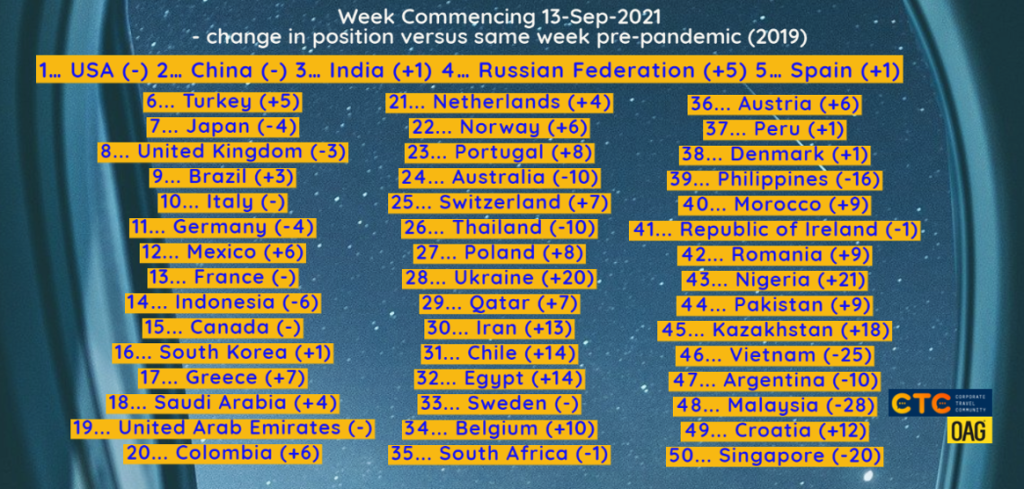

CHART: The world's biggest aviation markets by departure seats