Citilink had operated an all-A320 fleet until early this year, when it added ATR 72-600s that were transferred from Garuda in another major change to its business plan dictated by the parent. Garuda is also dictating Citilink's long-haul move by allocating the A330-900neos and selecting Frankfurt.

Garuda was previously planning to transfer Citilink two all-economy A330-300s. Garuda has operated six all-economy A330-300s since 2014, which have generally been deployed to Saudi Arabia and domestically, but this year also have been used on some flights to China and Hong Kong.

https://corporatetravelcommunity.com/indonesia-china-market-loses-business-class-option-as-garuda-switches-to-all-economy-aircraft-on-four-routes/

Taking on widebody aircraft is a bold move for any LCC but all-economy A330s and Saudi Arabia routes, which are relatively low risk given the block bookings from Indonesian agents offering religious pilgrimage packages, would make sense. The A330-900neos and serving Germany is less sensible given their configuration and the risk and competition in the Indonesia-Europe market.

The 365-seat A330-900neos Citilink is inheriting have 323 economy seats in an eight-abreast rather than the normal LCC nine-abreast configuration. The 42 premium economy seats, a product not currently available on any Citilink or Garuda aircraft, are in a seven-abreast arrangement.

While Garuda has 14 A330-900neos on order the two A330-900neos earmarked for Citilink were originally manufactured for WOW air and therefore have been configured with Wow's onboard design. The Icelandic carrier planned to take the aircraft in late 2018 but scrapped the acquisition just prior to delivery as it completed a business restructuring; it suspended operations entirely just months later.

Citilink could also end up with some or all of the A330-900neos ordered by Garuda, which Garuda will be able to design to its own or to Citilink's requirements. It could also still end up with Garuda's all economy A330-300s.

The two A330-900neos are now slated to be delivered to Citilink in Nov-2019 and Dec-2019. Citilink is aiming to launch three weekly services to Frankfurt on 15-Dec-2019 contingent on regulatory approvals. It is keen to also operate the aircraft to Saudi Arabia but so far Garuda has not yet approved Citilink to serve Saudi Arabia. Citilink will therefore likely only use the A330-900neo on domestic trunk routes and Frankfurt.

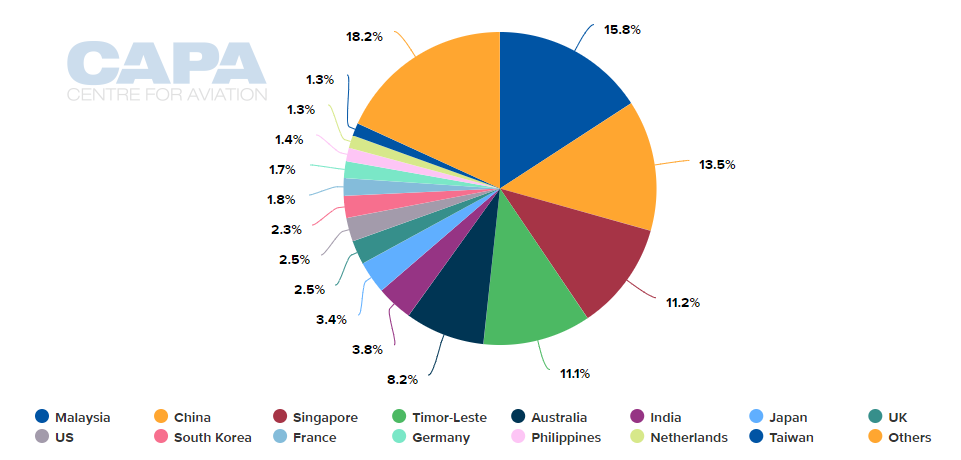

Jakarta-Bali will certainly be one of the domestic routes as Citilink intends to offer a Frankfurt-Jakarta-Bali one-stop service. Bali is Indonesia's most popular tourist destination, including for Germans. Germany is Indonesia's 12th largest source market, attracting 274,000 visitors in 2018 and prompting the interest from Garuda. The outbound Indonesia-Germany market is mainly from Jakarta but is very small.

CHART - Germany is Indonesia's 12th largest source market, attracting 274,000 visitors last year Source: CAPA - Centre for Aviation and BPS-Statistics Indonesia

Source: CAPA - Centre for Aviation and BPS-Statistics Indonesia

Frankfurt will be an extremely challenging market given Citilink is an unknown brand in Germany and the intense competition from Gulf carriers. LCCs have generally been dissuaded from competing in the Southeast Asia-Europe market due to the low fares offered by existing operators, particularly via the Middle East.

Norwegian suspended services to Singapore in early 2019 and currently only serves Bangkok; Scoot has just two routes to Europe - Athens and Berlin; Eurowings, only serves Bangkok and is planning to exit the long-haul business entirely; and AirAsia X has repeatedly shelved plans for resuming Europe links.

Citilink will also have to overcome payload restrictions which will prevent it from selling all 365 seats. A higher gross weight variant of the A330-900neo, which should be able to operate Jakarta-Frankfurt without restrictions, is only available from 2020. Citilink could potentially start operating the higher gross weight variant after a year but the question is: will the route last that long?