Governments have developed new long-term frameworks, industries and companies are taking a more ambitious outlook with a promise to reaching net-zero targets, offset carbon emissions and provide more eco-friendly options. According to a recent study by travel company Virtuoso, 82% of participants said the pandemic has made them want to travel more responsibly, while 72% said travel should support local economies, preserve culture and community and protect the planet.

Sustainable travel has grown in popularity in recent years as people have tried to mitigate the negative effects of business or leisure travel, either by avoiding damaging practices or offsetting them. But price and convenience also remain key drivers.

Another study, this time by travel site The Vacationer, has similarly found that sustainable travel was somewhat or very important to travellers (83%), but almost half respondents (48%) said they would opt for such trips only if it did not inconvenience them.

There are questions to whether travel can really be sustainable. The United Nations World Tourism Organization (UNWTO) has acknowledged the need for a "responsible recovery of the tourism sector" in order to "balance the needs of people, the planet and prosperity."

Francesca Viliani, director of public health and co-head of sustainability for Denmark, in an insight post for International SOS said that "addressing the interlinkages between environment, social, economics, and wellbeing are the initial building blocks" of this journey and noted that sustainability had become central to business resilience.

"Companies that integrated sustainability and transparency strategically into their business operations prior to the COVID-19 crisis have put an even stronger focus on it now during the crisis. More importantly, they were much more agile in responding to unexpected events," she said.

The pandemic has seemingly proven the viability of the environmental, social and governance (ESG) agenda for both stakeholders and investors. "It has specifically elevated the significance of social factors in the current moment, and environmental factors in the long-term," according to the World Economic Forum.

But what does this all mean for travel managers and the future of business travel? As we start to see the return of corporate travel in many parts of the world it is clear that the emerging landscape is very different.

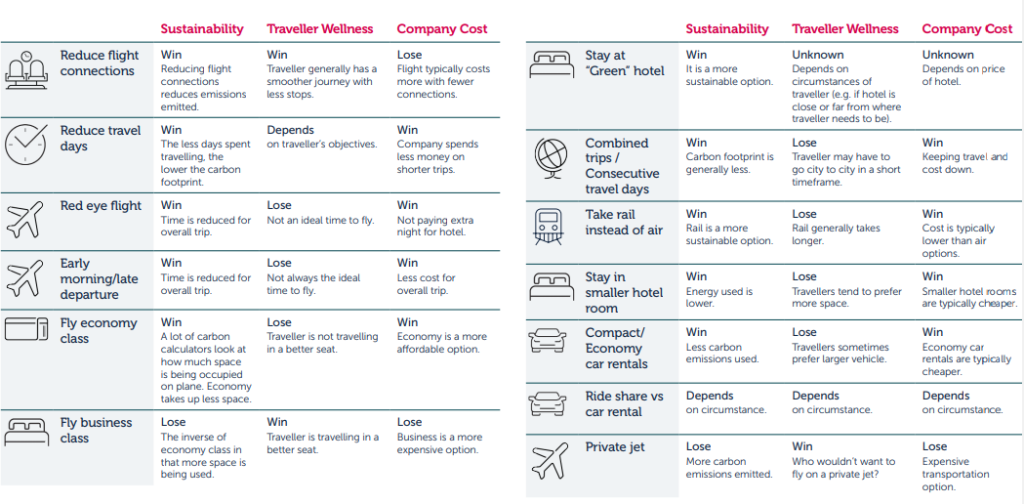

They say 'a picture paints a thousand words'. In this regular section CTC - Corporate Travel Community offers an illustrative insight into a key industry observation or trend, this week highlighting a simplified view from UK travel management company Corporate Traveller into how some common travel metrics rank against sustainability, traveller wellness and company cost.

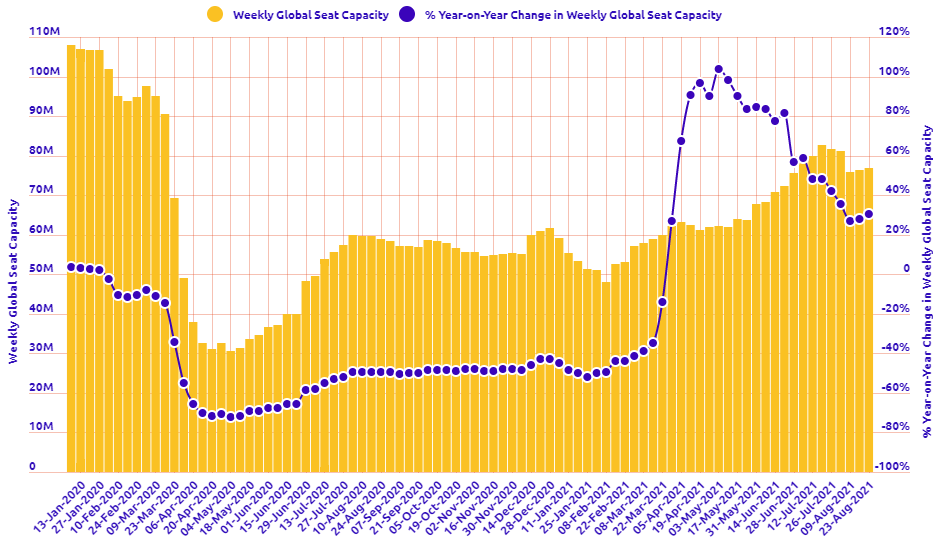

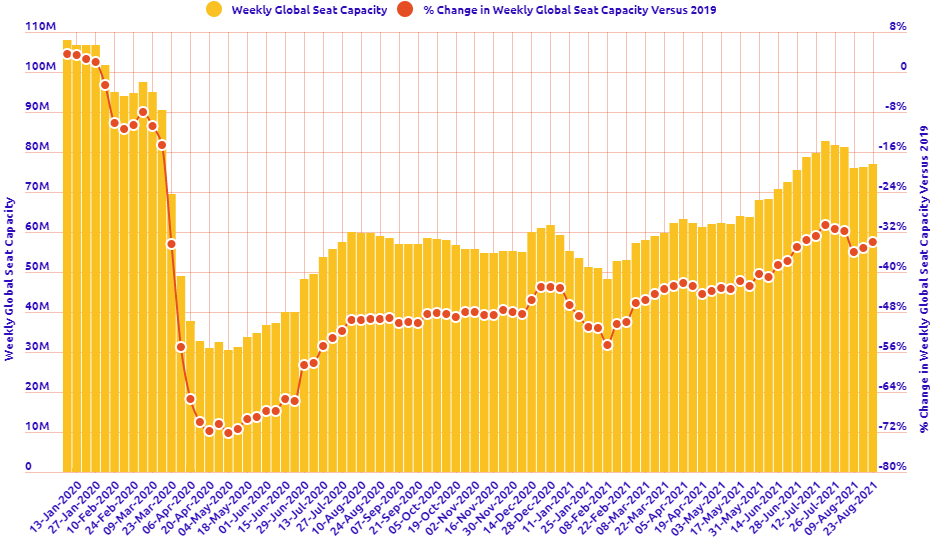

This regular section also now incorporates and expands on the charts produced in the 2020 air capacity series 'Coronavirus Statistics Snapshot'. These are based on an analysis of OAG schedule data and include a weekly look at how the pandemic is impacting global flight levels in the world's largest markets; a week-on-week and year-on-year comparison of flight departures by geographical region and a look at how weekly capacity is trending: the latter comparing levels to 2020 and also to the 2019 baseline performance.

HEADLINE FIGURES FOR WEEK COMMENCING 23-Aug-2021:

Departure frequencies up +0.54% versus last week; up+28.27% versus 2020 and down -32.49% versus 2019.

Seat capacity up +0.72% versus last week; up +30.29% versus 2020 and down -34.07% versus 2019.

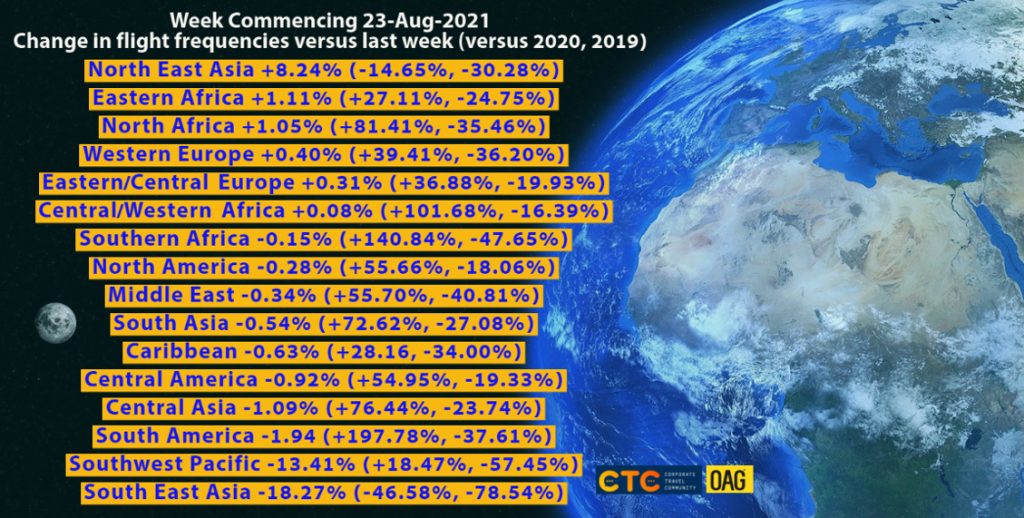

CHART: Week-on-week change in flight departures by region

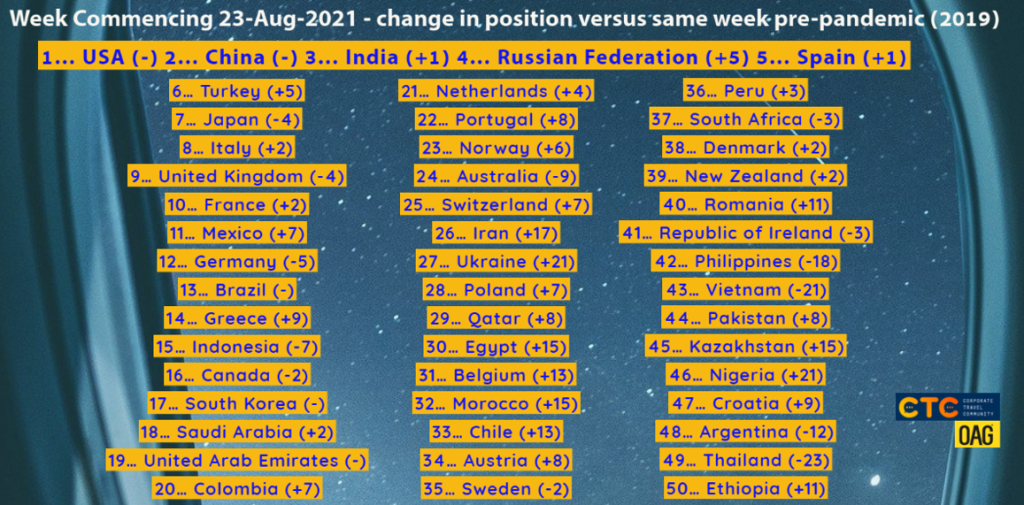

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2019

CHART: Year-on-year weekly departures performance for world's top 30 markets versus 2020

CHART: Departure capacity trends with year-on-year performance

CHART: Departure capacity trends versus 2019

CHART: The world's biggest aviation markets by departure seats