Just as technology has allowed us to maintain business via virtual teleconferencing platforms and will change how many future meetings take place by potentially removing the need for a degree of travel, new innovations in mobile payment, contactless technologies and other digital process are helping to make business travel more efficient and safer than before.

Right now business travellers appear eager to travel, but it is clear that the right safety measures need to be in place to make that happen. Business travel has certainly been one of the hardest hit sectors of the travel and tourism industry during the global pandemic, with a recent study of 1,400 regular business travellers by market research firm Opinium for travel technology specialist Amadeus, showing 93% have reduced travel for work, by an average of 60% since the pandemic began (78% for over 55's).

The research from Jan-2021 of those from France, Germany, India, Japan, Spain, USA and UK who travelled more than 15 times for business during 2019, does highlight cautious optimism as 84% of business travellers confirmed they would travel now if the correct safe travel measures are in place, rising to 87% for frequent flyers.

"The desire to travel for work is driven by human factors, with travellers most missing 'seeing customers and colleagues face-to-face' and 'sharing ideas at in-person meetings', closely followed by social aspects like 'sharing a meal', according to the research.

These safe travel measures are business changes that are being adopting through the travel process. When it comes to rebuilding confidence, frequent travellers highlighted five of nine options in the survey questioning as particularly important. These were COVID-19 medical insurance; up-to-date health and travel restriction information about destination; hygiene information for hotel / office; ability to pay using contactless methods; and mandatory test or vaccine certificate prior to boarding.

Interestingly, this research suggests that travellers will prioritise information on health and travel restrictions as well as contactless payments over testing and vaccination certificates, suggesting they seek the tools to more safely manage their own trip and the associated risks. Business travellers are also sensitive to the economic environment, with 96% confirming they would be happy to adhere more closely to their company's travel policy if it meant business travel could be justified.

The processes are changing and so too will the forms of travel. France's National Assembly voted in Apr-2021 in support of legislation to cut carbon emissions by 40% by 2030, against a 1990 baseline, including a ban on short haul domestic flights on routes than can be covered by train in under 150 minutes. Similarly, in Germany a joint plan issued by rail operator Deutsche Bahn and the country's airlines wants to boost rail transport at the expense of domestic air travel in order to reduce overall greenhouse gas emissions.

But will there even be a need to substitute rail for air travel? For connecting international travel the option would be favourable in environmental terms, but for domestic travel there may not even be the business demand in the future.

At the recent Institute of Travel Management (ITM) Revive virtual conference, Kelly Beaver, manager of public affairs at Ipsos Mori, cited research that half (50%) CEOs believe it is possible videoconferencing will eradicate the need for domestic business travel. Furthermore, almost two thirds (65%) believe videoconferencing could mean staff will no longer need to travel internationally in the next two to three years.

Experts say the 'new normal' in 2025 will be far more tech-driven, which could ultimately present more big challenges. A Feb-2021 paper by Pew Research Center, the American nonpartisan think tank, found that a plurality of experts think sweeping societal change will make life worse for most people as greater inequality, rising authoritarianism and rampant misinformation take hold in the wake of the COVID-19 outbreak. Still, a portion believe life will be better in a 'tele-everything' world where workplaces, health care and social activity improve.

The canvassing of experts in technology, communications and social change found around half respondents (47%) said life will be mostly worse for most people in 2025 than it was before the pandemic: a lesser, but not significantly different number (39%) said life will be mostly better for most people in 2025 than it was pre-pandemic. Among the 86% who said the pandemic will bring about some kind of change, most said they expect that the evolution of digital life will continue to feature both positives and negatives.

Predicting the future is hard at the best time, the only certainty is that uncertainty is guaranteed.

They say 'a picture paints a thousand words'. In this regular section CTC - Corporate Travel Community offers a graphical insight into a key industry observation or trend, this week looking at global COVID-19 vaccination rates, an obvious metric that will support the resumption of domestic and international travel. This data highlights the nations that now have the largest proportion of adults who have received at least one COVID-19 vaccine dose.

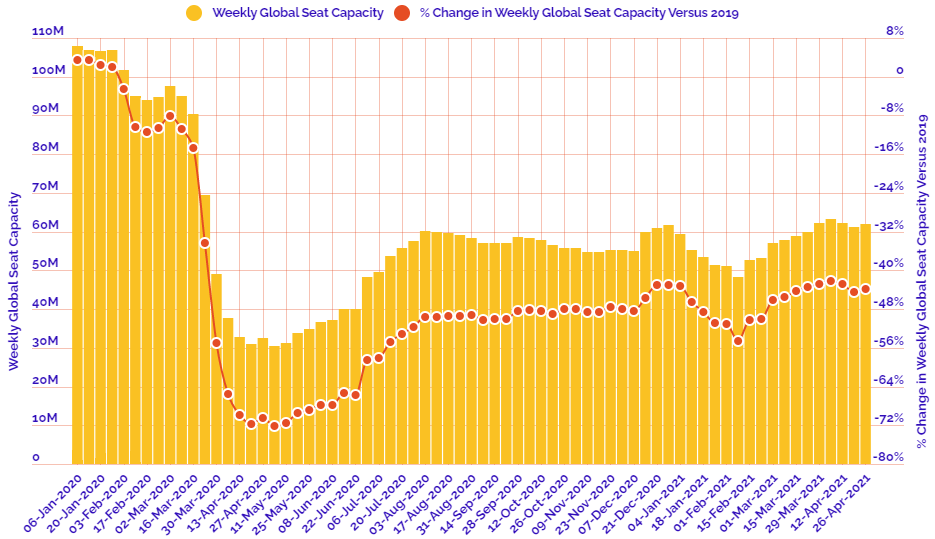

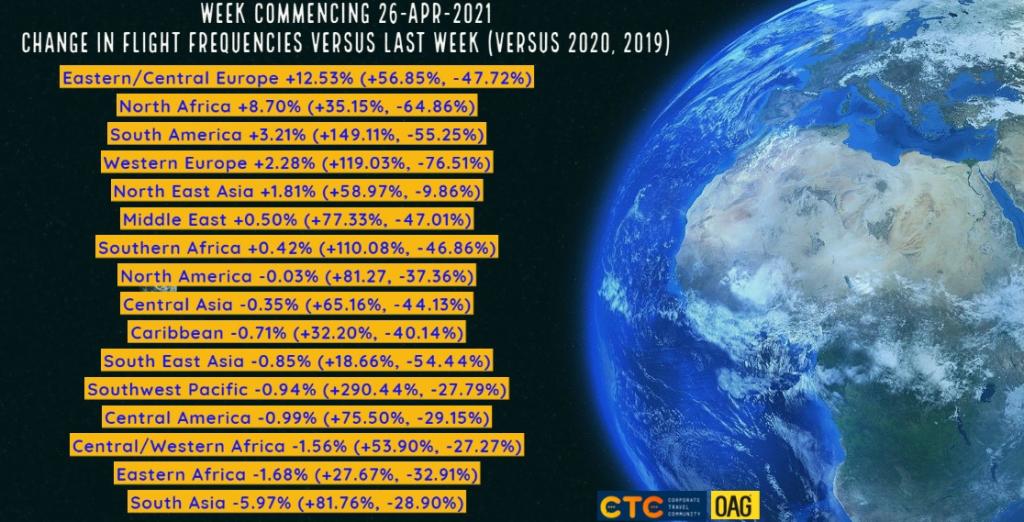

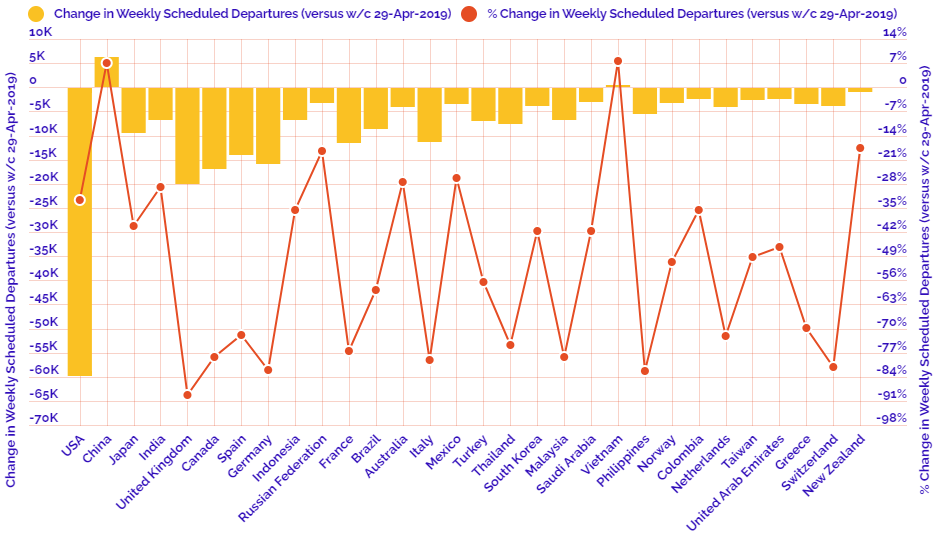

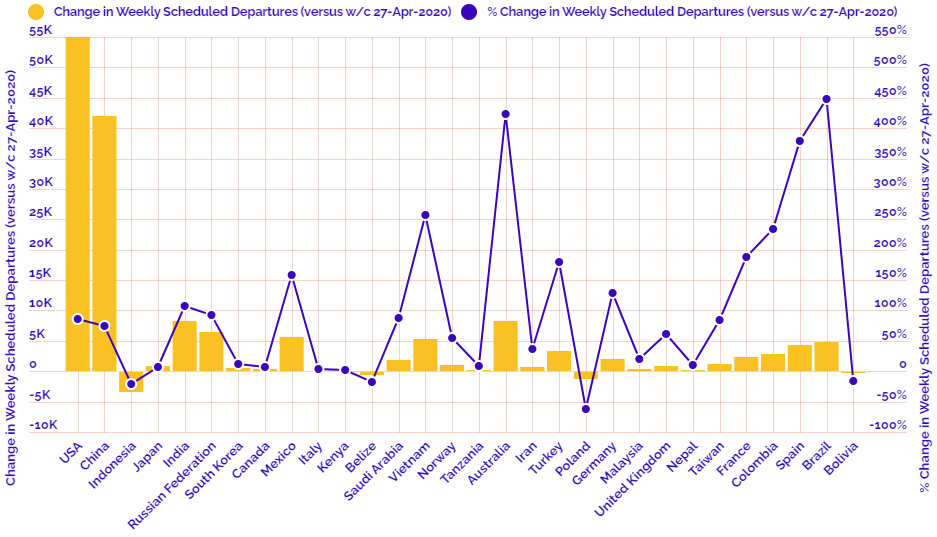

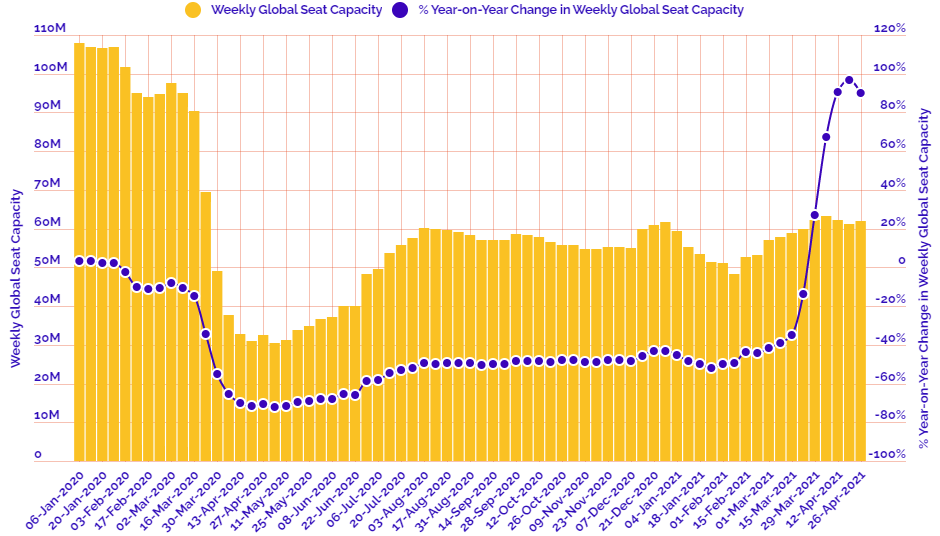

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 26-Apr-2021:

Departure frequencies up +0.80% versus last week; up+72.36% versus 2020 and down -42.38% versus 2019.

Seat capacity up +1.22% versus last week; up +90.09% versus 2020 and down -43.78% versus 2019.

CHART: Week-on-week change in flight departures by region

CHART: Year-on-year weekly departure performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departure performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019